The telecommunications sector has had a rough ride this year. However, the sector is stabilizing as of late. In this piece, we compared two telecom stocks that have both gained over 10% in the last month. Verizon Communications (NYSE:VZ) and AT&T (NYSE:T) both offer sizable dividend yields, but throughout much of this year, investors have punished one for weak guidance and rewarded the other for solid guidance. So is Verizon or AT&T a better investment? The simple answer would be “yes,” since both stocks are good.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Verizon Communications (VZ)

Verizon is the one that’s gotten punished for much of this year due to falling subscriber additions and guidance that suggested continued declines in subscriber adds. However, with a dividend yield of 6.66% after raising its dividend annually for the last 12 years, Verizon shouldn’t be written off yet. This is a company with staying power, so a long-term bullish view appears appropriate amid this year’s sell-off.

It’s true that Verizon has some problems right now. The company has struggled to add new subscribers and is seeing sizable churn rates because it raised prices, and management has been quite clear about the challenges.

At its second-quarter earnings report in July, VZ reduced its full-year guidance for wireless service revenue growth from 9% to 10% to a range of 8.5% to 9.5%. However, the company reiterated that guidance in its third-quarter report in October. While the higher prices did hurt Verizon initially, the third quarter brought a 10% increase in wireless service revenue, although postpaid net additions remained lackluster, at a mere 8,000.

With a company like Verizon, it’s crucial to look at the big picture. Multiple surveys have named Verizon as having the best mobile network for years. Thus, even if people avoid the company for a while due to its higher prices, it would take some very grave execution missteps by management to keep Verizon from bouncing back. With the current fears about a recession and persistent inflation, consumers are watching every dime, making them more sensitive to price increases than usual.

However, it seems likely that all Verizon needs right now is a little time, and the high dividend yield makes it worthwhile to hang around and wait for things to normalize. Additionally, Verizon’s trailing P/E of around 8.5x looks low relative to history, making the current valuation look like a buy-the-dip opportunity.

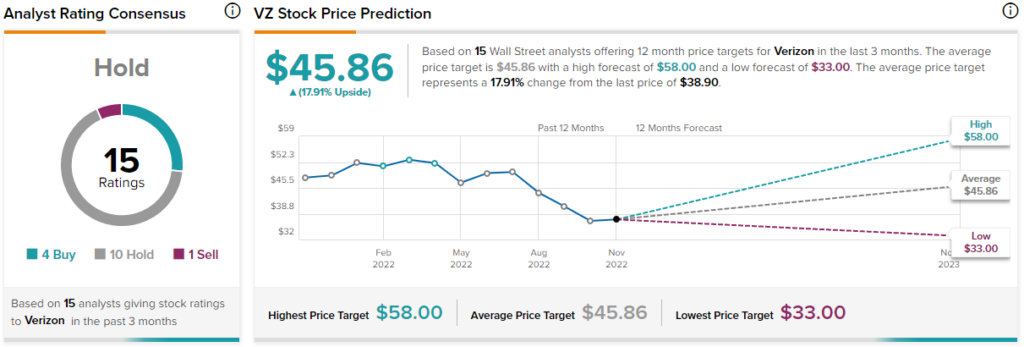

What is the Price Target for VZ Stock?

Verizon has a Hold consensus rating based on four Buys, 10 Holds, and one Sell rating assigned over the last three months. At $45.86, the average price target for Verizon Communications implies upside potential of 17.8%.

AT&T (T)

AT&T offers better guidance and subscriber trends and has an attractive dividend yield of 5.9%. Despite these positives, AT&T is trading at a slightly lower P/E multiple than Verizon, at around 7.9x. The low valuation and positive trends suggest a bullish view also looks appropriate for AT&T.

AT&T’s stock has climbed 11.6% over the last month, and like Verizon, AT&T is undervalued relative to history. However, unlike Verizon, AT&T deserves a premium over Verizon due to its stronger guidance.

The company bumped its full-year guidance up to at least $2.50 per share from up to $2.46 per share, which it had forecasted in the previous quarter. Raising profit expectations at this time is also compelling due to rising costs. AT&T also remains “confident” that it can generate $14 billion in free cash flow for 2022, meaning it has plenty of cash to support its dividends and debt repayments despite the rising interest rates.

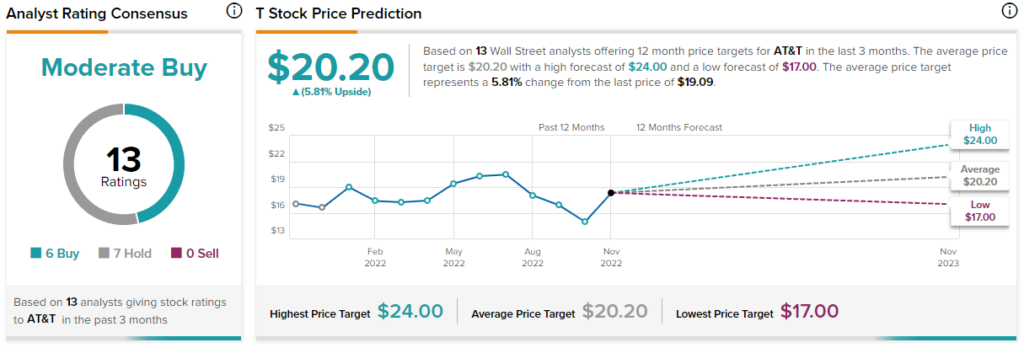

What is the Price Target for T Stock?

AT&T has a Moderate Buy consensus rating based on six Buys, seven Holds, and zero Sell ratings assigned over the last three months. At $20.20, the average price target for AT&T implies upside potential of 5.81%.

Conclusion: Long-Term Bullish on VZ and T

It’s hard to go wrong in a somewhat recession-resistant industry like telecommunications, which has also been weak in the current financial markets. As a result, Verizon and AT&T both look attractive, especially compared to their overpriced competitor T-Mobile (NASDAQ:TMUS), which trades at a massive P/E ratio of about 124x after excitement triggered by its subscriber trends.

However, it’s important to realize that Verizon and AT&T are both long-term positions. It could take time for a sustainable recovery to sweep the markets, but in the meantime, both companies’ dividends may help ease some of the pain for investors as they wait for a recovery.