British house building companies are good dividend payers: these companies were winners in the pandemic and have grown while riding on the higher housing demand.

Even now, with the market losing its shine under the inflationary pressure in the economy, these companies are committed to their shareholders and have favourable dividend policies.

Keeping this in mind, we have shortlisted Taylor Wimpey (GB:TW) and Barratt Developments (GB:BDEV) for the investors.

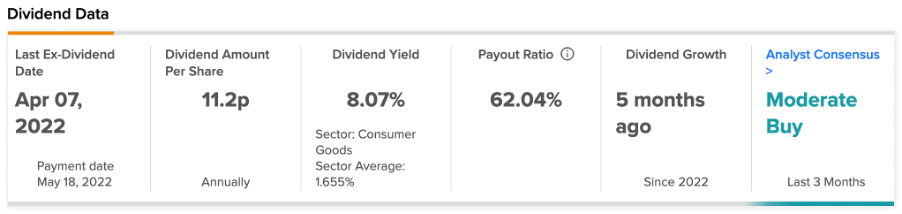

We have used the TipRanks Stock Comparison Tool to compare stocks in the housing sector based on dividend yields.

The companies have stable dividend growth, which is very well supported by their earnings.

Let’s see what’s working for these two companies.

Barratt Developments

Barratt is among the largest residential builders in the UK. The company operates through its brands: Barratt Homes, David Wilson Homes, Barratt London, and Wilson Bowden Developments.

The company has been known by investors as a stable dividend payer. It had to stop dividends in 2020 when the pandemic hit the sales. But the company is back with a revised dividend policy with a dividend cover of 2.0x in 2023 and 1.75x in 2024.

The interim dividend for 2022 is 11.2p per share. The full-year dividend will be based on a cover of 2.25 times adjusted earnings per share.

The company, in its latest trading update, reported total home completions back to pre-COVID levels at 17,908 homes. It is expecting its profit before tax to be in the range of £1.05 and £1.06 billion, ahead of market expectations.

The company is aware of the macro-economic challenges in the economy, but the forward order book along with a healthy cash position provides the flexibility to respond to the changes accordingly. The forward sales for Barratt are 13,579 homes as of June 30, 2022.

Is Barratt Developments a good investment?

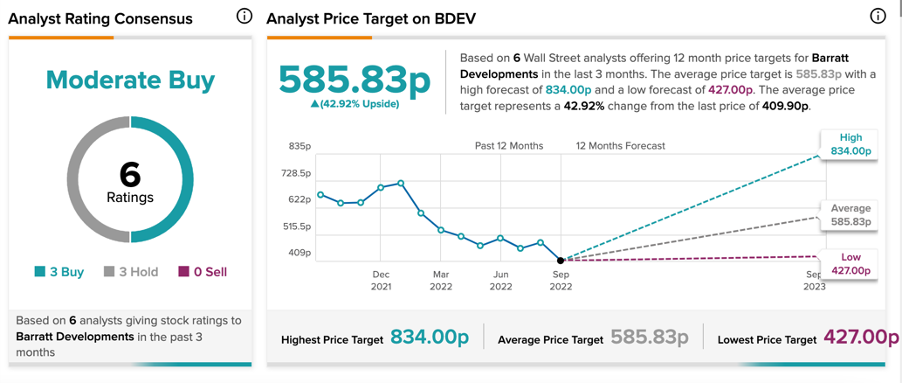

According to TipRanks’ analyst rating consensus, Barratt Developments stock has a Moderate Buy rating. This includes three Buy and three Hold recommendations.

The BDEV target price is 585.83p, which represents a 43% change from the current price level. The price has a low and high forecast of 427p and 834p, respectively.

Taylor Wimpey

Taylor Wimpey is a UK-based residential builder. The company’s operations involve the acquisition of land, designing, construction, and overall development of communities.

The company reported its half-yearly results in August 2022 and entered the second half in a strong position. The company’s profit before tax grew by 16.3% to £334.5 million, mainly pushed by higher house prices. The order book is strong, with 10,102 homes ordered for £2,800 million. Also, it is 89% forward sold for its 2022 private completions.

The company has a dividend policy to return around 7.5% of net assets to shareholders annually. In line with this policy, it announced an interim dividend of 4.62p per share.

The dividend yield of 8.19% is attractive and higher than most of its competition, and against the sector average of 1.65%.

Taylor Wimpey share price forecast

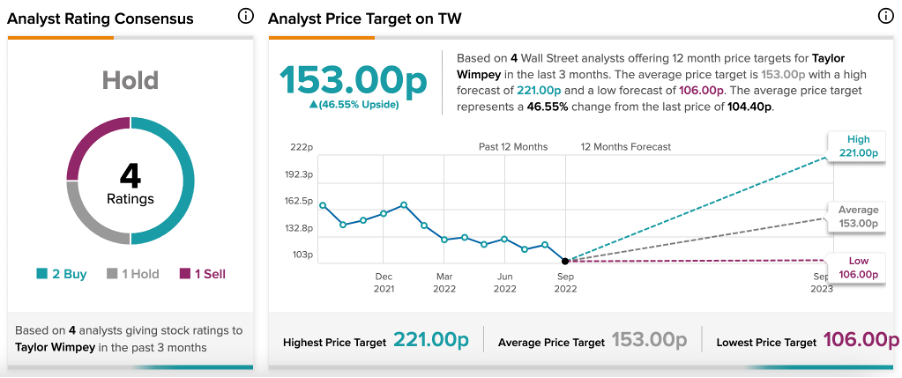

According to TipRanks’ analyst rating consensus, Taylor Wimpey stock has a Hold rating. This is based on two Buy, one Hold, and one Sell recommendations.

The TW target price is 153p, which has an upside potential of 46% on the current level. The price has a low and high forecast of 106p and 221p, respectively.

Conclusion

In today’s challenging scenarios, dividend stocks like TW and BDEV can help support the battle against inflation.