VinFast Auto (NASDAQ:VFS) shares are down 21% so far this week, after the company told Bloomberg that it plans to build 45,000 to 50,000 electric cars this year and raise ‘a lot’ of money to help fuel its expansion.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Might these facts be related? I think they might.

On the one hand, VinFast stock is following the growth stock mantra of “moving fast and breaking things” to the letter. Already, VinFast is coming off a quarter that saw its revenues grow nearly 160% while its production of electric vehicles grew five-fold in volume. In addition to reiterating its production target for this year, VinFast CEO Ms. Le Thi Thu Thuy told Bloomberg today that her company plans to ‘move into’ [the southeast Asian electric car market] aggressively, starting with Indonesia. There, VinFast is planning to build a $1.2 billion car plant — at the same time as it is investing $2 billion in Phase 1 of a car plant construction in North Carolina (growing to $4 billion over time).

All this expansion has the company contemplating an invasion not only of the lucrative American car market, but flooding the “Asean” market as well, where in addition to Indonesia, VinFast plans to begin selling EVs in six other markets as well.

The problem with all of this growth, however — even for growth investors, it seems — is that VinFast is making no secret of its need to raise a lot of money to pay for it.

VinFast’s SPAC IPO in August 2023, after all, was kind of a bust. After early investors pulled out ahead of the closing, VinFast ended up selling far less stock than it hoped to, leaving its balance sheet in a perilous state, with only $129 million in cash, versus nearly $3 billion in debt.

Suffice it to say, that’s not a lot of cash with which to pay for $5.2 billion in planned construction costs. And it raises the prospect of VinFast having to take on a lot more debt — or selling a lot of shares at a currently depressed stock price — in order to get ahold of the cash it needs.

Assuming VinFast goes the selling-stock route to raise this cash, it will face the problem of convincing people to invest in a company that lost $623 million last quarter even as its production rate soared — a situation that sounds an awful lot like “the more cars we sell, the more money we lose.” And on top of that, VinFast has already spooked a lot of investors with its announcement, earlier this month, that insiders plan to sell as many as 76 million of their own VinFast shares.

The fact that the “insiders” in question include primarily companies controlled by VinFast’s own founder — companies with names like Vingroup, Vietnam Investment Group, and Asian Star Trading & Investment Ltd (all majority owned by Vietnamese tycoon Mr. Pham Nhat Vuong) probably isn’t helping matters, either. It doesn’t inspire a lot of confidence in outside investors who do not own a controlling interest in VinFast.

The way things are going, in fact, I very much suspect what we’re looking at here in VinFast is a broken IPO. And the safest way for investors to look at it may be by slowing down, rubber-necking a bit — then driving straight on by.

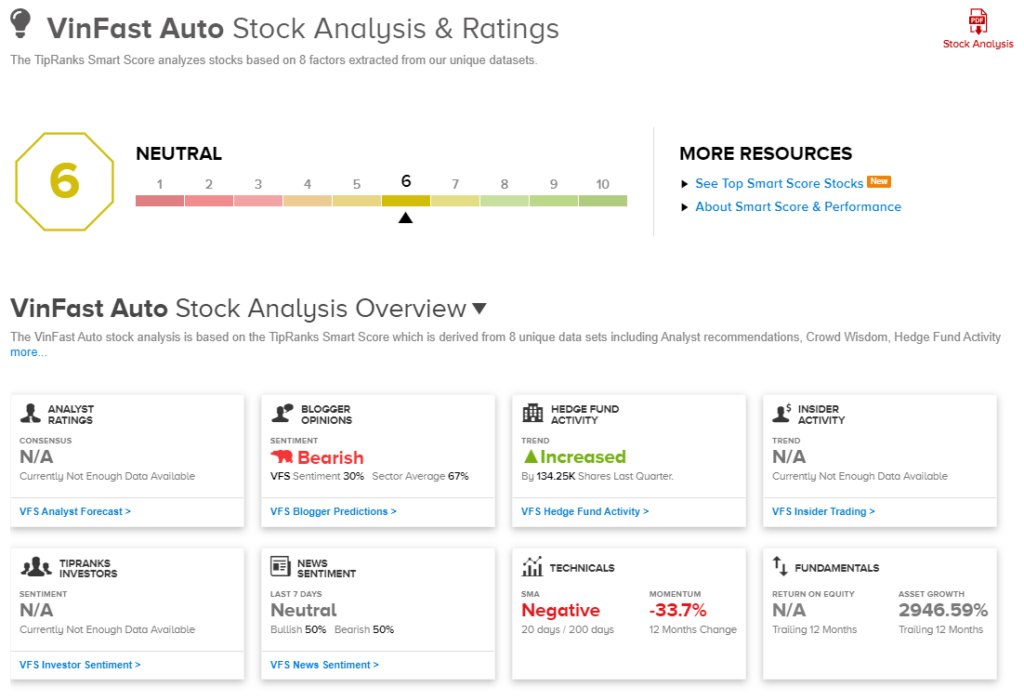

Overall, VinFast has a Smart Score of 6 (out of 10) on TipRanks, meaning that it is likely to perform in line with market expectations. This score suggests that the company has both strengths and weaknesses that investors should consider. (See VinFast stock analysis)

Smart Score is TipRanks’ proprietary quantitative stock scoring system that evaluates stocks on eight different market factors. The result is data-driven and does not involve any human intervention.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.