Yesterday, Catherine Wood’s ARK Investment Management LLC lapped up 1.77 million shares of Shopify (SHOP) shares despite the company’s plans to lay off 10% of its global workforce.

Shares of Shopify dived 14.5% yesterday after the company’s CEO, Tobi Lütke, accepted that his projection of the growth of the e-commerce business was too optimistic.

ARK’s move to buy the stock on the price dip once again reaffirms ARK’s bullish stance on the stock. In fact, Shopify takes the second position in terms of holdings in ARK’s Fintech Innovation ETF.

In contrast, Cathie Wood’s ARK also sold 1.42 million shares of cryptocurrency exchange stock Coinbase Global Inc. (COIN). This represents a whopping 4.2% of total share volumes traded yesterday.

Coinbase has recently come under the radar of the SEC as the regulator is investigating the crypto listings. The stock was down 5.3% on July 25 when the news first surfaced and fell another 21% yesterday to close at $52.93.

Wall Street’s Take on Shopify

Wall Street is cautiously optimistic about Shopify stock with a Moderate Buy consensus rating, based on 13 Buys, 14 Holds, and two Sells. The average Shopify price target of $70.48 implies 123.39% upside potential to current levels.

Wall Street’s Take on Coinbase

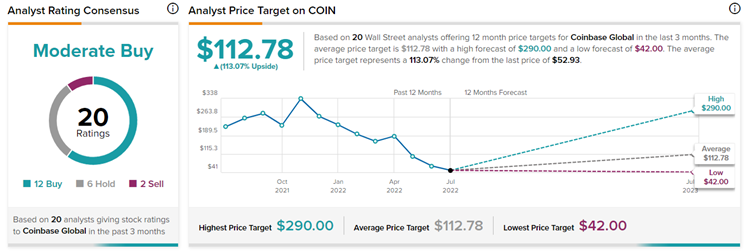

According to TipRanks’ analyst rating consensus, COIN is a Moderate Buy, based on 12 Buys, six Hold and two Sell ratings. The average COIN price target is $112.78, implying 113.07% upside potential.

Concluding Thoughts

Although COIN stock has been in the red for a while due to various uncertainties, Cathie Wood’s stance to buy Shopify despite the negative news and the subsequent share price weakness surely generates curiosity about what lies ahead.

Investors will learn more at the Shopify earnings call scheduled for later today.