Visa (V), along with its industry companion Mastercard (MA), has essentially monopolized the payments processing network industry.

Visa is operating a virtual toll booth for every single daily transaction, receiving a fee for all purchases its cardholders make. In other words, every time one swipes their cards for their daily coffee or automatically has their cards charged from Spotify and Disney+, Visa profits from frictionless and low-risk payment streams.

This is the case even when one utilizes third-party platforms and wallets, like Apple Pay, for instance. Further, due to the company’s prolonged relationships with most major global banking institutions, Visa features an incredible moat.

While Visa was notably impacted by the COVID-19 pandemic in 2020 and 2021, the company has recovered rather rapidly, with its financials reaching new record numbers in its latest results.

On the one hand, the ongoing uncertainties attached to a rather shaky macro environment that could materially affect consumer spending have spooked investors. Thus, despite its record results, shares of Visa currently trade around 21% below their 52-week highs.

On the other hand, the company’s performance trajectory remains very promising, while elevated inflation levels can even result in increased profitability levels amid increased consumer spending on a nominal basis.

With the stock’s valuation returning toward reasonable levels following the ongoing correction tech equities have been experiencing, I remain bullish on Visa.

Robust Growth Tailwinds Despite Uncertainties

Visa’s Q2-2022 results established continuous performance improvements coming off of the pandemic’s challenges.

With all retail locations now back and running as well as robust e-commerce trading activity, Visa reported year-over-year Q2-2022 net revenue growth of 25%, to $7.2 billion. This celebrated a new quarterly net revenue record for the company.

Increased revenues were primarily the result of positive advancements across the board. Payments volume grew 17% on a constant-currency basis, amid a complete recovery from Q2-2021 when many businesses were still being affected by the pandemic.

Surprisingly enough, elevated payment volumes continue to be boosted by the gradual shift of the world turning cashless. While electronic payments have become the norm in multiple counties, cash is still prevalent in others, offering Visa a great growth opportunity.

As management noted during the company’s earnings call, Visa continued to see a strong rate of cash displacement in consumer spending. In Q2, Visa recorded debit cash volumes growth of 2%, while debit payments volumes rose by 12%.

In fact, cash displacement persisted all around the world. Year-over-year, across debit and credit, the company recorded 7.9 billion more payment transactions and 16 million fewer cash transactions, which illustrates the shift toward a cashless world.

This trend is highly prevalent in Latin America, as well as in Central Europe, the Middle East, and Africa, where physical cash is still being used widely. To breathe in some perspective, In the full year of 2019, cash comprised 59% of total payments volume. In Q2-2021, it was 50%, while in Q2-2022, it was 46%.

Thus, we can see a clear trend when it comes to electronic payments adoption in emerging markets, which is set to benefit Visa for years to come.

It’s also worth noting that Visa’s potent recovery has been partially supported by strong cross-border volume growth. Cross-border payment volumes rose 38% versus the comparable period last year. Excluding Europe, which, up until recently, was experiencing various COVID-19 restrictions, cross-border volumes rose 47% year-over-year.

Regarding the ongoing invasion of Ukraine, Visa has suspended its operations in Russia. However, as management noted, the company still expects accelerated revenue growth versus the pre-COVID-19 era moving forward, even without Russia. This is due to a vast worldwide opportunity across Visa’s three growth drivers, including consumer payments, new flows, and value-added services.

Regarding its profitability, Visa benefits from the benefits of its frictionless business model. Its gross margins are practically 100%. Consider Visa’s cash flows as “royalties” yielded from each and every payment processed powered by Visa’s network, with virtually no cost of goods sold.

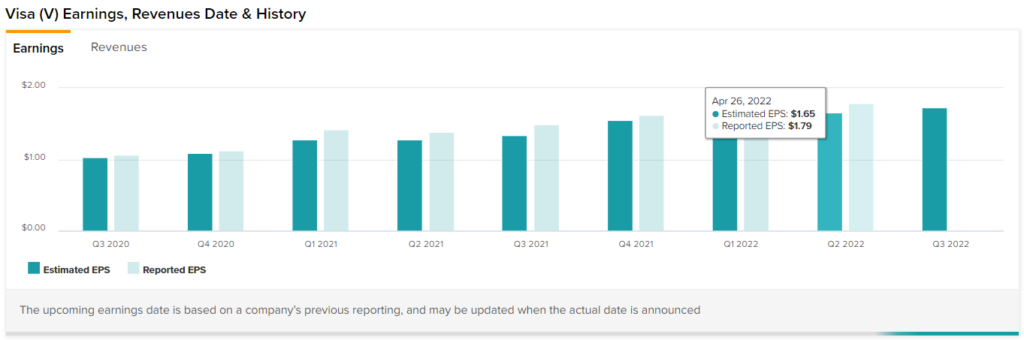

Thus, net margins remained at sky-high levels, coming in at 50.7% in fiscal Q2. Combined with robust revenue growth, adjusted earnings per share came in at $1.79, 29.7% higher compared to last year.

Visa’s business model is so scalable that it wouldn’t be an overstatement to say that net margins could converge towards 60% or 70% over the long run, which is utterly remarkable considering the company’s size.

Wall Street’s Take

Turning to Wall Street, Visa has a Strong Buy consensus rating based on 14 Buys and two Holds assigned in the past three months. At $267.81, the average Visa stock forecast suggests 32.2% upside potential.

Takeaway

Despite the underlying concerns surrounding the current macroeconomic landscape, Visa’s growth trajectory in a post-COVID world remains very impressive. With emerging markets gradually turning cashless and the traveling industry still recovering, resulting in sky-high cross-border volumes growth, the company continues to experience robust operating tailwinds.

Following elevated profit levels and the stock’s recent correction, Visa’s forward P/E has approached substantially more reasonable levels lately. At a forward P/E of around 26.2, I would argue that Visa shares are rather attractively priced considering the underlying growth prospects, deep moat, and sky-high profit margins. Accordingly, I remain bullish on the stock.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure