Pinterest (PINS) is an image-sharing and social networking platform. The corporation will release its Q122 financial results tomorrow, April 27.

The stock has been under significant pressure due to macro and company-specific challenges, with growth hampered by rising inflation and interest rates. In addition, the ongoing Russian war in Ukraine has added a degree of uncertainty for investors.

Further, slower user growth and increasing competition have added to Pinterest’s declining valuation. Notably, Pinterest revealed reduced monthly active user (MAU) statistics in the fourth quarter. MAU fell 6% year-over-year to 431 million in Q4. Revenues of $846.7 million, on the other hand, increased 20% year-over-year.

Let’s take a look at how the business is expected to perform in the first quarter.

Q1 Expectations

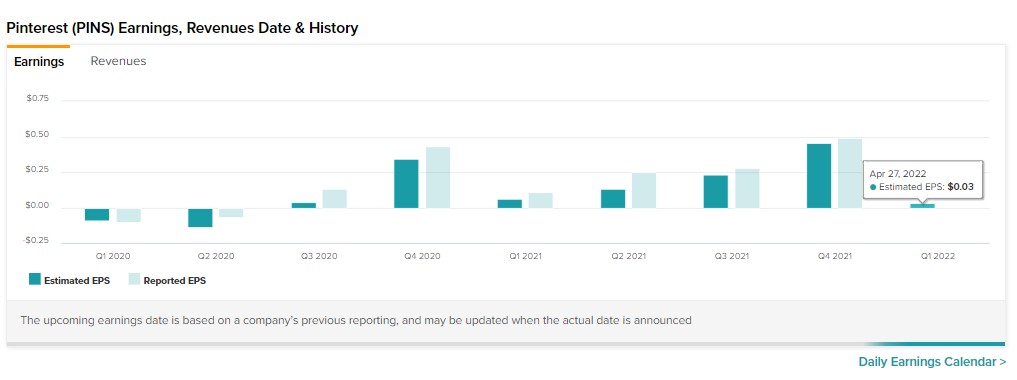

According to analysts, Pinterest is expected to report adjusted earnings of $0.03 per share. The Q1 estimates reflect a 73% decrease in earnings from the year-ago quarter.

Website Traffic Reflects Upward Trend

Pinterest is a social media platform, and its business depends on user traffic to stay afloat. So, to obtain a better understanding of Pinterest’s current status, we used TipRanks’ Website Traffic Tool to dig into the company’s monthly user numbers ahead of the Fiscal Q1 print.

We discovered through the tool that overall projected visits to the Pinterest website increased in Fiscal Q1. In particular, the total estimated worldwide visits to pinterest.com increased by 39.4% from the fourth quarter.

Wall Street’s Take

Rosenblatt Securities analyst Barton Crockett initiated coverage on the stock with a Hold rating and a price target of $21. This implies 5% upside potential from current levels.

Though the company’s top-line growth impresses the analyst, he believes that slowing user growth and growing cost pressures remain big issues. He also feels that increased rivalry from competitors such as TikTok and YouTube could lead to lower MAU figures.

Overall, the Street is cautiously optimistic about Pinterest, with a Moderate Buy consensus rating based on seven Buys and 17 Holds. At $36.76, the average PINS price target suggests 84% upside potential from current levels.

Bottom Line

Pinterest is one of the top social media stocks and has been crushed lately. Investors may be concerned about the low MAU numbers amid an increasingly competitive climate.

Learn more about the Website Traffic tool in this video by Youtube sensation Tom Nash.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure