Investing in dividend-paying stocks can be a great way to generate passive income and improve the portfolio’s growth potential. Given the current uncertain market situation, investors should consider shares of companies with a solid dividend history. Let’s take a look at two such high-yielding dividend stocks – EOG Resources (NYSE:EOG) and Energy Transfer (NYSE:ET) – that have received Strong Buy recommendations from the top Wall Street analysts.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

EOG Resources

EOG Resources engages in the exploration, development, production, and marketing of crude oil, natural gas liquids, and natural gas. The company’s strong balance sheet position, as reflected by its net cash position, supports its dividend payouts.

The company has been raising dividends every year since 2018. Also, EOG frequently rewards shareholders with special dividends of at least $1. Moreover, EOG stock has an impressive dividend yield of 7.85%.

Is EOG a Good Stock to Buy?

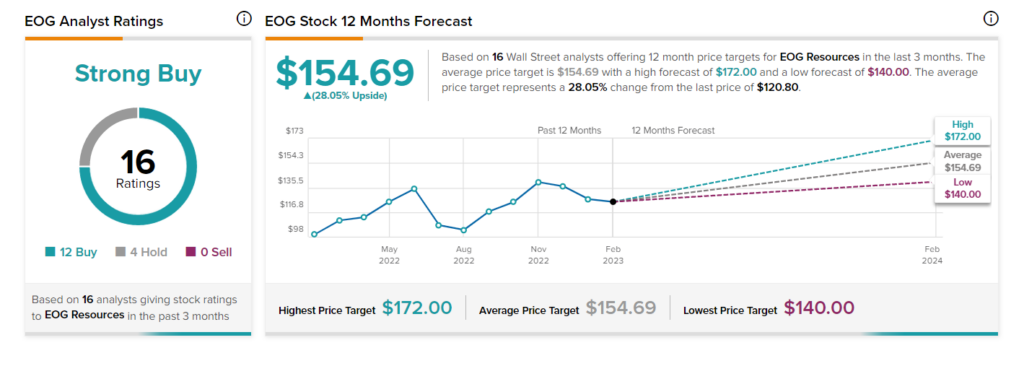

Wall Street continues to favor EOG stock, giving it a Strong Buy consensus rating based on 12 Buys and four Holds. The average stock price target of $154.69 implies 28.1% upside potential.

On another positive note, the stock has a maximum Smart Score of “Perfect 10” on TipRanks. Note that shares with a “Perfect 10” Smart Score have historically outperformed the S&P 500 Index (SPX) by a wide margin.

Energy Transfer

Energy Transfer provides natural gas pipeline transportation and transmission services. The company’s high dividend payouts are supported by robust cash flows and a strong financial position. This makes it a solid stock for income investors.

It is worth highlighting that last month, the company increased its quarterly dividend to $0.305 per share from $0.265 per share. With this hike, Energy Transfer restored its distribution level to where it was in the first half of 2020. ET stock boasts an attractive dividend yield of 6.9%.

Is ET a Buy Right Now?

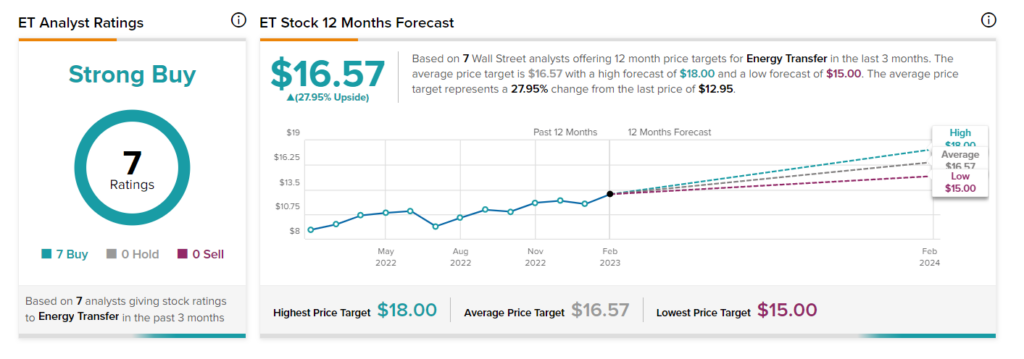

The Street is highly optimistic about Energy Transfer, giving it a Strong Buy consensus rating based on seven unanimous Buys. The average ET stock price target of $16.57 implies 28% upside potential from here.

Furthermore, Energy Transfer sports a “Perfect 10” Smart Score on TipRanks.

Concluding Thoughts

As per analysts, ET and EOG display the potential to generate strong returns based on solid fundamentals. Investors might want to consider adding these stocks to their portfolios to generate steady passive income.