Devon Energy Corp. (NYSE: DVN) is an oil & gas exploration and production (E&P) company in the United States, with a significant presence in the Delaware, Anadarko, Williston, and Powder River basins.

Its production volume was 575 thousand barrels of oil equivalent per day (Mboed) in Q1 of 2022, comprising 50% oil, 26% gas, and 24% natural gas liquids.

Its shares have increased 26.8% so far this year, including a gain of 7.5% on Monday. The last closing price was $57.79. On TipRanks, this $35.5-billion energy company has a Moderate Buy consensus rating based on 12 Buys and six Holds. DVN’s average price target of $82.56 suggests 42.86% upside potential from current levels.

The rising share price and favorable analysts’ opinions underpin the company’s growth potential. Knowing more about DVN might interest investors seeking exposure in the U.S. oil & gas market.

What is Driving the Stock?

Year-to-date, Devon Energy has leveraged the short supply and higher prices of oil and natural gas in the U.S. and globally. This was largely caused by the onset of the Ukraine-Russia war in the first quarter of 2022.

The company’s diversified portfolio, exposure to multiple basins in the U.S., and exploration capabilities add to its appeal. Further, a solid cash flow position supports its capital allocation between growth strategies and rewards for shareholders (through dividends and share buybacks). Keeping a close check on its debts is a priority for the company. It expects net debt to EBITDA of 0.2x by the end of this year.

For 2022, Devon Energy expects capital spending on upstream activities to be within the $1.9-$2.2 billion range. It also expects cash flow growth of nearly 75% in the year. Total production is forecast to be 570-600 Mboed in 2022.

However, the momentum in the stock suffered a little from speculations of a recession. Usually, demand for oil and natural gas subsides in a recessionary environment.

The impact of this fear on the stock was short-lived. The recently released data on durable goods and pending home sales highlights monthly growth in May 2022, suggesting that the economy is still thriving.

Analysts’ Take

Four days ago, Scott Gruber of Citigroup reiterated a Buy rating on DVN while lowering the price target to $62 (7.28% upside potential) from $68.

Also, a few days back, Jeanine Wai of Barclays maintained a Hold rating on DVN while increasing the price target to $90 (55.74% upside potential) from $73. Despite secular headwinds, the analyst expects a “healthy upside and compelling yield” from exploration and production companies, including Devon Energy.

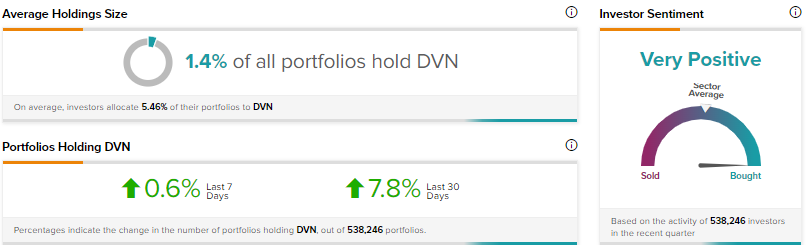

As per TipRanks, investors’ sentiment toward Devon Energy is Very Positive. The number of investors holding DVN stock has increased 7.8% in the last 30 days.

Conclusion

Investments to strengthen growth opportunities, rewards for shareholders, and favorable operating conditions in the industry and economy enhance Devon Energy’s investment appeal. Its rising share price is indicative of its past success and solid prospects.

Read full Disclosure