As XPeng (XPEV) continues to expand globally, investors should expect misplaced fears to hit the stock from time to time. Case in point: The stock was initially hit by news that Apple is looking to build a self-driving car called the iCar. However, Apple is far more likely to partner with XPeng on auto manufacturing than become a competitor.

As misplaced fears pop up in the future, investors should use the weakness to pounce on the stock.

iCar Fears Misplaced

The initial fears of Apple entering the EV manufacturing space appear misplace. The reports suggested the tech giant is looking to move forward with self-driving car technology and a goal of actually producing passenger cars in 2024.

The plan is questioned by many analysts due to the unlikely case of Apple entering the low-margin, capital intensive auto manufacturing business. On the other hand, XPeng has already sold 21,341 smart EVs by the end of November for an 87% increase.

With the Chinese EV company already selling the G3 SUV in Norway and looking to become a true international brand via the launch of both the G3 and P7 EV sports sedan in Europe, the risk on the Apple story just isn’t large in the short term. XPeng even has super charging stations that have recently gained in value due to business combinations with SPACs.

The company guided to Q4 deliveries of ~10,000 and total revenue growth of 244% over last year. XPeng plans to grow deliveries ~1,500 units from the Q3 levels of 8,578 for revenues of nearly $300 million. Both vehicles delivered and revenues will grow over 200% from 2019 levels.

The more likely outcome is that Apple partners with EV manufacturers around the globe like XPeng to implement a self-driving transportation service integrated with Apple services. Apple is more likely a partner than a competitor.

Loaded With Cash

As with the other hot EV stocks whether Chinese or in the U.S., XPeng has wisely raised billions recently. The company raised $1.7 billion via the IPO in August and another $2.5 billion via a follow-on offering of 55.2 million shares. Those shares were sold at $45 providing an interesting entry point here below the secondary price.

The company ended Q3 with a cash balance of $2.95 billion bringing the available cash following the secondary to nearly $5.5 billion. XPeng had a Q3 loss of $127 million and along with investments the company will need a lot of cash to compete in the very competitive global EV market.

More importantly, the Chinese EV company will need to build up scale to ensure a company such as Apple won’t enter the manufacturing space and instead partner with a player like XPeng.

Takeaway

The key investor takeaway is that XPeng is a far more interesting stock now after a cooling off period in December and a big secondary raise. Investors should hope for some more Apple iCar induced weakness to snap up the stock on dips knowing the fears are likely misplaced.

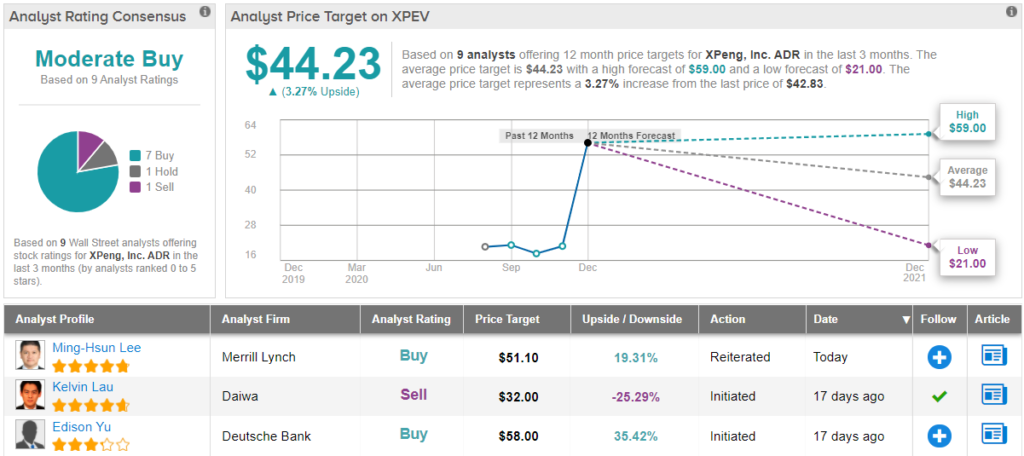

Among the analyst community, the majority are on XPeng’s side. Factoring in 7 Buys, and 1 Hold and Sell each, the EV player has a Moderate Buy consensus rating. However, the $44.23 average price target implies shares will stay range-bound for now. (See XPEV stock analysis on TipRanks)

Disclosure: No position.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.