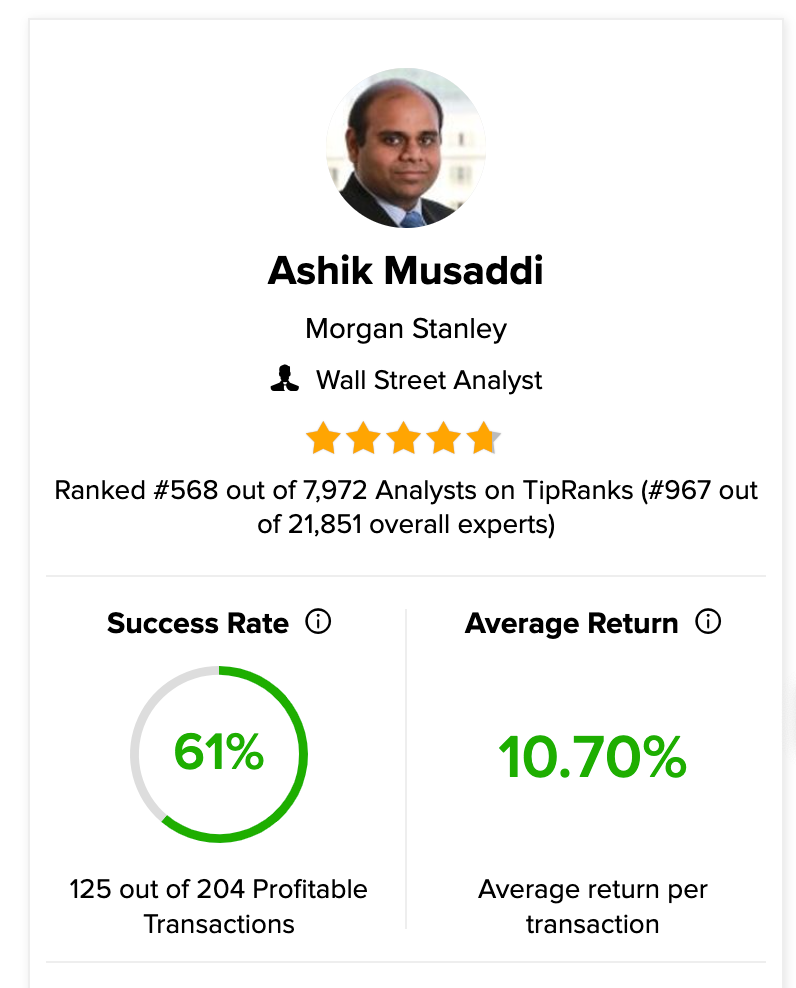

Ashik Musaddi is a five-star-rated analyst on TipRanks, covering financial stocks in the UK and U.S. markets, and is ranked 568 out of 7,972 analysts and 967 out of 21,851 overall experts – so which stocks does he favour?

He has a success rate of 61% with an average return of 10.7% per transaction.

He believes that there is considerable upside to the insurance sector in the coming months and years. Musaddi considers the long-term perspective of the sector and is bullish on Aviva (GB:AV) and Beazley (GB:BEZ).

However, his best rating so far was the credit insurance company Coface SA (GB:0QVK), which generated a 104% return between May 2020 and May 2021.

Mushaddi is head of European Insurance Research at Morgan Stanley. He specialises in insurance sector research in mature as well as developing markets. Before Morgan Stanley, Musaddi worked with J.P. Morgan as an insurance analyst for 14 years.

Let’s see what made him bullish on these stocks.

Beazley Stock

Beazley is a global specialist insurance company focusing on property, marine, reinsurance, risk and contingency, accident and life, and more.

Beazley’s stock has generated great returns for the shareholders and has been trading up by 51% in the last year.

In its results for the half-year ended June 30, 2022, the company’s profits were hit by market volatility. However, the company is betting big on its cyber risk premium and has raised the full-year guidance number for profits.

Beazley’s Cyber Premium grew by more than 70% to $473 million in the first half, reflecting a huge demand for cyber protection. The company expects this trend to continue, leading to a significant growth opportunity for the company.

Is Beazley a buy?

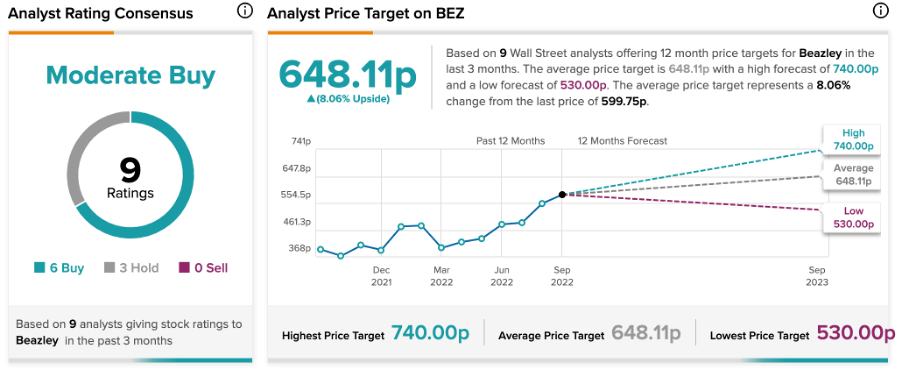

In August, Musaddi upgraded his rating to Buy on the stock and increased the target price from 540p to 678p.

Overall, Beazley has a Moderate Buy rating as per the TipRanks’ analyst consensus. The stock has six Buy and three Hold recommendations.

The BEZ target price is 648.1p, which is 8.02% higher than the current price level.

Aviva Stock

Aviva is a British insurance company with core operations in the UK, Ireland, Canada, China, and India. The company provides all major insurance services such as car, life, health, and home.

The company’s diversified services help it navigate through a challenging environment. Aviva’s interim results for 2022 were a testament to that.

The company’s Solvency II coverage ratio was 213%, which was 186% higher than the previous year. This is a measure of good financial health and enables a company to generate a better return for its shareholders.

Aviva’s stock is also attractive for income investors, with a dividend yield of 6.8% against the sector average of 2.1%. The company’s dividend guidance for the full year of 2022 and 2023 is 31p and 32.5p, respectively.

Are Aviva shares a buy?

According to TipRanks’ analyst consensus, Aviva stock has a Moderate Buy rating. It has a total of 10 ratings, including six Buy and four Hold recommendations.

The AV price target is 501.1p, which has an upside potential of 13.1% on the current level.

In May 2022, Morgan Stanley reiterated their Buy rating on the stock.

Conclusion

Insurance stocks are known to be quite balanced in the market. Looking at Musaddi’s vast knowledge and experience in the insurance sector, investors can pick these stocks for reasonable returns.