Walmart (WMT), the retail and wholesale behemoth, is set to release its fiscal first-quarter 2023 earnings on May 17 before market open.

Walmart’s stock has increased by about 0.6% in the last six months. Despite supply chain problems and rising inflation in recent quarters, Walmart is one of the few companies that have done well, thanks to its strong purchasing power.

Walmart’s fourth-quarter results demonstrate the company’s consistent resilience and strength. In Q4, Walmart delivered a solid performance, with adjusted earnings up 10% year-over-year and revenues up 0.5%. However, due to divestitures in the quarter, revenues were reduced by $10.2 billion.

Let’s see how the business is expected to perform in the upcoming quarter.

What Do Walmart’s Website Visit Statistics Indicate?

The company offers merchandise and services at fair and discounted prices through its physical stores, walmart.com, and mobile applications (flipkart.com and samsclub.com). Being in the retail/wholesale space, it’s obvious that every virtual visit to the company’s website and apps is a potential revenue source.

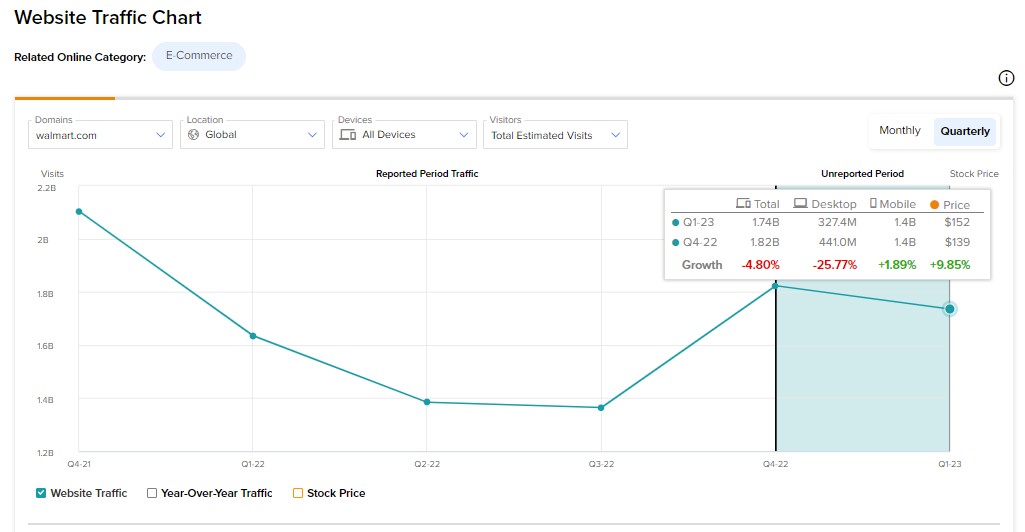

As a result, we used TipRanks’ new website tool to investigate Walmart’s monthly visitor data in order to get a better picture of the company’s current state ahead of the Q1 print.

Using the tool, we discovered a 4.8% decline in total global visits to the walmart.com website from the preceding quarter (Q4 2022).

However, on a year-over-year basis, monthly visits to the Walmart website spiked 6.2% in the first quarter.

Expectations for Q1

According to experts, Walmart is expected to report adjusted earnings of $1.48 per share in the first quarter. The Q1-EPS forecast shows a decline of 12.4% in earnings from the year-ago quarter.

WMT is optimistic about its Fiscal 2023 performance. During its Q4 earnings call, the company stated that it expected sales, operating income, and earnings to improve this year as COVID-19-related expenses and supply chain disruptions subside.

Wall Street’s Take

Ahead of Q1 results, RBC Capital analyst Steven Shemesh remains concerned about the growing inflation. He believes that growth could have slowed in April as “inflationary pressures adversely impacted consumption trends.”

However, the analyst is optimistic about the company’s long-term fundamentals. He writes, “WMT’s high grocery exposure and commitment to keeping prices low for consumers make it one of the most defensive names in our coverage universe.”

As a result, Shemesh maintained a Buy rating on the stock and a price target of $160 per share.

On TipRanks, Walmart stock commands a Moderate Buy consensus rating based on 11 Buys and four Hold ratings assigned in the past three months. As for price targets, the average WMT stock price prediction of $164.13 implies almost 11% upside potential from current levels.

Bottom Line

Walmart is widely regarded as one of the most secure and defensive retailers. The company’s website visits during the first quarter do not appear to be particularly spectacular. Also, the current unpredictable market conditions are concerning,

Despite the above concerns, Walmart’s track record implies that it will continue to grow in the near future. It’ll be intriguing to see if the company can keep its winning streak going despite supply chain challenges and rising inflation.

Learn more about the Website Traffic tool in this video by YouTube sensation Tom Nash.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure