Shares of the internet-based home furnishings retailer Wayfair (NYSE: W) continue to trend lower, erasing a substantial portion of its gains. For context, Wayfair stock declined about 77% in the first six months of 2022. Moreover, it has fallen by approximately 86% in one year.

The rapid adoption of e-commerce during the pandemic and government stimulus stepped-up demand for Wayfair’s products and offerings. However, with easing restrictions, revenue growth has begun to moderate.

During the Q1 conference call, its CEO, Niraj Shah, stated that the company was seeing signs of normalization in consumer behavior as a portion of their spending is now shifting towards physical retail.

Besides the normalization in demand, macro headwinds, including rising prices and interest rates, continue to play spoilsport. Also, geopolitical headwinds are a drag.

RH (NYSE: RH), the luxury home furnishing chain, recently trimmed its full-year revenue outlook, citing macro headwinds. Notably, RH now expects its top line to decline in FY22 as higher mortgage rates and a drop in luxury home sales are leading to a slowdown in demand.

RH’s guidance cut weighed on Wayfair stock. It closed about 9.65% lower on Thursday.

Bottom Line

The uncertain macro environment, supply disruptions, and expected weakness in consumer spending amid a higher interest rate environment pose challenges. Further, a shift in consumer spending towards travel remains a drag.

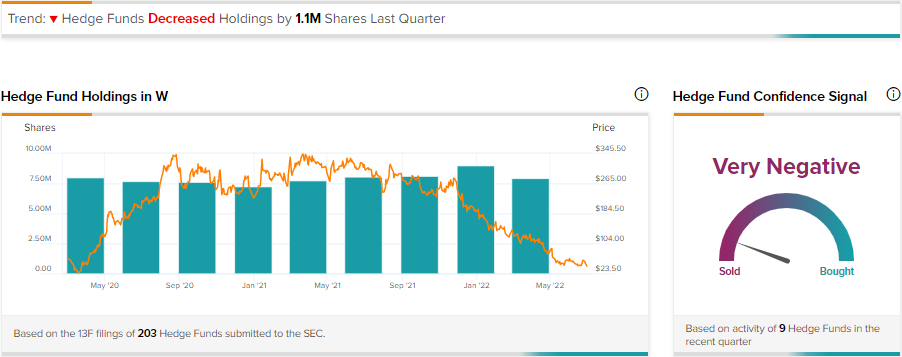

Wayfair has negative indicators from hedge funds and retail investors who sold its stock in the recent past. In the last three months, hedge funds sold 1.1 million Wayfair shares.

Wayfair stock has received seven Buy, 10 Hold, and eight Sell recommendations for a Hold consensus rating. Meanwhile, due to the massive decline in its price, the average Wayfair price target of $85.58 implies 96.5% upside potential.