The current macroeconomic situation is volatile, where inflation in the U.S. soared to a 40-year high in May at 8.6%. In an attempt to rein in this inflation, the U.S. Federal Reserve increased interest rates by 0.75 percentage points last week, its largest increase in 28 years.

As fears of a recession loom, unemployment in the U.S. remains low, while spending by U.S. consumers so far is still holding up.

According to a Wall Street Journal report from last week, this “confounding economic picture” has resulted in investors selling off both stocks and bonds resulting in higher trading volumes. The report cited data from Credit Suisse, which stated that U.S. cash equity volume increased 16% year-over-year while equity futures and options volume soared 77% from the second quarter of 2019.

The CBOE Market Volatility Index, or VIX, is a measure of volatility and is up 87.5% this year. According to the Wall Street Journal, in this scenario, banks could see trading revenues go up.

Using the TipRanks database, we did a deep dive into two of the stocks mentioned in the article, namely, JPMorgan and Citigroup. Let us take a look.

JPMorgan Chase & Co. (NYSE: JPM)

JPMorgan Chase & Co. is a financial services company incorporated in 1968. The bank had $4 trillion worth of assets and $285.9 billion worth of shareholders’ equity as of March 31.

Shares of JPM have fallen 30.1% this year as the company posted mixed Q1 results. However, Evercore (EVR) analyst Glenn Schorr came away impressed by JPM’s recent Investor Day.

The company’s management stated on its Investor Day that Net Interest Income (NII) for FY22 is expected to exceed $56 billion (excluding its securities trading and brokerage services business), “which takes into account Fed funds reaching 3% by year-end,” loan growth that is projected to be in “high single-digit”, and “modest securities deployment.”

Analyst Schorr pointed out that with trading revenues expected to rise between 10% and 15% year-over-year in Q2, higher loan growth, and a “super benign credit backdrop,” JPM is well-poised to achieve its target of Return on Average Tangible Common Shareholders’ Equity (ROTCE) of 17% in 2022.

ROTCE is frequently used in the case of banks and insurance companies and measures the business performance across time, regardless of whether the business was developed internally or acquired. ROTCE is calculated by dividing net income by the average monthly tangible common shareholders’ equity.

The analyst is also positive about JPM’s longer-term investments, “which should prime the growth pump for years to come.” JPM has ramped up its investment in technology, new products, markets, bankers, and branches this year to $14.7 billion, from $11.1 billion in 2021.

As a result, Schorr reiterated a Buy rating and a price target of $150 on the stock, implying an upside potential of 32.7% at current levels.

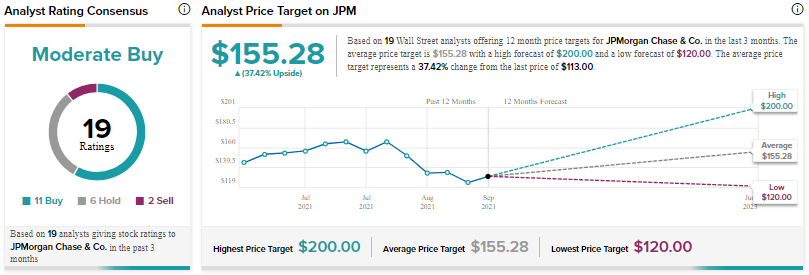

Other analysts on Wall Street are cautiously optimistic about the stock with a Moderate Buy consensus rating based on 11 Buys, six Holds, and two Sells. The average JPM price target of $155.28 implies an upside potential of 37.4% at current levels.

Citigroup (NYSE: C)

Citigroup is a financial services holding company that provides a broad range of consumer and credit banking, securities brokerage, corporate and investment banking, trade and securities services, and wealth management.

In Q1, Citi’s net revenues declined 2% year-over-year to $19.2 billion, beating analysts’ estimate of $1.1 billion. Also, net income dropped 46% year-over-year to $2.02 per diluted share but still came in ahead of consensus estimates of $1.43 per share.

However, shares of Citi have still tanked 26.3% this year and the stock is currently near its 52-week low of $45.40.

Citigroup CEO Jane Fraser, in the company’s Q1 press release, acknowledged that the macro and geopolitical environment had become more volatile, but the company continues “to see the health and resilience of the U.S. consumer through our cost of credit and their payment rates.”

Andy Morton, Citigroup’s Global Head of markets also addressed the market volatility at a recent Morgan Stanley conference. Morton stated, “Volatility is basically our friend,” and believes that “revenue-wise, we’re currently expecting to come in north of 25% above last year’s same quarter results.”

Citigroup could also benefit from rising interest rates as this could strengthen the company’s debt offerings, in turn expanding the company’s bottom line.

Wall Street analysts believe that Citigroup is undervalued. The stock is currently trading at a 0.6x discount to its book value, suggesting that its asset base isn’t fully priced by the market. Banking stocks are usually strong candidates whenever they trade below their book value.

Credit Suisse analyst Susan Roth Katzke, however, downgraded the stock to a Hold from a Buy late last month after the stock came within 10% range of their price target of $58. Katzke’s price target implies an upside potential of 24.7% at current levels and is closer to the lowest price target of $53 on the Street.

The analyst commented, “We realize that the downside to C shares may prove more limited given a valuation within reach of prior cyclical troughs; but we believe the upside, relative to peers, will also prove more limited given the long road ahead in Citi’s transformation process.”

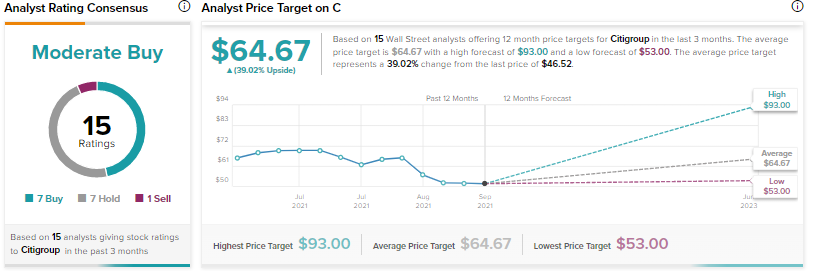

The rest of the analysts on the Street are cautiously optimistic about the stock, with a Moderate Buy consensus rating based on seven Buys, seven Holds, and one Sell. The average Citigroup price target of $64.67 implies an upside potential of 39% from current levels.

The Bottom Line

Wall Street is cautiously optimistic about both stocks, but it seems like the recent market volatility could benefit them.

Read full Disclosure