In a landmark decision last week, the UK Supreme Court decided that Uber Technologies, Inc. (UBER) needs to classify their drivers as employees of the company, not contract workers. As a result of this decision, Uber drivers in the UK will be eligible for paid leave, insurance payments, and a guaranteed minimum wage. If other countries follow this decision in an attempt to ensure the job safety of drivers who partner with Uber, it could bring about the end of the business model as we know it.

Since its inception more than 10 years ago, Uber has been able to control its operating costs by treating partner drivers as freelancers, but things might change dramatically in the coming years. Evaluating the financial impact of these regulatory decisions is therefore key to determining Uber’s appeal as an investment.

Uber Has A Couple Of Options Up Its Sleeve

The ridesharing giant has a few options to choose from, and the company has yet to release an official statement on the subject matter. In an interview with Reuters, Uber’s Northern and Eastern Europe head Jamie Heywood said the court ruling will only apply to a select group of drivers at this point in time, and that the company is carefully evaluating the situation in order to implement the necessary changes.

Uber can respond to this regulatory threat in two ways. First, the company could increase the rates charged per ride, passing on the cost burden to consumers. The court ruling not only applies to Uber, but also to all other companies that hire freelance workers, so passing some of the costs to riders makes sense as this would be the path most ridesharing companies will follow to keep their operating margins intact.

Second, Uber could cease its business operations in the United Kingdom by selling its business to a competitor, which is exactly what it did in China when it sold Uber China to rival Didi Chuxing in 2016. Uber retained a small percentage of ownership in the merged entity, but the company is not actively involved in Chinese business operations anymore.

Even though Uber could go down this path, it seems like a distant second choice because Uber is the largest player in the UK market with more than 45,000 drivers and 3.5 million riders. According to data from Business of Apps, rivals such as Bolt, Free Now, and Ola are yet to reach 2 million app users, which is a testament to Uber’s dominance in the UK. Because of this market-leading position, Uber is more likely to make changes to its business model rather than divesting its UK business altogether.

Macroeconomic Tailwinds Will Help Uber Grow

For now, Uber faces this regulatory risk primarily in the UK and a few other European countries. On a global scale, Uber has a total addressable market opportunity of over $10 trillion through its mobility and food delivery segments, and the company is already the market leader in key regions such as North America, Latin America, and the Middle East. These competitive advantages are likely to help Uber report stellar earnings growth in the next decade, even though the recent UK Court ruling will exert pressure on operating margins until the company formulates a strategy to overcome this hurdle.

According to data from MarketsandMarkets, the Mobility as a Service industry will grow at a CAGR of 31.1% through 2030 to reach a value of $70.4 billion, and this paints a promising picture for Uber as the market leader of this industry. Urbanization in emerging nations, the increasing internet penetration rate, and growth of concepts such as the Internet of Things will all be catalysts for the growth of both the industry and Uber in the coming years.

Wall Street’s Take

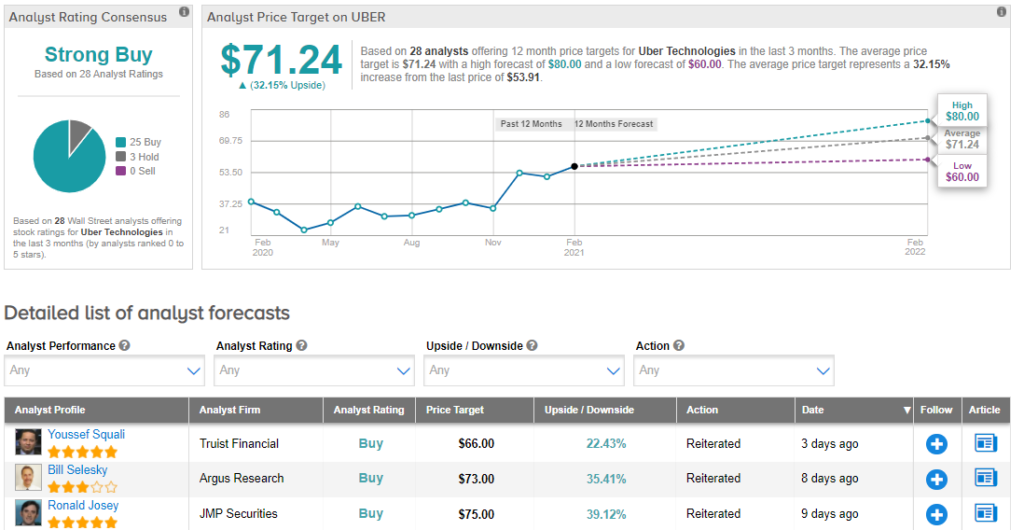

Looking to Wall Street, Uber has a Strong Buy consensus rating, and the average analyst price target of $71.24 implies upside potential of around 32% from the current market price of $53.91.

Many analysts believe Uber has what it takes to mitigate the threat from regulators, and grow exponentially because of its industry leadership and favorable macroeconomic developments. The reopening of the global economy following the success of the vaccination program could be a short-term catalyst in helping Uber shares converge with the average analyst price target. (See Uber stock analysis on TipRanks)

Takeaway

Uber will face headwinds in the UK as a result of the recent Supreme Court ruling, and operating margins are likely to contract. That being said, Uber’s global presence and the exponential growth expected in its mobility segment will help negate this impact.

The real threat would be a decision by other countries to follow the precedent set by the United Kingdom, but this is not a material risk at this time. Uber shares remain undervalued, but keeping a close eye on regulatory developments will be the key to identifying inflection points.

Disclosure: Dilantha De Silva was long Uber shares at the time of publication.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.