Founded in 2007 and headquartered in California, Veeva Systems (VEEV) is a leader in cloud-based software for the global life sciences industry. Its solutions are focused on pharmaceutical and life sciences industry applications.

We are bullish on the stock.

Veeva’s Competitive Advantage

There are a couple of ways to quantify a company’s competitive advantage using only its income statement. The first method involves calculating a company’s earnings power value (EPV).

Earnings power value is measured as adjusted EBIT after tax, divided by the weighted average cost of capital, and reproduction value (the cost to reproduce the business) can be measured using total asset value. If the earnings power value is higher than the reproduction value, then a company, in theory, has a competitive advantage.

For VEEV, the calculation is as follows:

EPV = EPV adjusted earnings / WACC

$8.628 billion = $604 million / 0.07

Since Veeva has a total asset value of $3.82 billion, we can say that it does have a competitive advantage. In other words, assuming no growth for Veeva, it would require $3.82 billion of assets to generate $8.628 billion in value over time.

The second method to determine a competitive advantage is by looking at a company’s gross margin because it represents the premium that consumers are willing to pay over the cost of a product or service. An expanding gross margin indicates that a sustainable competitive advantage is present.

If a company has no advantage, then new entrants would gradually take away market share, leading to a decreasing gross margin over time in an effort to remain competitive.

In Veeva’s case, its gross margin has expanded steadily in the past several years, rising from 56% in Fiscal 2013 to 72.8% in the past 12 months. This indicates that a competitive advantage is present in this regard as well.

DuPont Analysis

When taking a look at Veeva Systems’ return on equity, we can see that the trend has been flat. Stocks with a high return on equity tend to outperform the market, which is why it is an important metric to watch.

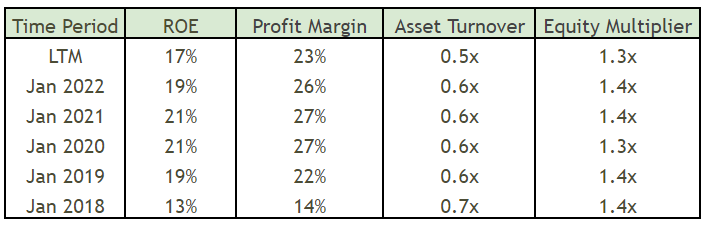

The company’s return on equity trend is as follows:

This would suggest that Veeva Systems is efficient at using its capital. However, let’s take a deeper look at just how efficient the company truly is. When breaking down the ROE trend into a DuPont analysis, we can separate it into three different parts.

The first part is the profit margin, which measures what percentage of revenue the company keeps as profit. The second part is asset turnover, which measures how efficiently a company uses its assets to generate revenue. Lastly, we arrive at the equity multiplier to measure how much leverage the company uses.

By multiplying all three metrics together, we arrive at ROE. The DuPont analysis is useful because it helps management and investors determine the key drivers of return on equity. It also allows managers to address issues such as too much leverage or inefficient uses of assets.

For Veeva Systems, the breakdown of ROE is as follows:

As we can see, the trend has remained very steady over the past several years. This suggests that the company is reasonably predictable and reliably profitable under many different market conditions.

Hedge Fund Activity

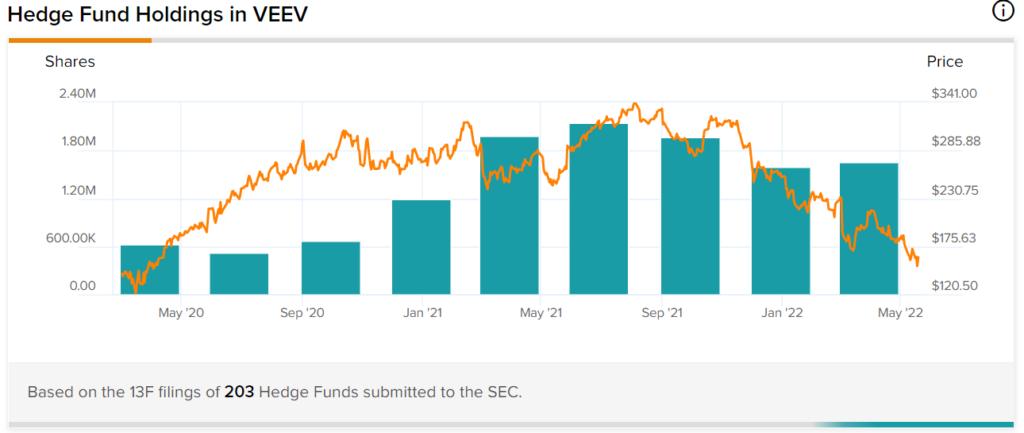

Since the market crashed in 2020 due to COVID-19, the number of Veeva Systems shares held by hedge funds increased from a low of 514,000 in June 2020 to 2.15 million at its peak in June 2021.

Since then, hedge funds reduced their holdings in the stock to 1.65 million in the last quarter. This was up slightly from the quarter ending in December 2021, which may be a positive sign.

However, it’s important to remember that this data is backward-looking, and it’s likely that hedge funds have since then reduced their positions in the company, given that the price has fallen near 52-week lows.

Risks

Some potential risks for Veeva in the long term might be what is giving it its advantage today. Veeva offers a very specialized platform for drugmakers in a specific niche of the IT Healthcare industry. This specialization has allowed the company to focus its resources on developing a platform that has become crucial for its customers.

However, the potential risk is that such a narrow focus may eventually limit growth potential. Nevertheless, Veeva is very profitable and has the resources to expand into segments that complement its current operations.

There are other risks associated with the company, though. According to Tipranks’ Risk Analysis, Veeva has disclosed 44 risks in its most recent earnings report. The highest amount of risk came from the Finance & Corporate category.

The total number of risks has decreased over time, as shown in the picture below.

Wall Street’s Take

Turning to Wall Street, Veeva Systems has a Moderate Buy consensus rating based on 13 Buys, five Holds, and zero Sells assigned in the past three months. The average Veeva Systems price target of $248.56 implies 51.8% upside potential.

Final Thoughts

Veeva is a solid business with a measurable competitive advantage. In addition, it is reasonably predictable under all market conditions and has the backing of analysts that see strong upside potential.

As a result, we are bullish on the stock.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure