Shares of the AI-based lending platform Upstart (NASDAQ: UPST) have dropped over 93% from its 52-week high. Multiple headwinds are impacting its business and stock price. However, what stands out is the positive signal from hedge fund managers, who have been increasing their exposure to UPST stock.

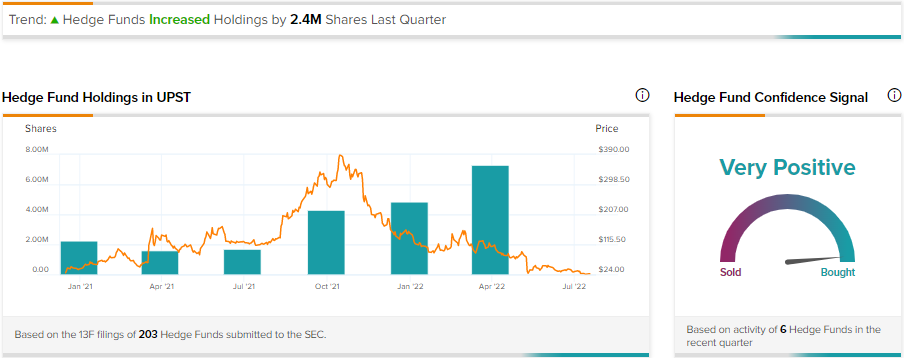

Per TipRanks’ Hedge Fund Trading Activity tool, hedge fund managers have raised their holdings in UPST stock by 2.4 million shares in the last quarter.

Looking at hedge fund activity, four hedge fund managers, including Bridgewater Associates’ Ray Dalio, have started a new position in UPST stock.

Meanwhile, Vulcan Value Partners’ C.T Fitzpatrick increased the holdings in UPST stock. However, Eos Focused Equity Management’s Steven M. Friedman & Brian D. Young closed their position in UPST stock.

Hedge funds accumulating UPST stock is a positive signal. However, analysts’ neutral stance adds uncertainty over the recovery.

Analysts Maintain a Hold Stance

UPST stock has received two Buy, seven Hold, and five Sell recommendations for a Hold rating consensus. Meanwhile, the average Upstart price target of $33.04 implies 26.6% upside potential to current levels.

It is worth mentioning that higher loan pricing amid tightening of the monetary policy, increased funding costs, delinquencies, and a decline in the number of products getting sent to the ABS (asset-backed securities) market are adversely impacting UPST’s business.

Citing these challenges, Upstart’s management recently lowered Q2 revenue guidance. UPST expects Q2 revenue to be $228 million, down from its previous guidance of $295 to $305 million.

Upstart’s CEO, Dave Girouard, stated that banks and capital market participants have turned cautious amid a weak macro environment. This has led to funding constraints in the market. Moreover, UPST’s attempt to convert on-balance sheet loans to cash resulted in losses as increasing interest rates led to discount selling.

In response to UPST’s reduced guidance, Wedbush analyst David Chiaverini stated that “we expect originations to be down ~20% in 2Q to $3.6 billion vs. our prior forecast of down ~10% to $4.1 billion.”

Chiaverini maintains his bearish stance on UPST stock and expects UPST “to squeeze as much profitability as possible out of each funded loan.” The analyst believes this will drive loan pricing and lead to a “higher take rate along with a lower conversion rate.”

Bottom Line

Hedge funds accumulating UPST stock is a positive indicator. However, the company is facing multiple challenges, including funding constraints, which were a key growth catalyst for UPST. The increase in the number of headwinds may stall the recovery in the short term.