Visa and Mastercard were among several corporations that severed ties with Russia following its invasion of Ukraine. While Russia was an important market for these companies, analysts believe they will recover from the impact of the suspension of Russian operations on their financials.

Visa (NYSE: V)

Let’s begin with Visa. Last month Visa announced that it is suspending all its operations in Russia. And now, a recent Wall Street Journal report stated that Visa’s decision to pull out of Russia has eroded about 4% of its revenue. However, this shouldn’t worry investors much as the company’s CFO, Vasant Prabhu, remains confident of recovering the lost revenues within a year through other markets, the report highlighted.

Notably, strong domestic volumes and a recovery in cross-border travel are driving growth at Visa. Visa’s CEO, Alfred Kelly, stated, “We remain confident that we are well-positioned, via our multi-pronged growth strategy, to deliver strong results well into the future.” He added that economies continue to improve worldwide, and cross-border travel will continue to recover with the easing of restrictions.

Echoing similar sentiments, Deutsche Bank analyst Bryan Keane stated that volumes are trending positively for Visa as cross-border travel is recovering. Further, Visa’s business remains resilient outside Russia. The analyst is bullish on Visa and has a price target of $270 (24.4% upside potential).

Along with Keane, Donald Fandetti of Wells Fargo also recommends a Buy on Visa stock. However, he lowered his estimates due to the Russia/Ukraine conflict. Fandetti stated that Visa generated about 4% of its net revenue from Russia in FY21. However, he added, “Visa is essentially able to offset all of the lost revenue, resulting in no negative operating leverage.”

Including those of Keane and Fandetti, Visa stock has received 16 Buy and two Hold recommendations for a Strong Buy analyst consensus rating. Further, the average price target of $277.13 indicates 27.7% upside potential over the next 12 months.

Mastercard (NYSE: MA)

Along with Visa, Mastercard suspended operations in Russia. Notably, Mastercard has operated in Russia for over 25 years. Moreover, Russia accounted for about 4% of its revenues, according to Fandetti. The analyst expects the suspension of operations in Russia and disruptions in Ukraine to impact Mastercard’s near-term financials, and he lowered his EPS estimates.

However, Fandetti reiterated a Buy rating on Mastercard stock and a price target of $430 (22.1% upside potential). He stated, “We are keeping our Q1’22 estimate of $1.45 unchanged” and “believe strength in the core business can offset the loss of Russia and impact from Ukraine.”

Notably, improving spending trends (cross-border spending above pre-pandemic levels), new deals, and the expansion of products are supporting Mastercard’s financial performance. During the Q4 conference call, Mastercard’s CEO, Michael Miebach, stated, “Underlying spending trends remain strong.” This should benefit Mastercard.

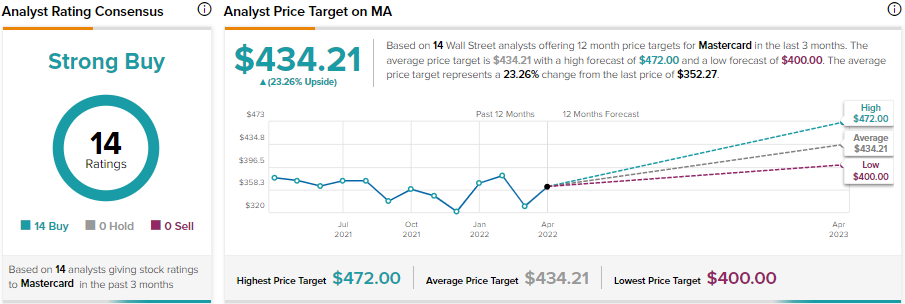

Along with Fandetti, Wall Street analysts are also bullish on Mastercard stock. It has received 14 unanimous Buy recommendations for a Strong Buy consensus rating. Further, the average price target of $434.21 indicates 23.3% upside potential over the next 12 months.

Bottom Line

Both Visa and Mastercard lost about 4% of their net revenues due to the suspension of operations in Russia. However, strong cross-border spending and strength in their domestic businesses bode well for growth and will likely offset the loss of revenue. Further, e-commerce adoption, geographic expansion, and new products provide growth opportunities.

It’s worth noting that hedge funds have accumulated Visa and Mastercard stocks over the past quarter. Per TipRanks’ Hedge Fund Trading Activity tool, hedge funds added 12.5M Visa shares in the last three months. Further, they accumulated 5.6M Mastercard shares during the same period.

Also, according to TipRanks’ data-driven Smart Score rating system, both Visa and Mastercard are expected to outperform market expectations over the next 12 months.

Download the TipRanks mobile app now

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure