Walmart (WMT) reported Q4 2022 earnings last week, which included a push from its holidays sales.

The company beat the consensus on revenue (+$2.67 billion) and EPS (+$0.03). The company foresees sales increasing over the next calendar year.

The continuation of divestitures by the company is slightly offsetting its financial performance. Although current volatile market conditions have produced a short-term down trend for the company’s stock price, I still rate the company as bullish in the long-term.

Q4 Financial Reports and Future Outlook

Holiday sales pushed the company’s revenue numbers for the quarter. Walmart reported $152.9 billion in revenue, representing a 0.5% increase year-over-year. Revenue has increased in every report for the last three quarters. The company is successfully navigating supply chain disruptions and inflation issues.

Walmart reported U.S. net sales of $105.3 billion. International sales were $27.2 billion and Sam’s Club sales were $19.2 billion. Global sales were down and negatively affected by divestitures. The company is selling assets in the U.K. and Japan and the loss of revenue was due to the loss of these operations.

The company saw growth in its China and Mexico operations, as well as in Flipkart, an Indian e-commerce website.

The company reported a gross profit of $27.3 billion and an operating income of $5.9 billion. Walmart showed a net income $3.5 billion. The company had free cash flow of $11 billion in 2021. The consensus revenue estimate for Q1 is $138.25 billion.

Bullish Rating

Over the last two years, the company’s stock price has seen a lot of uptrend. Since the start of the year, there have been dramatic $10 swings in the stock price, which are representative of larger market volatility being driven by inflation, fed rate hikes, and now war.

The company’s stock price has been on a downtrend the last three months, although it has made several attempts to hit the $150 price channel. The price has met a lot of resistance on its upper limits.

Without the current volatility, I feel that the stock price would push the $150 limits.

Wall Street’s Take

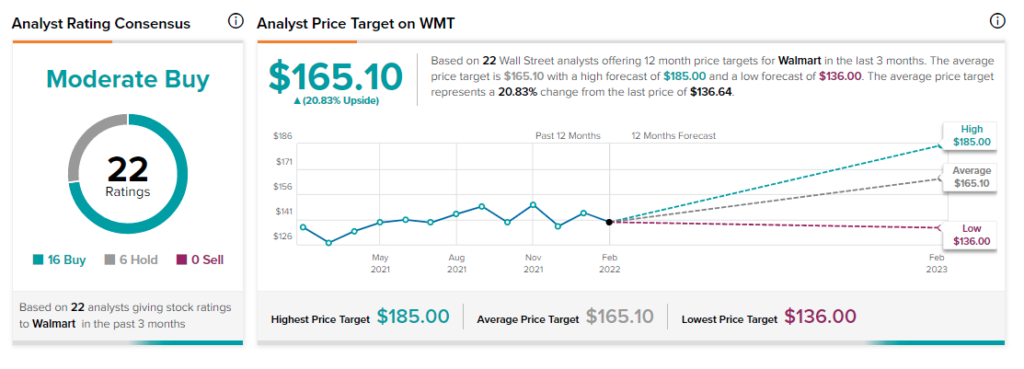

Turning to Wall Street, Walmart has a Moderate Buy rating based on 16 Buy and six Hold ratings in the last three months. The average Walmart price target of $165.10 implies a 20.8% upside potential.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure