Television streaming platform Roku, Inc. (ROKU) is scheduled to report its first-quarter fiscal 2022 results on April 28, after the market closes. Although Roku has consistently exceeded earnings consensus for the past several quarters, its revenues have somehow shown a mixed picture.

After streaming giant Netflix’s (NFLX) disastrous show of huge subscriber losses in Q1, investors are apprehensive about the streaming industry. Besides, the uncertain geopolitical environment, rising interest rates, and inflationary pressures are pushing investors away from growth stocks and into the hands of safe value names.

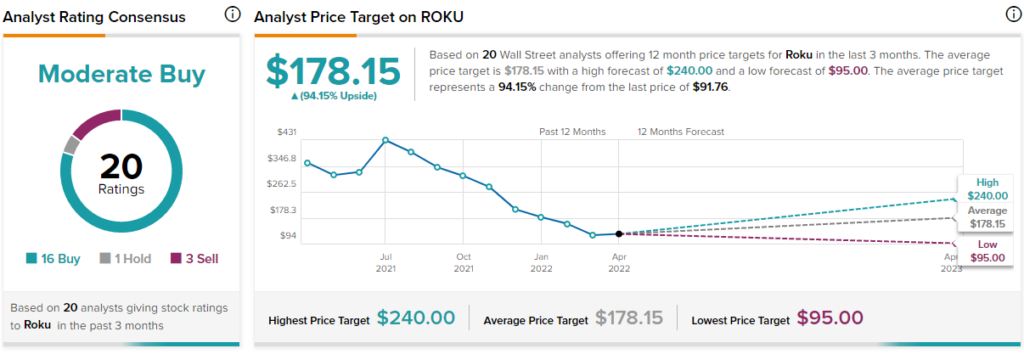

The stock closed down 9.5% at $91.76 on April 26. Year-to-date, the stock has lost 56.5% due to the broader market turbulence and tech sell-off.

Let us look at what TipRanks’ Website Traffic Tool portends for Roku’s Q1 performance.

Strong Website Traffic Signals a Strong Quarter

For streaming platforms like Roku, website traffic trend is a valuable indicator of its performance since it simply puts forward how many people visited the website for streaming services. If the website visits are high, then it is more likely that the platform has performed well.

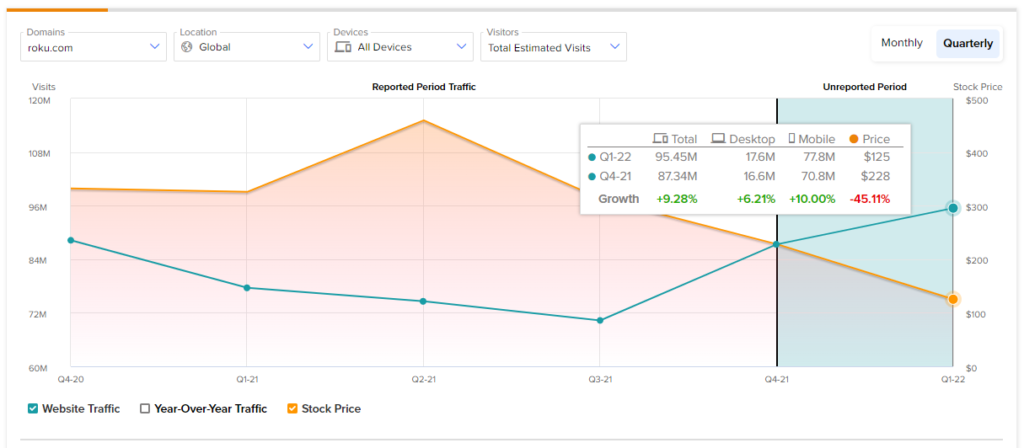

According to the tool, Roku’s website traffic recorded a 9.28% sequential increase in global estimated visits in Q1 2022. Similarly, year-to-date website traffic growth on all devices increased by 23.02% compared to the same period last year.

However, the stock price has been pushed down by 45.11% in contrast as investors fled the stock on the sector’s poor quarterly results and other macro factors.

Wall Street’s Take

For Q1, the consensus estimates for revenue are pegged at $718 million, and an adjusted loss of $0.19 per share is expected. Moreover, active accounts are projected to be at 61.4 million, along with 20.6 billion streaming hours.

Recently, Rosenblatt Securities analyst Barton Crockett initiated coverage of the ROKU stock with a Buy rating and assigned a price target of $188, which implies a whopping 101.8% upside potential at current levels.

Amid the uncertain economic backdrop, despite the company’s missed guidance and the market’s stance against high multiple growth stocks, Crockett remains highly optimistic about Roku’s future trajectory.

According to Crockett, Roku’s “sales growth is still healthy, and it sits in a powerful gatekeeper position at the nexus of TV’s transition from legacy platforms to streaming. I expect that to continue, and Roku’s position to remain, driving value that is impressive.”

The other analysts on the Street, however, are cautiously optimistic about ROKU stock with a Moderate Buy consensus rating based on 16 Buys, one Hold, and three Sells. The average Roku price forecast of $178.15 implies almost 94.2% upside potential to current levels.

Concluding Thoughts

Considering the uptick in website traffic trends and the optimism of analyst Crockett, Roku seems set to crack Q1’s expectations. Combining that with the high room for growth expected from the stock’s current lows makes Roku a very attractive investment opportunity.

Learn more about the Website Traffic tool in this video by YouTube sensation Tom Nash.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure

Related News:

Twitter & Elon Musk Saga Ends on Definitive Cash Deal Worth $44B

Why Did Activision Perform Poorly in Q1?

Kohl’s Soars on Another Buyout Offer