Shares of popular ride-hailing firm Uber (UBER) are attempting to come back after a year-long sell-off in excess of 50%.

There’s no question that the company has endured more than its fair share of headwinds over the years. While the firm has moved on from COVID woes and labor issues, a new slate of concerns have hit the stock. I remain bullish, however.

The Ukraine-Russia crisis has sent oil prices skyrocketing to unprecedented levels, raising the price at the pump. Many drivers were already considering leaving Uber during the worst of pandemic lockdowns.

Now, higher fuel costs appear to be yet another reason for Uber drivers to contemplate quitting altogether amid the Great Resignation.

To alleviate the higher price of fuel, Uber introduced $0.55 surcharges to rides. Early signs suggest that drivers don’t view the efforts as enough, with some drivers going as far as to call the effort “insulting.”

Uber’s Reputation with Drivers at Risk

Yet again, Uber’s reputation with its drivers is taking a hit. Although the company could raise surcharges further without disrupting demand, it may be a better idea for the company to absorb the impact of the latest oil shock without upsetting the biggest source of the firm’s moat.

The oil shock is unlikely to persist for a prolonged period. The sour taste in drivers’ mouths, though, is unlikely to be forgotten. The last thing Uber needs is more pressure on its margins, as it pushes closer towards profitability.

That said, the company could risk long-term damage by not keeping its drivers happy. If the economics no longer make sense with gas prices at elevated levels, they’ll simply stop driving and will not look back.

For Uber and its drivers, COVID and the Ukraine-Russia-induced oil shock have been a one-two hit. Despite the horrid headwinds, the stock seems incredibly oversold.

Such unprecedented headwinds will not last forever. For that reason, UBER stock looks like a value bet for long-term thinkers who believe management can steer through yet another black-swan-event-induced crisis.

The oil shock is bad news for Uber over the near term, but the company should be more than willing to take a hit for its drivers. Like it or not, unhappy drivers are likely correlated to unhappy customers. For now, the firm will have to walk on a tightrope to keep its customers, drivers, and investors from throwing in the towel.

Uber’s Foot Is on the Growth Pedal

Despite the near-term road bump of higher fuel expenses, Uber’s recent Investor Day, which followed robust Q4 numbers, was upbeat. The firm is experiencing solid growth across the board, with longer-term trends still pointing to significant margin expansion and growing profitability on a GAAP basis.

For the fourth quarter, demand was robust. More drivers are comfortable hitting the roads, as supply looked to meet the surge in demand. Indeed, a recovery from COVID conditions appears to be in full swing.

Could the fuel spike curb the recent recovery from COVID? Perhaps, the sudden spike in fuel prices was a shocker, giving Uber and its drivers less time to effectively pivot.

As time goes on, though, an equilibrium will be reached, and sights will be set to a continuation of the recovery towards pre-pandemic levels.

Wall Street’s Take

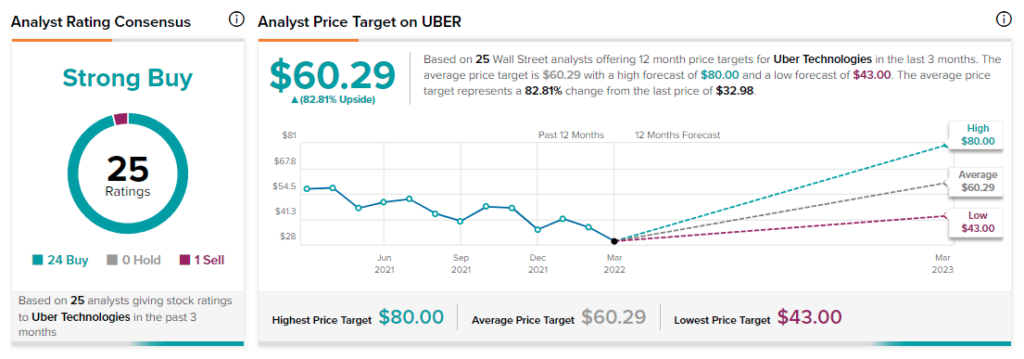

According to TipRanks’ rating consensus, UBER stock comes in as a Strong Buy. Out of 25 analyst ratings, there are 24 Buy recommendations and one Sell recommendation.

The average Uber price target is $61.39, implying 82.8% upside potential. Analyst price targets range from a low of $43 per share to a high of $80 per share.

Bottom Line on UBER Stock

Analysts remain incredibly bullish on the stock, with a Street-high price target that calls for shares to more than double. Such analysts are fans of the depressed valuation and the long-term path.

At writing, Uber stock trades at a mere 3.3 times sales, making it a potential glimmer of value in the tech space.

Though there are prominent headwinds, uncertainties, and hurdles that could step in the way of the firm’s operating margin expansion push, I do think patience will be rewarded.

In due time, the fuel spike and Omicron headwinds will blow over. Until then, expect Uber to be a bumpy ride as management looks to hit its targets.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure