Banking stocks such as HSBC Holdings (GB:HSBA) and NatWest Group (GB:NWG) have shown stable growth post-pandemic – and one highly rated analysts believe the two banks are well-placed to weather the coming economic storm.

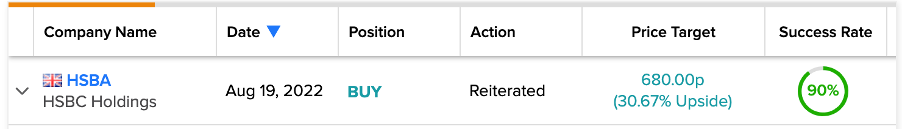

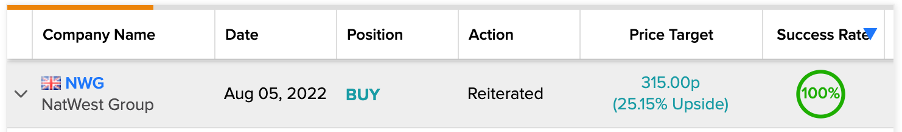

Four-star-rated analyst Jason Napier from UBS has a Buy rating on these stocks and feels they are attractively valued. He has high success rates on both stocks.

Napier believes the banks will be able to manage their costs well during the inflationary environment in the near term, leading to better margins and lending growth.

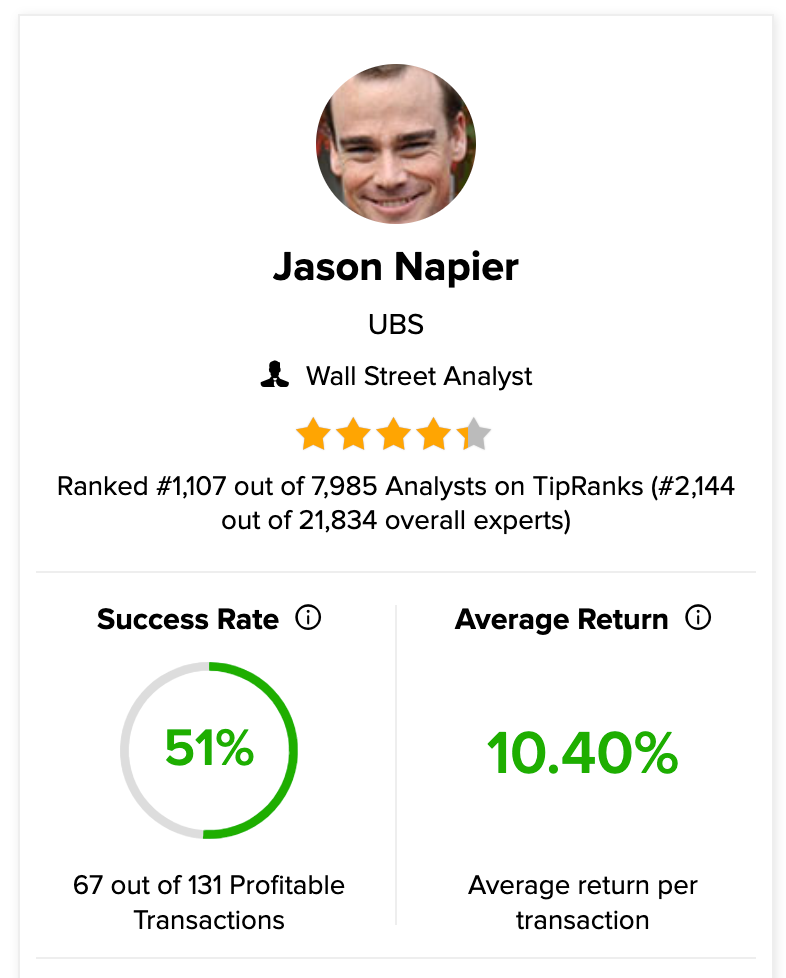

Napier is the Head of European Banks Research at UBS and is mainly responsible for covering the UK banks.

He is a chartered accountant and started his career with KPMG, focusing on audit and consulting for banks and brokerage houses. Later on, he moved to Deutsche Bank AG, before moving to UBS in September 2015.

According to the TipRanks star rating system, Napier is ranked 1,107 out of 7,985 analysts and 2,144 out of 21,834 overall experts on TipRanks. He has a success rate of 51% with an average return of 10.4% per transaction.

Let’s see the two stocks in detail.

HSBC Holdings

HSBC Holdings is a global banking and financial services company. The company operates through three business segments: wealth and personal banking, commercial banking, and global banking and markets.

After the company released its interim results in August 2022, a lot of analysts raised their expectations. Napier recently reiterated his Buy rating on HSBA with a price target of 680p, which has an upside potential of 28.7%.

HSBC reported adjusted revenue of $13.1 billion in the first half of 2022, as compared to $11.8 billion in 2021. The profit after tax was flat at $5.0 billion. The highlight of the results was the dividends, which will be back starting in 2023. The company is aiming to restore them to their pre-COVID levels at a dividend payout ratio of 50%.

The company does have some pressure from its shareholder, Ping An to spilt the operations and separate Asia.

However, Napier believes, “The group is not as driven by Asia as it may appear at a headline level, noting that significant income booked in Asia comes from HSBC’s business relationships outside the region. Being the biggest trade bank in the world is at least partly driven by being in markets outside Asia.”

HSBC share price predictions

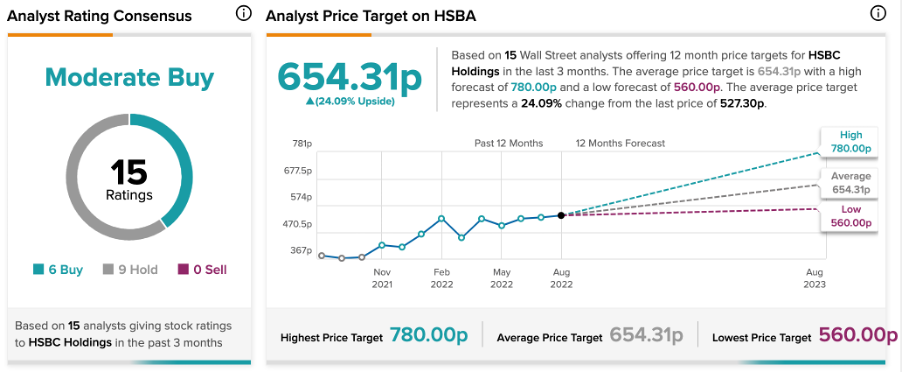

According to TipRanks’ analyst rating consensus, HSBC stock has a Moderate Buy rating. It has a total of 15 ratings, including six Buy, and nine Hold recommendations.

The HSBA target price is 654.3p, with a high forecast of 780p and a low forecast of 560p. The price target is 24% higher than the current level.

NatWest Group

NatWest is a UK-based banking and insurance company. Some of its brands include Royal Bank of Scotland, Ulster Bank, Coutts and Lombard.

NatWest, like its peers, reported strong results in the first half of 2022. The company’s total income increased from £5.1 billion to £6.2 billion during the period.

Rising interest rates helped NatWest post a 15% increase in its net interest income to £4.3 billion. The company also rewarded shareholders and increased its dividend by 17%, to a total of 20.3p per share.

NatWest remains Napier’s top banking pick in the UK market. He raised his target price on the stock from 290p to 315p, while maintaining a Buy rating on the stock.

Napier expects, “to re-rate the stock once investor confidence around the economic outlook improves.”

Is NatWest stock a buy?

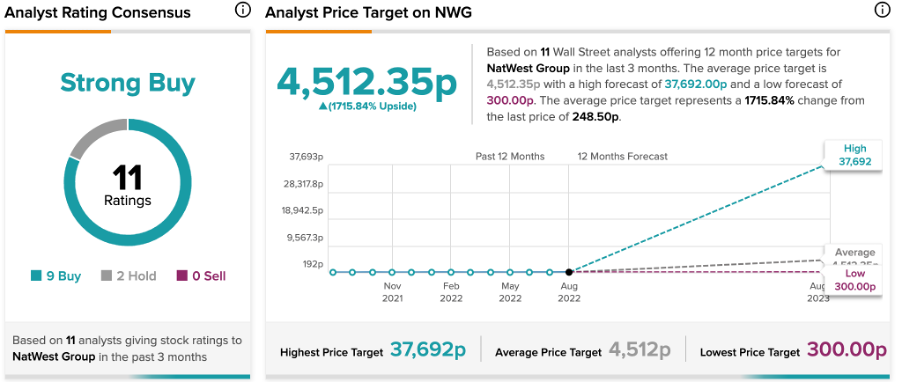

According to TipRanks’ analyst rating consensus, NatWest stock has a Strong Buy rating. The stock has a total of 11 ratings, out of which nine are Buy and two hold.

The NWG target price is 4,512p, which is 1715.8% higher than the current price level.

Conclusion

UBS has a bullish take on all the major banks in the UK market. Even though Napier has Buy ratings on these two stocks, he feels investors are worried about macroeconomic conditions.