Retail giant Walmart (NYSE:WMT) is scheduled to report its third quarter Fiscal 2024 results on Thursday, November 16. Ahead of the company’s Q3 earnings release, several analysts remain bullish about WMT stock and have reaffirmed their Buy ratings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

WMT’s competitive pricing and extensive product range might have supported growth in its comparable sales. However, high inflation may have impacted merchandise sales to some extent. Wall Street expects WMT to post adjusted earnings of $1.52 per share on revenues of $159.65 billion.

Here’s What Analysts Are Saying

Heading into WMT’s Q3 results, Jefferies analyst Corey Tarlowe expects the retailer to post stronger-than-expected U.S. comp sales and EPS. The top-rated analyst has maintained a Buy rating on Walmart stock and raised the price target to $195 (implying 16.3% upside) from $190.

Similarly, Stephens analyst Ben Bienvenu raised the price target to $190 from $185 and reaffirmed a Buy rating on the shares. Bienvenu expects the company to surpass fiscal Q3 estimates and raise its guidance for Fiscal 2024. Furthermore, the analyst believes WMT’s margins might show improvement driven by top-line growth momentum and benefits from the investments made last year.

Also, analyst Robert Ohmes from Bank of America Securities reiterated a Buy rating on Walmart with a price target of $190. The analyst expects that the company will continue to increase its share in the grocery market. Additionally, Ohmes predicts an uptick in Walmart’s gross margin in the latter half of Fiscal 2024, driven by higher-margin revenue sources like digital advertising, third-party marketplaces, and fulfillment services.

Five-star Wells Fargo analyst Edward Kelly is of the opinion that Walmart’s competitive pricing and diverse offerings position it favorably to capture more market share despite a downturn in consumer spending.

Is Walmart a Good Stock to Buy?

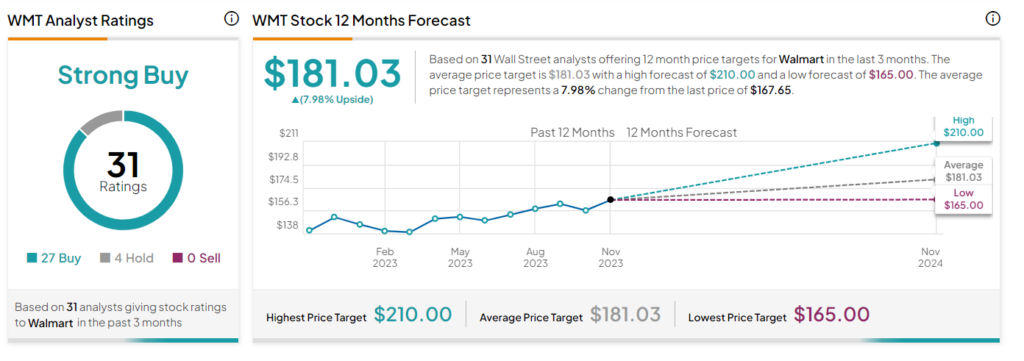

Overall, analysts are upbeat about Walmart stock ahead of the Q3 report. It has 27 Buy and four Hold recommendations for a Strong Buy consensus rating. Further, analysts’ average price target of $181.03 implies 8% upside potential from current levels. The stock has gained over 18% so far in 2023.

Insights from Options Trading Activity

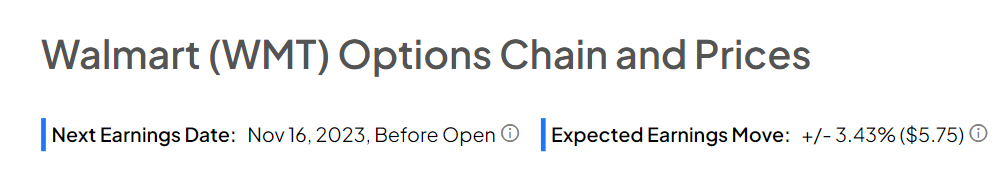

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in a +/- 3.43% move on Walmart’s earnings. WMT shares have averaged a negligible 0.18% upward move in the last eight quarters. In particular, the stock fell 2.24% in reaction to Q2 2023 results.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Key Takeaway

Wall Street remains bullish about Walmart’s performance in the quarter. While high inflation remained a drag in the quarter, WMT’s strong market position and its value offerings are key supporting factors for the company.