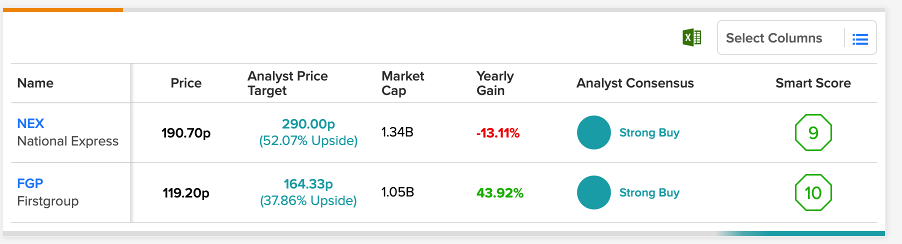

Leading transport providers National Express (GB:NEX) and First Group (GB:FGP) stocks have a high scores on TipRanks Smart Score tool with ‘Strong Buy’ ratings – here’s some insight into why.

As the travel industry is back to its full form, the transport companies’ operations are in full swing, as are their revenues.

Stocks with a score of nine and ten are meant to outperform the market returns.

The TipRanks Smart Score tool helps the investor to identify stocks which can outperform the market across various sectors. The tool also allows further filtering options talong with the smart score such as analyst rating, target price, dividends, and more.

Let’s have a closer look at these high-performing stocks.

National Express

National Express is a leading transport provider in the UK and also has services in Continental Europe, North America, North Africa, and Bahrain.

Services include bus, air, train, express coach, and airport travel.

The company has leverage from its size and geographical diversification, which help it win many big contracts. These contracts help it maintain consistent top-line growth.

In its half-year results for 2022, the company won 16 new contracts, mostly in North America, adding £150 million in revenues spread over the contracts’ lives. The company’s total revenue increased by 33% to £1.32 billion, which was the highest in the last 10 years.

The company is on track to achieve its growth goals in the second half through new contracts in Lisbon, Murcia, and Geneva. The company’s pipeline for new contracts is also promising, leading to huge scope for future revenue growth.

The company faces some headwinds with the rising cost of fuel – but higher demand for affordable travel options during a cost-of-living crisis could be beneficial for the company.

Is National Express a good stock to buy?

According to TipRanks’ analyst rating consensus, National Express’ stock has a Strong Buy rating, based on four Buy recommendations.

The NEX price target is 290p, which has an upside potential of 56%. The price has a high forecast of 350p and a low forecast of 240p.

First Group

First Group is a provider of public transport, including buses and railways, in the UK, the U.S., and Canada. The company leads the public transport space with its first bus and first rail divisions.

Company stock has recovered well after hitting the bottom when COVID began. The stock has been trading up by 19.1% this year.

The company’s operations are back on track as it fights its way out of the lockdowns. In its full-year results for the fiscal year 2022, its First Bus passenger volume jumped by 91%, reflecting the huge demand for bus travel.

In its First Rail segment, the company has secured various long-term contracts, adding to its income streams. First Group recently signed a multi-year national rail contract with Britain’s DfT (department for transport) for Great Western Railway.

The company has strong earnings opportunities in both its segments, which makes it confident in meeting targets for 2023.

Are First Group shares a good buy?

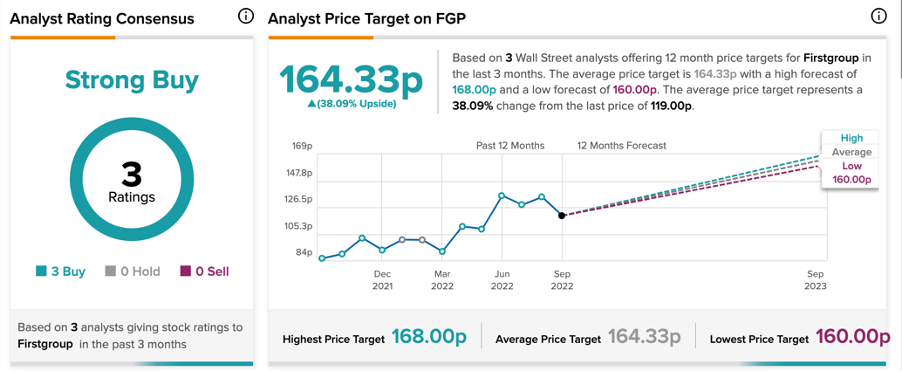

According to TipRanks’ rating consensus, First Group stock has a Strong Buy rating.

The FGP share price forecast is 164.3p, which represents a growth of 38% on the current price level. The price target has a high forecast of 168p and a low forecast of 160p.

Conclusion

The companies have strong market presence and have recovered well from the lockdowns.

Both companies are on track to deliver a strong year in 2023 in terms of growth. And the high Smart Scores clearly shows that they are well-placed to beat market returns.