At times, dividend-growth investors become too focused on yield, and let many excellent dividend stocks pass them by. Case in point, a stock such as VISA (V) may not even cross their radars given the company’s 0.6% yield.

With a market capitalization north of $460 billion, Visa is the largest company in the credit services industry. It is the largest payment processor in the world and in Fiscal Year 2020, it processed almost $9 trillion in purchase transactions. Visa operates in over 200 countries, and processes transactions in over 160 currencies.

To give investors an idea of its scope, VISA is capable of processing over 65,000 transactions per second.

Worried about how crypto might change the landscape for traditional payment providers?

Visa is fostering partnerships with industry leaders, and the company’s purchase of CryptoPunk, albeit symbolic, opens the door for future collaborations.

Visa is a Blue Chip by every standard, and is worthy of consideration from both aggressive and conservative investors. However, it is too often ignored by dividend-growth investors.

The company can make for an excellent growth anchor in one’s portfolio and despite the low yield, is growing the dividend at a rapid pace. I am bullish on the stock. (See Insiders’ Hot Stocks on TipRanks)

Fiscal 2021 Q4 Results

On October 26, Visa reported fourth-quarter results that rattled the market. While the company beat on the top and bottom lines, a disappointing outlook weighed on the share price. Lost in the negative headlines was the 17.2% hike to the company’s quarterly dividend.

The raise extends the company’s dividend growth streak to 14 years. The double-digit raise shouldn’t come as a surprise since the company is averaging 18% dividend growth over the past five years. There is no reason to expect that this pace of dividend growth will slow.

In FY 2021, Visa generated $14.5 billion in free cash flow (FCF). That led to $8.7 billion in share repurchases, and $2.8 billion in dividends. With a Fiscal 2021 FCF payout ratio of only 19.23%, there is ample room for dividend growth in the mid-to-high teens.

History of Outperformance

While Visa may not check all the boxes for those in need of income today, it can lead to outsized gains for those who only need the income further down the line.

Over the past decade, Visa has returned 1,056.6% and $10,000 invested 10 years ago would be worth $115,659.74 today. In comparison, the S&P 500 has only returned 280.7% and a $10,000 investment would have grown to only $38,070.

Of note, these are total returns and assumes all dividends were reinvested. That means that Visa’s total returns were more than double that of the S&P 500. That is no small difference.

While Visa may not have yielded much in terms of dividend income over that period, there is no question Visa was the better investment. For those with a longer-term horizon, a low-yield, high-growth company can turbo charge one’s portfolio.

Homemade Dividends

There is also something that yield-seeking investors overlook and that is homemade dividends. Using the example above, investors could start taking advantage of those outsized capital gains by selling a portion of their holdings to satisfy their cash flow needs.

Homemade dividends are also the basis for the Dividend Irrelevance Theory, which suggests that investors shouldn’t put much emphasis on the company’s dividend policy. It argues that since the company’s stock price decreases by an amount equal to the dividend paid after the ex-dividend date, an investor can simply choose to sell a portion of their equity before this date and achieve the same level of cash flow.

The main argument against homemade dividends are the transaction costs associated. However, with the advent of free trading platforms like Robinhood (HOOD), this argument is become irrelevant. In fact, it makes using stocks like Visa to generate homemade dividends an even more attractive proposition.

Wall Street’s Take

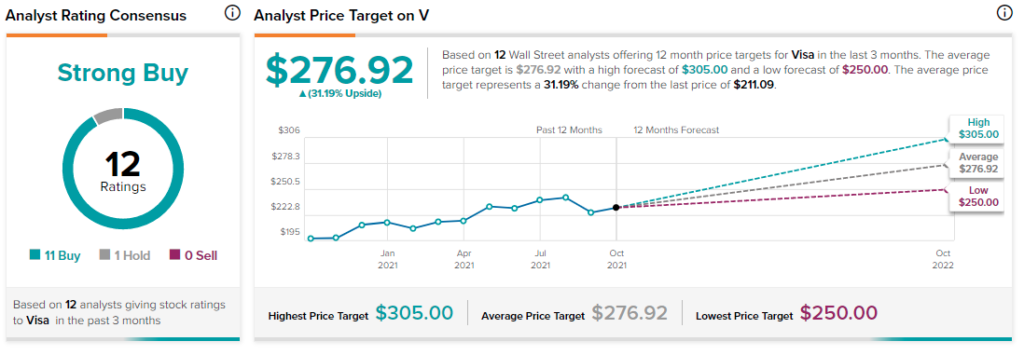

From Wall Street analysts, Visa earns a Strong Buy analyst consensus based on 11 Buy ratings, and one Hold rating. Additionally, the average Visa price target of $276.92 puts the upside potential at 31.2%.

Disclosure: At the time of publication, Mat Litalien did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.