A journey of a thousand miles begins with a single step, and a big one in this case. On Monday, Sorrento Therapeutics (SRNE) announced the FDA had given it the go ahead to initiate a Phase 2 trial of Abivertinib in COVID-19 patients with moderate to severe lung-related symptoms.

Abivertinib – a small molecule tyrosine kinase inhibitor – has already been studied in over 600 patients across the globe for several oncologic indications, with it able to target multiple cytokines at the same time. Sorrento is confident Abivertinib’s potent effect can help it prevent the “cytokine storm,” in which the body attacks its own cells on account of the immune system’s overreaction, in COVID-19 patients.

Dawson James analyst Jason Kolbert believes Sorrento is on track to create the perfect “cocktail” capable of providing “100% inhibition.”

“[The] news is consistent with the company’s goal to generate an antibody cocktail against SARS-CoV-2 coronavirus infection. As a cocktail, the product could remain effective even if virus mutations occur. Through the U.S.’s Project Warp Speed, it’s possible we could see this cocktail move rapidly to commercialization,” the analyst said.

Sorrento has multiple COVID-19 programs in various stages of development. These include antibody STI-1499 (COVI-SHIELD), which also recently demonstrated promising in vitro results. The drug was able to completely block the SARS-CoV-2 virus, and is set to be the first antibody in the antibody cocktail Sorrento is working on.

The company is also developing COVI-TRACK, a COVID-19 antibody testing solution, with it currently awaiting Emergency Use Authorization (EUA). Sorrento has already secured the means to produce up to five million test kits per month, which will be distributed to clinical sites across the U.S. once authorization is received.

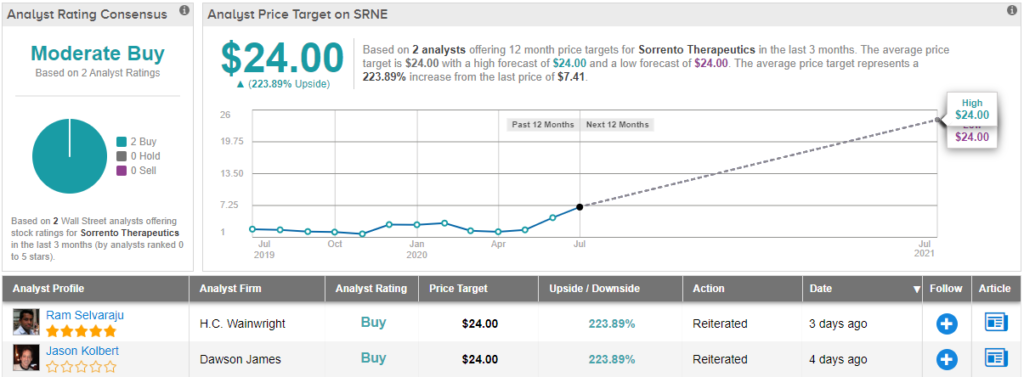

Accordingly, Kolbert keeps a Buy rating on Sorrento, along with a $24 price target. From current levels, there’s massive potential upside of 223% should the analyst’s thesis play out over the next year. (To watch Kolbert’s track record, click here)

Overall, it has been relatively quiet when it comes to other analyst activity. In the last three months, only 2 analysts have issued ratings. However, as they were both Buys, the word on the Street is that SRNE is a Moderate Buy. This is accompanied by a $24 average price target – the same as Kolbert’s. (See Sorrento stock-price forecast on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.