A new connection between Virgin Galactic (SPCE) and Boeing (BA) might prove helpful going forward, and it has already given Virgin a boost today. Shares are currently up 12%.

Virgin Galactic established a deal with beleaguered aircraft maker Boeing to produce motherships. More specifically, Boeing’s subsidiary Aurora Flight Sciences will build a set of carrier planes known as motherships.

The motherships in question will take Virgin Galactic spacecraft up into the atmosphere and allow them to launch from much farther up, requiring less fuel and improving reusability. The parts will be prepared for assembly by 2025, reports note.

Virgin might seem like a major waste of time and money to some, especially given that its primary stock in trade is space travel. Yet, the idea is sufficiently romantic in and of itself to draw at least some interested investors.

While the short-term future for Virgin Galactic looks rocky, I’m bullish on it anyway. A combination of a very low point of entry coupled with some exciting possibilities makes this tailor-made for a small flier that could pay off enormously down the road.

The last 12 months tell a tale of disaster. Last year at this time, Virgin Galactic was selling for more than $50 per share. Now, it’s down to just over $7. July 2021 started a precipitous drop that took until January 2022 to finally level off.

Wall Street’s Take on SPCE Stock

Turning to Wall Street, Virgin Galactic has a Hold consensus rating. That’s based on one Buy, two Holds, and two Sells assigned in the past three months. The average Virgin Galactic price target of $9 implies 24.1% upside potential.

Analyst price targets range from a low of $4 per share to a high of $20 per share.

Investor Sentiment is Starting to Look Up

There are some who are clearly convinced that Virgin Galactic is a pig in a poke that will never get off the ground – literally or figuratively. In fact, Virgin Galactic has a Smart Score of 2 out of 10 on TipRanks, which is the second-lowest level of “underperform.” That makes it very likely to lag the broader market.

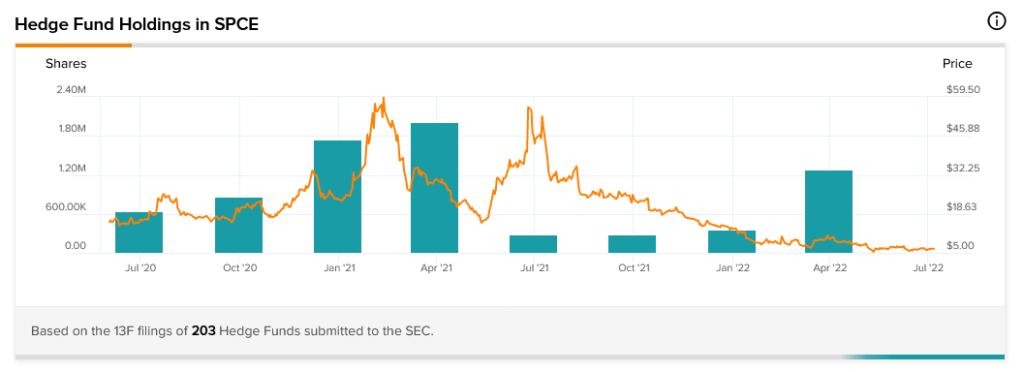

Hedge Funds Show Optimism

However, there are signs that investors are coming around. Hedge fund involvement is the biggest such sign. The TipRanks 13-F Tracker recently revealed that hedge funds bought 911,200 shares in the last quarter. That alone might not sound impressive, but for two points.

One, it’s the third consecutive increase in hedge fund involvement. Two, it’s a massive increase; in December 2021, hedge funds owned 364,489 shares. Today, they own over 1.275 million, over three times what they did in the preceding quarter.

Insiders Have Been Buying Recently

Someone is betting big on Virgin Galactic to win, and hedge funds aren’t alone here. Insider trading in the last three months shows a significant uptick in buying. There were only transactions recorded in May for the last three months, but Buy transactions outpaced Sell transactions seven to four. That’s nearly two to one.

Going back to the last year tells a somewhat different story, as sell transactions led Buy transactions by 26 to 17. 2022, so far, has been a big year for purchases, with 10 of those 17 transactions taking place so far this year. Again, 2022 looks like insiders are putting their money on Virgin Galactic going to the moon.

TipRanks Investors are Still Pessimistic

It’s a different story for retail investors, at least those who hold portfolios on TipRanks. The number of TipRanks portfolios that hold Virgin Galactic stock is down 0.4% in the last seven days and down 1.6% in the last 30 days. Though the pace of exit is slowing considerably, retail investors are still abandoning their Virgin Galactic positions.

A Potentially Huge Play, Someday

Let’s be frank; Virgin Galactic is not a play that will pay off quickly – most likely. In fact, it’s a play that will easily take at least into the second half of this decade to show its true worth. Virgin won’t even get the parts for its new motherships until 2025, remember.

Moreover, an upcoming recession—some think we’re already there—won’t help either. Few people will have an interest in taking a recreational trip to the vast emptiness of space when they’re having a tough time affording dinner and gas to get to work. Recessions have long hurt recreational travel prospects. Travel doesn’t get more recreational than going off-planet.

However, this is a case where timing works out in Virgin Galactic’s favor. The odds that a recession that starts in 2022 will last into 2025 will be fairly long.

It’s possible, certainly—the market could collapse entirely—but betting on such an outcome is generally a long shot. By the time Virgin Galactic gets its motherships assembled and ready for use, the recession may well be a bad memory.

It’s worth having a contingency plan just in case, but the odds of that long a recession actually happening are fairly remote. People said the market would collapse completely in 2008, too, and look how that turned out.

Anyway, Virgin Galactic is a long-term play. Very long-term. It may not appreciate much within the next five years. Consider this: 100 shares of Virgin Galactic can be had for the price of a modest television today.

That might be worth a flier just to hang onto for a couple of decades and then come back to it. Hedge funds and insiders’ positions certainly suggest someone’s looking for this stock to appreciate in a big way.

Once Virgin Galactic gets those motherships in place and operating, they can run many more flights. More flights mean lower prices per ticket. Eventually, Virgin Galactic might go from a struggling space liner at $7 per share to a thriving suborbital flight airline, moving people in remarkably short times for prices comparable to a standard airline ticket.

Concluding Views – A High-Risk, High-Reward Bet

There are people who will spend more money on Powerball tickets in a month than even 50 shares of Virgin Galactic are selling for right now. However, considering how much more likely Virgin Galactic is to pay off than those Powerball tickets, it’s likely a much better investment to Buy the stock.

Virgin Galactic could eventually be a big winner for those willing to put a comparatively small chunk of their portfolios on the line on a somewhat risky investment. That’s why I’m bullish on Virgin Galactic.

A fairly small amount of cash today could pay off substantially in a few years. It’s going to require a very patient investor to pick up cheap Virgin Galactic and hold it until it appreciates substantially. However, if it works out, that wait could represent one of the greatest gains your portfolio has ever seen.