Snowflake (SNOW) will release its financial results for the fiscal fourth quarter of 2022 on March 2.

The company is a cloud-based data platform that provides data scientists and business analysts with machine-learning technologies.

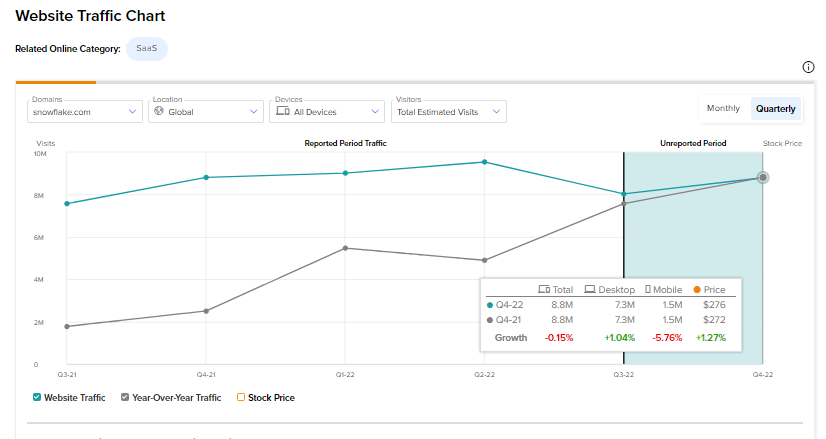

It’s crucial to track user visits to Snowflake’s website in order to gauge demand for its cloud computing services. For Snowflake, a greater monthly visit count might represent more new customers and higher product revenues, and vice versa.

So, to gain a better idea of the company’s present status, we dug into Snowflake’s monthly user data, using TipRanks’ new online tool, ahead of the Q4 print.

Snowflake Monthly User Showed a Positive Trend

We discovered through the tool that overall projected visits to the Snowflake website increased in Q4. The total projected worldwide visits to snowflake.com increased by 9.5% sequentially from the third quarter.

Notably, a large number of businesses are turning to cloud computing services due to the growing digital revolution. The rise in monthly visits suggests strong demand for Snowflake’s cloud services, which could translate to higher top-line growth in the quarter that has yet to be published. Furthermore, Snowflake’s key indicators, such as total customers, might have increased in the fourth quarter, due to the increase in its monthly user base.

However, according to TipRanks’ new methodology, website visits to snowflake.com fell 0.15% year-over-year to 8.8 million in Q4 2022 versus Q4 2021.

The drop in website traffic on a year-over-year basis might be attributed to fierce competition from hyperscale cloud providers, legacy suppliers, and new market entrants.

Wall Street’s Take

The Wall Street analysts are cautiously optimistic on Snowflake, with a Moderate Buy consensus rating based on 17 Buys and 6 Holds. The average Snowflake stock prediction of $388.36 implies upside potential of approximately 46.2% to current levels for this stock.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure