Union Pacific (UNP) is a railroad company that operates in the U.S. We are neutral on the stock.

Growth Catalysts

As a railroad company, Union Pacific is crucial for transporting goods across the country. In fact, ~28% of all freight in the U.S. is transported by rail.

In addition, the industry has a very high barrier to entry as it would require billions of dollars to duplicate the vast railroad networks that the current players have built over a very long time.

As a result, Union Pacific offers an essential service with pricing power, making it a potential hedge against inflation. If inflation persists, UNP should have very little trouble passing the costs on to its customers because, in many instances, transporting by rail is the most efficient method for shipping products.

Furthermore, UNP expects volumes in 2022 to increase for fertilizer, coal, industrial production, chemicals and plastics, auto sales, and domestic intermodal.

On the other hand, it expects a volume decline from forest products only and is unsure about grain products and international intermodal. Therefore, it appears that volume is more likely to increase in 2022 than decrease overall.

However, since UNP is a mature company, investors shouldn’t expect to see stellar growth. Nonetheless, the company regularly repurchases its shares which tends to boost share prices.

Consistent share repurchases have a dramatic difference in share count over the long run. In 2012, the share count was 946 million, whereas, in the most recent quarter, it was only 640 million.

Since the company generates plenty of free cash flow, it will likely continue buying back shares for many years to come.

Dividend

Union Pacific currently has a 1.85% dividend yield which is above the sector average of 1.34%. When taking a look at its LTM free cash flow figure of $6.1 billion, its $2.8-billion dividend payment looks safe.

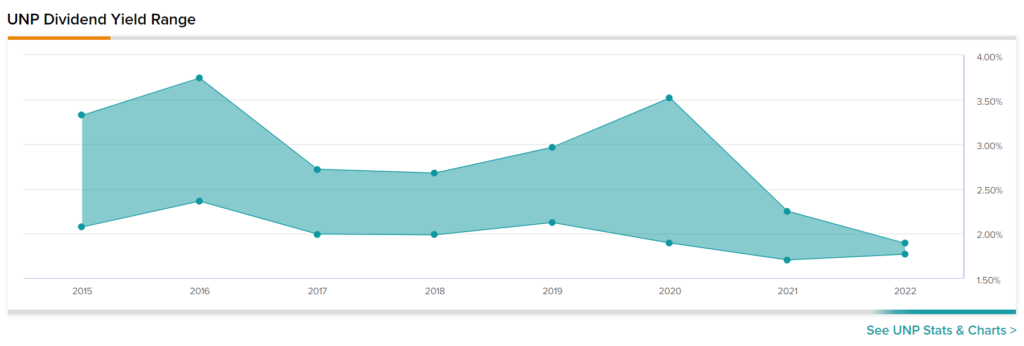

Taking a look at its historical dividend payments, we can see that its yield range has trended downwards over the past several years.

At 1.85%, the company’s dividend is near the low end of its range, implying that the stock price is trading at a premium relative to the yields investors have seen in the past.

Valuation

To value Union Pacific, we will use the H-Model, which is similar to a three-stage DCF model. The H-Model assumes that growth will decelerate linearly over a specified period of time. We believe this is a reasonable assumption as companies gradually slow down as they mature.

The formula is as follows:

Stock Value = (CF(1+tg))/(r-tg) + (CFH(hg-tg))/(r-tg)

Where:

CF = cash flow per share

tg = terminal growth rate

hg = high growth rate

r = discount rate

H = half-life of the forecast period

For Union Pacific, we used the following assumptions:

CF = $9.48 per share

tg = 2.218% (using the 30-year U.S. Treasury yield)

hg = 8.4% (based on analysts’ estimates)

r = 7.064%

H = five years (we are assuming it will take 10 years to reach terminal growth)

As a result, we estimate that the fair value of Union Pacific is approximately $260.43 under current market conditions.

Wall Street’s Take

Turning to Wall Street, Union Pacific has a Strong Buy consensus rating based on 17 Buys, two Holds, and zero Sells assigned in the past three months. The average Union Pacific price target of $273.84 implies 11.2% upside potential.

Final Thoughts

Union Pacific is a solid company with great fundamentals that generates plenty of cash. The company is reasonably predictable, as our fair value estimate is fairly close to the analyst consensus.

Nevertheless, we remain neutral because there isn’t a large enough margin of safety, and we believe that better opportunities can be found elsewhere.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure