Movie studio and streaming magnate Paramount (PARA) has made some impressive strides lately. The company has gained sufficient ground to draw the attention of no less than the Wizard of Omaha himself, Warren Buffett. However, just because Berkshire Hathaway (BRK.A) has been buying shares, does that mean you should too?

Warren Buffett buying in is a good reason to be bullish, especially since it assumes that he, or someone connected to him, has done due diligence ahead of such a buy. A closer look at the company’s internals, meanwhile, suggests other reasons, and this is why I’m bullish on Paramount too.

The last 12 months for Paramount have been a bit up and down, but after some volatility in the early going, the stock has generally leveled off.

The latest news suggests that its relatively tight trading range is hiding excellent potential. Over the last several months, Berkshire Hathaway has picked up about over $2.6 billion worth of Paramount shares. Reports noted that Berkshire Hathaway had been an investor in Viacom before it ultimately became Paramount.

It doesn’t seem to be sentimentality that’s pushing Buffett back toward Paramount, however, but rather an expectation of further gains or a potential merger to come. Interestingly, Berkshire Hathaway purchased the stake in the form of Class B shares, which don’t come with the same kind of voting rights that Class A shares do.

Wall Street’s Take

Turning to Wall Street, Paramount has a Hold consensus rating. That’s based on six Buys, seven Holds, and three Sells assigned in the past three months. The average Paramount price target of $34.25 implies 8.3% upside potential.

Analyst price targets range from a low of $24 per share to a high of $49 per share.

Investor Sentiment is Strongly on Paramount’s Side

Right now, Paramount holds a Smart Score of 9 out of 10 on TipRanks. That puts it one step below the maximum level of “outperform” potential and is still considered an “outperform” overall. Interestingly, that sentiment is echoed throughout several markers of investor sentiment but not all of them.

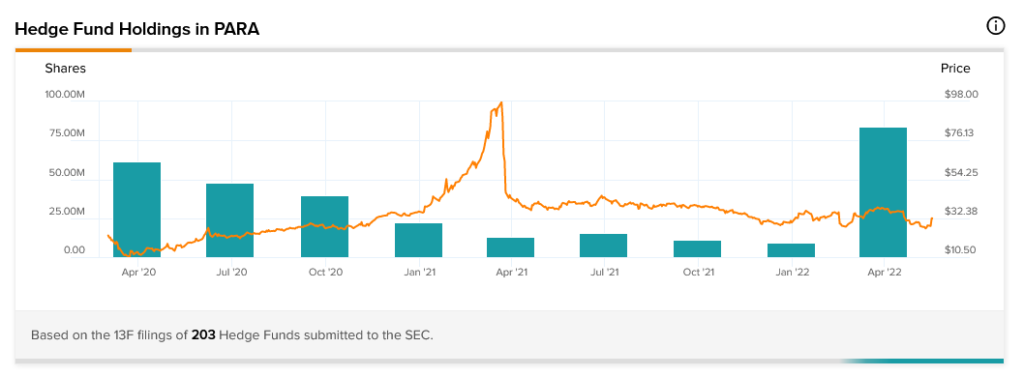

First, there’s the matter of hedge fund involvement, as tracked by the TipRanks 13-F Tracker. Hedge funds had been selling out of Paramount positions for years prior to the most recent quarter. There was a bit of a comeback between March 2021 and June 2021, but that lost ground in the two quarters that followed.

The latest quarter is a whole different story. Between December 2021 and March 2022, hedge funds went from holding just under 9.349 million shares to just over 84 million shares.

Meanwhile, insider trading at Paramount is very, very heavily buy-weighted. There have only been four transactions in the last three months, but all of them were buy transactions. Going back to the full year, buyers led sellers by 53 buy transactions to five sell transactions.

As for retail investors who hold portfolios on TipRanks, they’re the only downside here. TipRanks Portfolios holding Paramount stock have dropped 0.6% in the last seven days, and 1.7% in the last 30 days.

Paramount’s dividend history, while present, is less than ideal for income investors. While Paramount has regularly paid a dividend for the past 15 years, the last increase came with the December 2019 payment. It’s held stable ever since. While that was a feat during the pandemic years, it’s much less a feat right now.

It’s Going Somewhere. The Question is, Where?

One of the biggest objections that some investors have had about Paramount is that it’s too small to have much impact on the streaming market. In a way, they’re right, but not in every way.

We have to remember here that Paramount encompasses a range of properties. Everything Viacom was is now Paramount, which includes CBS, Nickelodeon, Comedy Central, MTV, and more. That’s a lot of programming.

From TV Land classics to modern-day wonder hits like Yellowstone, there’s quite a bit going on here. In fact, when you start looking at the broader slate of Paramount titles, you get to wondering how Paramount could ever go wanting for content. Some of the biggest names of the last 20 years are found therein, from Cloverfield to Transformers to Star Trek.

Certainly, Paramount has been making hay while the sun shines on the Star Trek license. I can think of five recent Star Trek series off the top of my head: Picard, Discovery, Lower Decks, Prodigy, and now Strange New Worlds.

That’s a lot of Trek. I can easily remember an era in which you got one new series, and they stuck with it for years. Deep Space Nine, anyone?

Yet, the problem here is one of resources. It takes a lot to bring a new media property to fruition. If it doesn’t return the investment fairly quickly, it’s abandoned in favor of something else. As much as Paramount can try, it only has the resources to try so much.

Suggesting that Paramount might be interested in some mergers is worthwhile; Paramount has a lot of media it can work with. Finding a partner with deep enough pockets to bankroll those efforts could be what Paramount needs to become a titan in the field. It’s wholly possible that Warren Buffett has seen such an effort coming and is investing accordingly.

Concluding Views

Paramount has a ton of media to work with. It just needs the ability to actually work with that media effectively. It has ample catalog titles it can offer up for streaming—when’s the last time you saw Raul Julia in The Addams Family?—and that’s helping it build an audience.

Paramount+ and Showtime together currently boast around 62 million subscribers. That’s one serious customer pool.

Better yet, Paramount is trading below its average price targets and has been trading at a fairly stable level for the last year. Add to that a solid, if slowly moving, dividend, and there’s a lot of reason to get bullish on Paramount. Warren Buffett’s involvement is really little more than a positive sign for what Paramount’s already been doing.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure