Despite the rear-view damage and considerable negative momentum, many Wall Street analysts remain upbeat on beaten-down payment plays. In this piece, I’ll use TipRanks’ Comparison Tool to look at three contrarian payment plays that the market has been too quick to give up on.

Payment stocks, especially those leveraging financial technologies, have been the canary in the coal mine over the past year, enduring considerable selling pressure well before the broader markets headed into a correction and, eventually, a bear market.

Still, it’s hard not to want to do some buying after the pummeling they’ve taken this year. It’s entirely possible that more than just a “mild” recession is baked into shares at this juncture. Though coming quarters will be nail-biters, I think there’s real value to be had over the long run.

Block (SQ)

Block, formerly known as Square, used to be one of the most attractive fintech stocks in this market. The hype and euphoria got slightly out of hand in late 2020 and early 2021. Shares peaked in February 2021 before enduring a bumpy road and eventually crashing hard into the latter half of 2021. The first half of 2022 has just been salt in the wounds of Jack Dorsey’s empire.

The firm behind Cash App and Square Point-of-Sale has been busy working on other initiatives behind the scenes. With Jack Dorsey giving the firm his full attention, there are many reasons to give SQ the benefit of the doubt, even as it moves through one of the roughest macro environments in recent memory.

RBC analysts recently noted that Block’s second-quarter results will see the firm “walking on a fine line” as inflation’s impact begins to weigh on spending habits. Other analysts have also been busy lowering their price targets in response to the stock’s brutal 75% crash.

It’s not just a questionable consumer that’s a cause for concern for Block; the firm faces considerable disruption as rivals look to take a bigger bite out of the payments space. It seems that everybody wants to get into payments these days. If there are economic profits to be had, you can be sure it’ll get the attention of the disruptive big-tech heavyweights.

With a robust Cash App ecosystem and a focused Jack Dorsey giving the firm his undivided attention, I’d not bet against Block stock, even as the fintech scene gets more crowded with time.

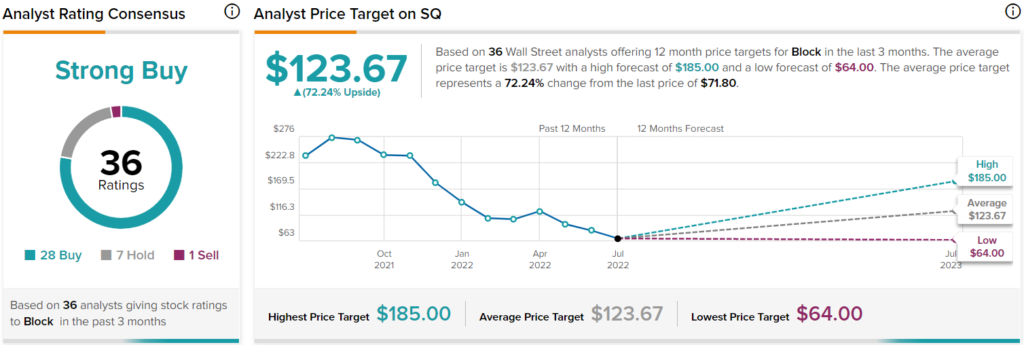

The stock trades at 2.5 times sales, which heavily discounts Dorsey’s capabilities. I think the stock is severely oversold. Analysts agree, with a “Strong Buy” rating. The average Block price target of $123.67 implies 72.2% upside potential from current levels.

PayPal (PYPL)

PayPal is another fintech company that’s fallen hard amid the “fintech bubble” burst. Like Square, PayPal has a robust peer-to-peer service (Venmo) that may have stickier users than many expect. With big-tech darlings looking to sink their funds into their own digital payments services, PayPal needs to pivot in a way it’s never done before.

In prior pieces, I noted that merging with a social-media company would make a lot of sense to capitalize on the nascent social-commerce trend. Even if investors shoot down any merger attempts or acquisitions, I think the PayPal of tomorrow will look quite different as management looks to respond to rising competitive threats.

PayPal isn’t just a sitting duck as new entrants into payments arise. The company has been making smart moves, including the acquisition of digital-coupon firm Honey, that could make the PayPal ecosystem stickier with time (like honey).

Honey isn’t just a nice-to-have for PayPal. It’s an extension that can help save digital shoppers a considerable sum of money. As the extension is integrated into PayPal’s “super app,” I expect the company will make it hard for its users to jump ship to a rival payments platform.

Add cryptocurrency wallets, value-adding perks, and other innovations into the equation, and PayPal seems like a firm that’s more than capable of expanding its reach into new verticals.

At 3.6 times sales, PayPal stock is priced as though it’s out of answers for competitive threats and coming e-commerce spending headwinds. Though hiring could slow significantly, I wouldn’t count the juggernaut out of the game after a 74% plunge.

Wall Street is incredibly bullish, giving it a “Strong Buy” rating. The average PayPal price target of $114.39 implies 41.1% upside potential.

Visa (V)

Visa is a credit card company that’s pretty much gone nowhere for two-and-a-half years. Shares are down a mere 15% from all-time highs, far less than your average fintech stock. Amid the rocky, albeit relatively-muted correction, the stock has seen its valuation multiple contract considerably.

At writing, the stock trades at 33.1 times earnings and 16.5 times sales. On a price-to-sales basis, the stock is still uncomfortably expensive, especially in an environment that could see consumer spending grind to a halt.

Management decreased its sales guidance for Fiscal Year 2022 by a couple of percentage points. The suspension of operations in Russia and other macro headwinds are to blame.

With a lowered bar and solid market leadership, Visa is a stock that may get its legs back in as soon as a few quarters, even if consumers can’t dodge and weave through the coming economic pressures.

Turning to Wall Street, analysts are bullish, giving Visa a “Strong Buy” rating. The average Visa price target of $257.71 implies 20.6% upside potential.

Conclusion: Analysts are Most Optimistic About SQ Stock

Wall Street is staying bullish on the fallen payments plays. Block, PayPal, and Visa are all “Strong Buys.” Of the three names, analysts expect the most from Block stock, which is currently expected to see 72.2% upside over the year ahead.