Waste Connections (WCN) is a solid waste management services company. It provides waste collection, waste disposal, transfer, and recycling services in the U.S. and Canada.

The company recently reported earnings. Revenue came in at $1.64 billion, a beat of $30 million and an 18% increase year-over-year. Earnings per share were essentially in-line at $0.82, but a miss of $0.01 nonetheless.

In addition, the company is still expecting to meet its cash flow guidance for the year. However, the stock still sold off following the release causing it to close lower on the week.

Waste Connections is an essential business that provides some stability during periods of uncertainty. However, this predictability comes at a premium, with the stock trading at a P/E ratio of 53 times. As a result, we are neutral on the stock.

Growth Catalysts

Collecting waste is an essential service that modern societies simply cannot go without. Removing this service would quickly lead to piles of garbage everywhere on the streets. If we thought COVID-19 was bad, the diseases that would be caused by garbage strewn about could be potentially worse.

Furthermore, the waste management industry is a very capEx-intensive business that requires heavy investment to simply get started. In addition, a company requires an ability to run operations unprofitably for a while as it gains traction in its market

As a result, a company like Waste Connections has a lot of pricing power due to the business’s necessity and the high barriers to entry. Therefore, the company is able to hedge against inflation by passing on costs to customers.

In addition, since Waste Connections is one of the more prominent players in the industry, it can grow through acquisitions, which it has been doing. What we like about its approach to acquisitions is the fact that it doesn’t take on too much leverage to do so, indicating that the company is responsibly managed.

Waste Connections is Predictable

The way we like to determine a company’s level of predictability is by analyzing its free cash flow trend. We want to see relatively smooth growth over a long period of time.

In Waste Connections’ case, the free cash flow has been increasing every year (with the exception of 2020) over the past decade. This has undoubtedly been aided by its acquisition strategy. However, it’s good to see that the acquisitions are adding to the free cash flows instead of impacting it negatively.

Waste Connections has been able to maintain reasonably consistent free cash flow margins over the past decade as well. Since 2012, the range has been between 13.3% to 17.6%, with the majority of the time being greater than 15%.

Valuation

To value Waste Connections, we will use a single-stage DCF model. We’ll use this because its main growth driver is acquiring companies, which uses up a large portion of the company’s free cash flow. This means that most of the money doesn’t actually go to shareholders.

Therefore, instead of trying to speculate how much money will be spent on future acquisitions and the impact they will have on future cash flows, we will value the company assuming no acquisitions.

Since WCN is a mature company, we believe the growth rate will be close to long-term GDP growth. Thus, we will use the 30-year U.S. Treasury yield as a proxy for expected long-term GDP growth for the terminal growth rate.

Our calculation is as follows:

Fair Value = Average FCF per share / (Discount Rate – Terminal Growth)

$85.07 = $3.64 / (0.075 – 0.0322)

As a result, we estimate that the fair value of Waste Connections is approximately $85.07 under current market conditions.

Dividend

For investors that like dividends, Waste Connections is not the stock for income because it currently has a 0.62% dividend yield, which is above the sector average of 0.45% but well below current treasury yields. Nonetheless, with a payout ratio of 30%, the current dividend payment is likely safe.

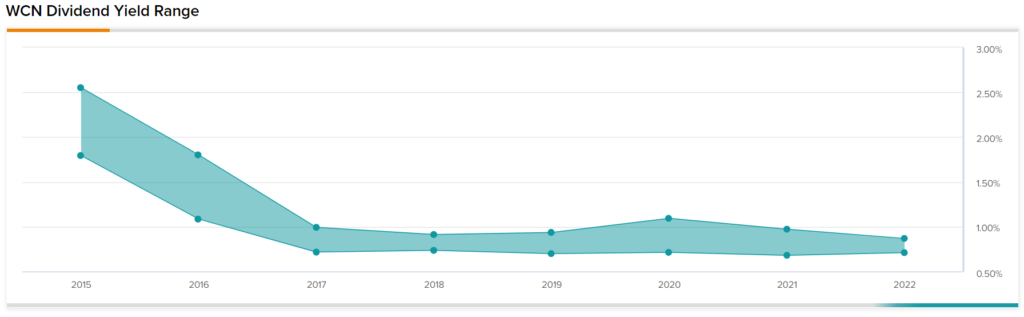

Looking at its historical dividend payments, we can see that its yield range has been relatively flat in the past five years.

At 0.62%, the company’s dividend is near the lower end of its range, implying that the stock price is trading at a premium relative to the yields investors have seen in the past.

Wall Street’s Take

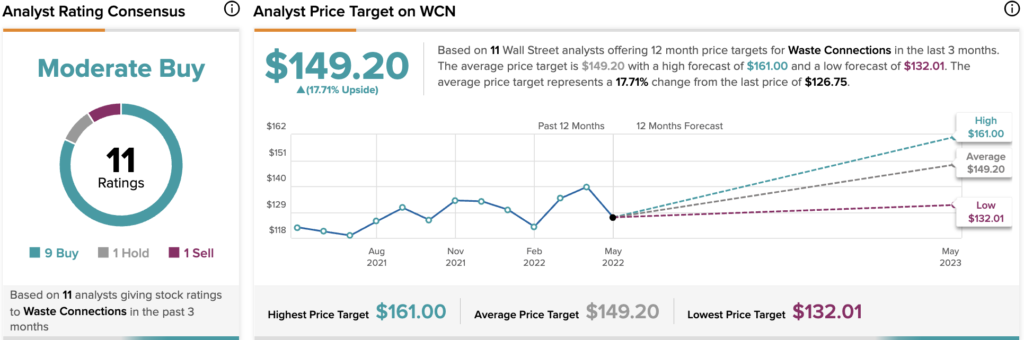

Turning to Wall Street, Waste Connections has a Moderate Buy consensus rating, based on nine Buys, one Hold, and one Sell assigned in the past three months. The average Waste Connections price target of $149.20 implies a 17.71% upside potential.

Analysts’ price targets range from a low of $132.01 per share to a high of $161 per share.

Final Thoughts

There’s no question that Waste Connections is a good business that effectively turns trash into cash. As an industry leader, it has the cash flow to acquire smaller players in order to grow its market share and appears to be doing so responsibly.

Nonetheless, the valuation is not cheap, which is why we are neutral on the stock.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure