American electric vehicle (EV) kingpin Tesla Inc. (TSLA) is the EV option of choice for many investors. Maybe it’s the brand or the emphatic CEO, but whatever the case, Tesla exemplifies the true nature of a meme stock.

A best friend of retail investors and growth-oriented institutional funds, Tesla has been a high-flyer in recent years. The astronomical five-year 750% aggregate return that TSLA stock has given its investors is certainly admirable.

Investors who have held TSLA stock for any significant portion of the past decade may indeed wish to continue doing so.

However, there’s one big question on the minds of many Tesla bulls right now: what the heck is going wrong with TSLA to warrant some pretty poor near-term performance? Since hitting a high of more than $900 in late January, shares have declined more than 30%.

Let’s dive into interpreting this dramatic underperformance of late. (See Tesla stock analysis on TipRanks)

Earnings Good, But Not Good Enough for TSLA Investors

Tesla’s recent earnings beat came and went without applause from investors.

The selloff, which has been of the slow-and-steady variety, picked up steam following the company’s earnings.

Regarding the reason for the selloff, a couple of key factors appear to be at play with Tesla’s earnings quality. That is, investors are disappointed by the amount that Tesla’s bottom line was boosted by gains on Bitcoin trading and zero-emission vehicle credit sales.

First, Elon Musk’s high-profile bet on Bitcoin, and subsequent sale, didn’t strike many investors as business-like. A high-profile CEO just speculated on a high-risk emerging asset class (if you can call it that) and got lucky. He booked a profit. This one-time event likely isn’t repeatable, so the markets are ignoring it.

Secondly, Tesla’s zero-emission vehicle credits have been a source of revenue for the company for some time. These have played a large role in financing Tesla’s capital spending needs. Other large automakers buy these credits to offset their missing allocation from zero-emission quotas. As large automakers shift more production toward EVs, the expectation is that these sales will slow or stop over time. For example, Stellantis recently announced it would discontinue buying Tesla’s European emission credits this year.

That trend does not bode well for Tesla.

Emerging Production Issues

Every stock price is an aggregate of future expectations of long-term earnings and cash flows. As such, assumptions are made to gauge how much cash will flow from said entity over time. These cash flows are discounted over time, weighting near-term results more heavily than those over the longer-term.

Accordingly, Tesla’s stock price appears to be getting hit very hard by the global chip shortage that’s wreaking havoc on the EV sector broadly. This chip shortage has already resulted in a number of EV companies lowering forward guidance for production.

Surprisingly, Tesla isn’t one such company.

Tesla’s CEO Elon Musk has remained firm about Tesla’s growth prospects moving forward. He recently tweeted, auspiciously, “Thanks Tesla suppliers for providing us with critical parts!” This tweet has been taken as confirmation that there’s nothing to see here, at least for Tesla, in terms of the chip shortage issue.

Additionally, a report from Electrek suggesting Tesla is sold out through the end of the second quarter seems very bullish indeed.

So why the grim outlook?

Well, analysts, investors, and the broader market don’t seem to believe Tesla is somehow special and different from the rest of the industry. A global chip shortage is truly global, and investors suspect that at some point, Tesla’s supply chain will provide production headwinds. These risks are being priced into Tesla stock as we speak, and significantly so.

Wall Street Weighs In

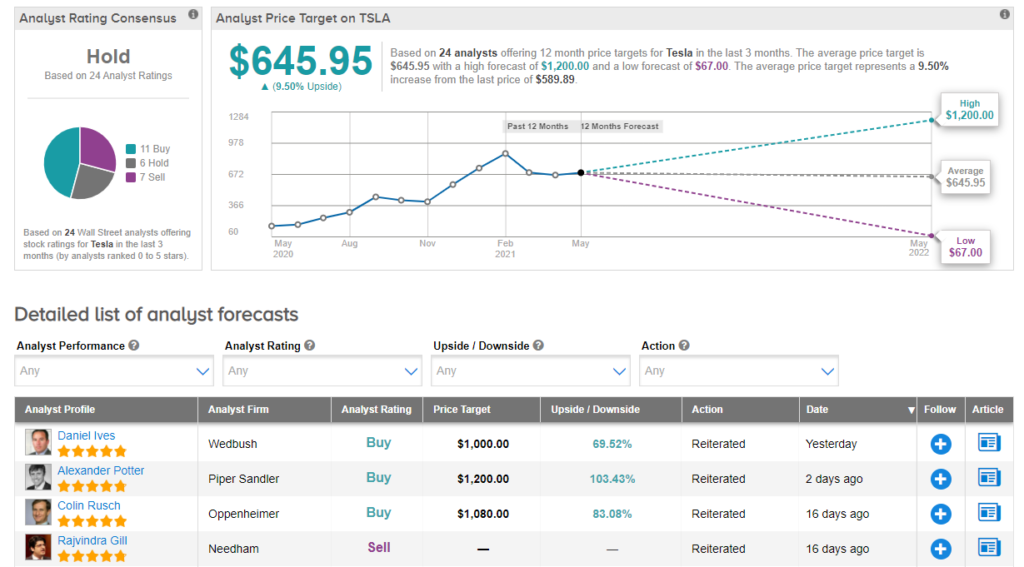

According to TipRanks’ analyst rating consensus, TSLA stock comes in as a Hold. Out of 24 analysts covering the stock, 11 rate it a Buy, 6 rate it a Hold, and 7 rate it a Sell.

As for price targets, the average analyst price target on TSLA stock today is $645.95 per share, implying around 9.5% upside potential.

Bottom Line

Investors in Tesla may be rightly scratching their heads at the downward trajectory TSLA stock has taken of late.

However, this decline could be viewed as purely rational. Indeed, TSLA stock may be perfectly priced right now. Any inkling of slowing growth could provide a catalyst for another leg down. The market is losing some of its speculative steam, and with this backdrop, TSLA stock might not be able to grow its way out of another jam.

Disclosure: Chris MacDonald held no position in any of the stocks mentioned in this article at the time of publication.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.