Four-star analyst Richard Taylor has a satisfyingly high average return on two of his rated stocks – online trading group IG Group Holdings (GB:IGG) and watch retailer Watches of Switzerland Group (GB:WOSG), which have returns of around 20% and 48%, respectively.

Taylor is an equity analyst with Barclays and has previously worked with Liberum Capital, Citi, and HSBC Securities.

According to the TipRanks star rating system, Taylor is a four-star rated analyst with a success rate of 52%. He is ranked 1,440 out of 7,991 analysts and 2,445 out of 21,223 overall experts on TipRanks. His average return per transaction is 10.5%.

Let’s see the two stocks in detail.

IG Group Holdings

IG Group is a global fintech company dealing in online trading and investment solutions.

The company has hugely benefited from the rush of retail investors over the last few years. This is clearly visible in its share prices, which have grown by around 69% in the last 3 years.

In July, IG Group reported its annual results, with record revenues and profits. Net trading revenue was up by 16% to £972.3 million, supported by good client retention rates.

The company has also implemented a new capital allocation policy to reward its shareholders. The policy implies that 50% of the adjusted profit after tax should be distributed through ordinary dividends and also special dividends whenever necessary.

As per this policy, the board approved a dividend of 31.24p per share. It has a dividend yield of 5.4%, far above its sector’s average of 2.1%.

View from the City

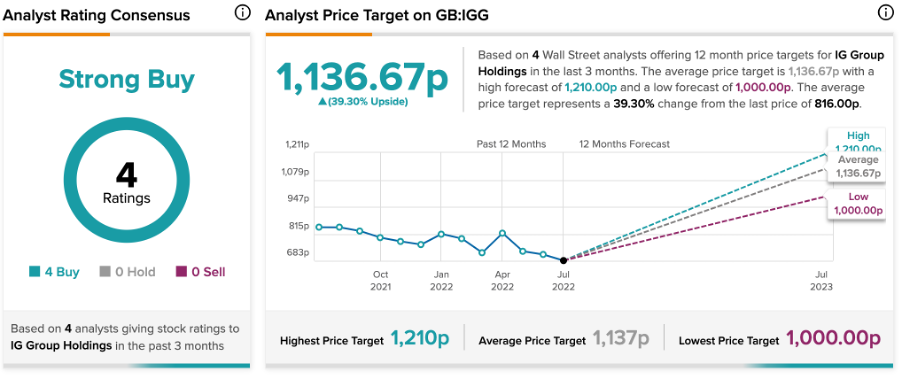

According to TipRanks’ analyst rating consensus, IG Group stock is a Strong Buy. It has four Buy ratings.

The average price target is 1,136.7p, with a high forecast of 1,210p and a low forecast of 1,000p. The price target is 39.3% higher than the current level.

Watches of Switzerland Group

WOSG is a UK-based retailer of premium Swiss watches.

WOSG has been Taylor’s best rating so far. During the period between May 2020 and May 2021, the stock generated a 225.2% return in the wake of Taylor’s Buy rating on the stock.

In the last three years, the stock has generated a massive return of 198.7%. But the share prices have been volatile in the last few months and the stock went down by 44% in the year to date.

Last month, the company posted its annual report for 2022, which ended on May 1, 2022. In the words of its chief executive, Brian Duffy, “the company has had a tremendous year.”

The group’s revenue jumped by 37% on a year-over-year basis to £1.2 billion. The U.S. market revenue increased by 44% and the UK increased by 34%. The growth is a testament to the fact that premium customers are not affected by inflation rates.

The company’s luxury jewellery revenue grew by 79%, boosted by strong growth of 130% from the U.S. market.

For the full year of 2023, the company expects its revenue to reach £1.45 billion to £1.5 billion.

View from the City

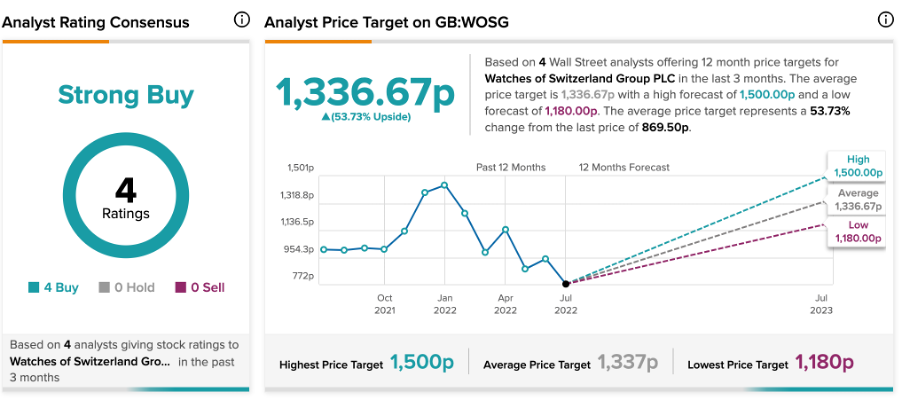

According to TipRanks’ analyst rating consensus, WOSG stock is a Strong Buy. The stock has four Buy ratings.

The average price target is 1,336.7p, which is 53.7% higher than the current price level. The price has a high forecast of 1,500p and a low forecast of 1,180p.

Conclusion

The two companies from Richard Taylor illustrate a good potential for growth, pushing their stock prices.

IG Group: The company’s product demand is strong based on the growing number of retail investors. Also, don’t forget the highly attractive dividend policy.

WOSG believes the worst of the pandemic is over and is entering a new year with a broad spectrum of brands and strong demand both offline and online.