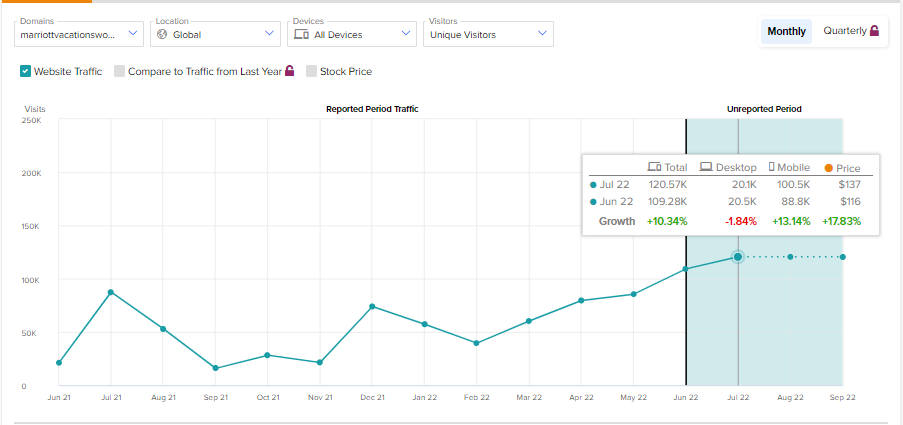

The easing of travel restrictions and sharp recovery in demand helped Marriott Vacations (NYSE:VAC) deliver strong quarterly results. TipRanks’ Website Traffic tool shows that visits to marriottvacationsworldwide.com continue to rise month-over-month, implying that the company could produce strong financials.

Website Traffic for Marriott Vacations

TipRanks’ Website Traffic tool shows that demand for its offerings remains strong despite macro headwinds. According to the tool, the number of visits to marriottvacationsworldwide.com increased 10.34% month-over-month in July 2022.

It’s worth mentioning that since February 2022, the web visit trends for VAC have improved month-over-month. Meanwhile, on a year-to-date basis, the website traffic for VAC has grown 127.87%.

Improving Trends Point to a Healthy Financial Performance

The continued improvement in website traffic trends indicates that Marriott could deliver strong financials and boost shareholders’ returns. VAC’s CEO Stephen P. Weisz stated, “With the strong recovery of our operations, as well as cash proceeds from dispositions, we accelerated our return of cash to shareholders, surpassing $500 million this year through the end of July.”

Thanks to the strong demand, VAC’s management expects its contract sales to increase at a double-digit rate in 2H22, led by solid volume per guest.

Further, high resort occupancy and a strong tour package pipeline are positives, and will support its growth.

With continued momentum in the business, VAC’s management expects its FY22 contract sales and adjusted EBITDA to come near the upper range of its guidance. VAC expects to deliver contract sales between $1,775 million to $1,875 million. Further, it projects adjusted EBITDA to come in the range of $880 million to $930 million.

Also, VAC raised its full-year adjusted free cash flow outlook. VAC expects to deliver adjusted free cash flow in the range of $650-730 million, up from its previous forecast of $590-670 million.

Is Marriott Vacations a Buy, Sell, or Hold?

Analysts are bullish about Marriott Vacations stock. It has received five unianimous Buy recommendations for a Strong Buy rating consensus. Meanwhile, the analysts’ average price of $184.20 implies 22.3% upside potential.

VAC stock also sports a maximum Smart Score of 10 on TipRanks, implying it could outperform the broader markets averages.

Bottom Line: Business Remains Strong but Uncertainty an Issue

The growing web traffic trends and management’s confidence in the business indicate that VAC is poised to gain from the recovery in leisure and travel demand. However, the uncertainty over demand sustainability amid a weak macro environment poses challenges.