There are over 7,600 stock analysts on Wall Street, writing and publishing an ever-increasing volume of notes on stocks and investment opportunities. The volume of data is both intimidating – and a gold mine for retail investors.

In these reports, the collected collective wisdom of Wall Street, investors can find everything they need to know about the right stocks to buy – and the right stocks to avoid. This trove of information, including descriptions, notes, and ratings on stocks, is all there for investors’ taking, but for one possible pitfall: How can investors tell which analysts to trust?

Start by looking to the best-rated analysts from the Street. TipRanks collects and collates the data of the stock markets, and brings it together in one place – including comprehensive rankings of the stock analysts. Each analyst is rated on his or her accuracy and average return, over a span of months or years. And for now, the top spot is held by Oppenheimer’s Brian Schwartz, an expert in the tech sector, and the #1 analyst overall on Wall Street.

Schwartz’s top rating is based on his 82% success rate, with 340 accurate stock ratings out of 413 total, and his average rate of return of 36%. That is, an investor putting money into all of Schwartz’s stock choices over the past year would have seen the investment grow by one-third; it’s an impressive return.

And now, here are the details on two of the top analyst’s recent stock picks.

PubMatic (PUBM)

We’ll start with PubMatic, a software company with a focus on marketing and advertising. PubMatic designs platforms for digital publishers, with tools purpose-built to make life easier on media buyers and app developers. The company’s software and tools connect mobile app, website, and video publishers with advertisers using automated systems – and maintaining the privacy of personal information. PubMatic bills itself as the future of online monetization for internet content creators.

PubMatic entered the public markets last December, in an IPO that saw the company put 2.655 million shares up for sale. And additional 4.13 million shares were put up by certain existing shareholders. PubMatic priced its stock at $20, well above the $16 to $18 range initially expected. The IPO raised over $118 million in new capital for the company.

On August 10, PubMatic released its 2Q21 earnings, its third quarterly report since the IPO. Revenues came in at $49.9 million, up 13% sequentially and an impressive 88% year-over-year. EPS doubled from 9 cents in Q1 to 18 cents in Q2 – and was far above the break-even recorded in the year-ago quarter. The company reported a solid balance sheet for Q2, with no debt and an in 11% yoy increase in cash to $122 million.

Oppenheimer’s Schwartz is impressed with PubMatic’s solid growth and strong prospects, writing, “We leave the quarter incrementally positive on the company’s Identity Hub solution, as it allows publishers to seamlessly integrate alternative identifiers into their ecosystem, which should unlock incremental monetizable inventory. FY21 revenue/EBITDA guidance increase of 5%/19% and initial FY22 guidance signals mgmt.’s confidence in business momentum.”

The top analyst added, “The company has a good moat, architectural advantages, highly referenceable account and is well positioned to gain future market share by continuing to offer features, functionality and capabilities that publishers want and are willing to be flexible on pricing for larger commitments. As the industry consolidates over the next decade, the company will become more profitable.”

To this end, Schwartz rates PUBM shares an Outperform along with a $45 price target. Investors could be pocketing gains of ~64%, should Schwartz’s forecast hit the mark over the next 12 months. (To watch Schwartz’s track record, click here)

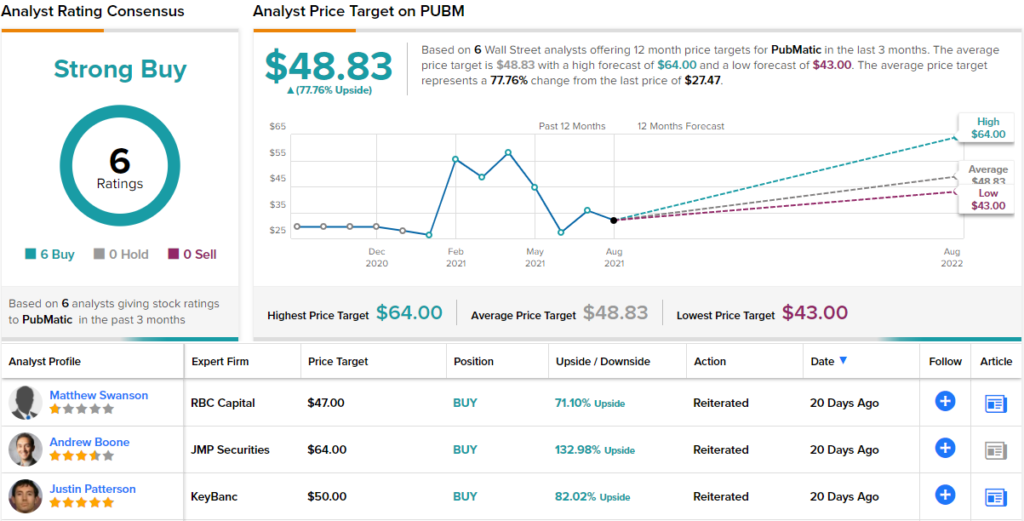

This stock has picked up 6 analyst reviews in its first months of public trading, and they all agree that it’s a Buy, making the Strong Buy consensus unanimous. PUBM shares are priced at $27.47 with an average price target of $48.83, suggesting room for ~78% price appreciation in the coming months. (See PUBM stock analysis on TipRanks)

Zendesk (ZEN)

The second stock we’re looking at here is Zendesk, another software company. Zendesk, based in San Francisco, offers a customer service software platform optimized for fast customer response times; Zendesk’s business clients can use the platform to speed up customer response time and improve engagement. The Zendesk CRM platform is compatible with live chat, social message, and voice contact.

Zendesk boasts customers in over 160 countries around the world, with over 160,000 paid customer accounts. The company brought in over $1.02 billion in total revenue last year, despite the COVID crisis, and has seen eight consecutive quarter-over-quarter revenue increases over the past two years.

In Q2, the most recent quarter, Zendesk brought in $319.6 million at the top line, up 29% year-over-year, although the net loss deepened sequentially from 41 cents to 49 cents. Looking ahead, the company is guiding toward full-year 2021 revenue in the range of $1.310 to $1.318 billion. At the midpoint, this represents a 28% yoy revenue increase. Zendesk expects $120 million to $130 million free cash flow for the year.

ZEN shares have shown volatility this year. The stock has had three separate peaks above $150 in the last 6 months, and is currently down approximately 18% from that level. According to top analyst Schwartz, this opens up a buying opportunity for investors, as it puts a quality stock in a relatively low price.

“We recommend taking advantage of the ZEN weakness… Zendesk continues to drive solid growth via its new platform suite and good enterprise momentum. Also, with a broadening platform of solutions, Zendesk is well-positioned to rebound next quarter given the bookings momentum and healthy end market demand and customer service software spending driven by remote work and COVID-19 catalysts,” Schwartz opined.

In line with these comments, Schwartz says that ZEN’s ‘fundamentals remain solid,’ and he rates the stock an Outperform (i.e. Buy), with a $180 price target. Shares could appreciate ~46%, should Schwartz’s thesis play out in the coming months. (To watch Schwartz’s track record, click here)

Overall, of the 9 recent analyst reviews on ZEN, 8 are to Buy and only 1 to Hold, for a consensus rating of Strong Buy on the shares. ZEN is selling for $123.04 and its $181.14 average price target suggests it has room for ~47% one-year upside. (See ZEN stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.