Humpty Dumpty sat on a wall. Humpty Dumpty had a great fall — and crashing right down beside him was semiconductor giant Advanced Micro Devices (AMD), which lost 8% of its market capitalization — about $16 billion — after investment bank Barclays downgraded its stock to Equalweight (i.e. Hold) on Thursday.

Despite admitting that AMD will, in all likelihood, exceed expectations for 31% sales growth this year, and gain market share “in both the client and server markets” besides, Barclays’ 5-star analyst Blayne Curtis cut his rating on AMD — and cut his price target by 22%, to $115 a share. (To watch Curtis’ track record, click here)

As Barclays analyst Blayne Curtis explained, “we see cyclical risk across several end markets (PC, Gaming, and broad-based/XLNX)” for AMD somewhere in the “2024/2025” timeframe. Although that’s still a few years away, and although in the nearer term, Curtis admitted that AMD is still growing strongly, the analyst nevertheless said he would “rather move to the sidelines until we have better clarity as to the magnitude of these corrections and what the competitive landscape will look like.”

But Rosenblatt analyst Hans Mosesmann thinks that’s just crazy talk.

Addressing “incoming calls [presumably from its clients] regarding weakness in AMD shares,” Mosesmann placed the blame for AMD’s decline directly on Barclays’ downgrade “on 2023 cyclical issues” and to resulting “angst” on the part of investors. But rather than echo Barclays’ insecurity, Mosesmann urged Rosenblatt’s clients to slow down and conduct a “sanity check.”

Barclays’ analysis, says Mosesmann, is tied to worries about “potential consumer weakness in PCs and mobile.” But as Mosesmann points out, AMD actually “does not sell into this market,” and so would not be affected even if this weakness does arise. He also notes that while Barclays raises cyclical industry concerns about AMD, it does not appear to have similar fears for cyclicality for Intel (INTC) or Nvidia (NVDA) — despite the fact that all three of these companies work in the same cyclical industry.

Also nonsensical, in Mosesmann’s view, is selling AMD stock despite the fact that:

- The company “is not in any jeopardy of missing the +30% y/y sales growth target for 2022” — a fact even Barclays concedes.

- To the contrary, AMD is continuing “to gain PC CPU market share” (as Barclays also concedes).

- Intel has delayed introduction of both its Sapphire Rapids and Granite Rapids server processors into 2024, which suggests “Intel has limited ability to defend server share at any price.”

- There is no evidence of “broad aggressive PC CPU pricing from either AMD or Intel” (i.e. a price war that would drive profits down for all players).

- The more so in Intel’s case, because a price war would exacerbate that company’s “extreme sensitivity to gross margins.”

Long story short, Mosesmann sees little reason to worry about AMD, and even less reason to dump AMD stock. To the contrary, given that “AMD fundamentals are better today than they were entering the year … we are buyers,” insists Mosesmann.

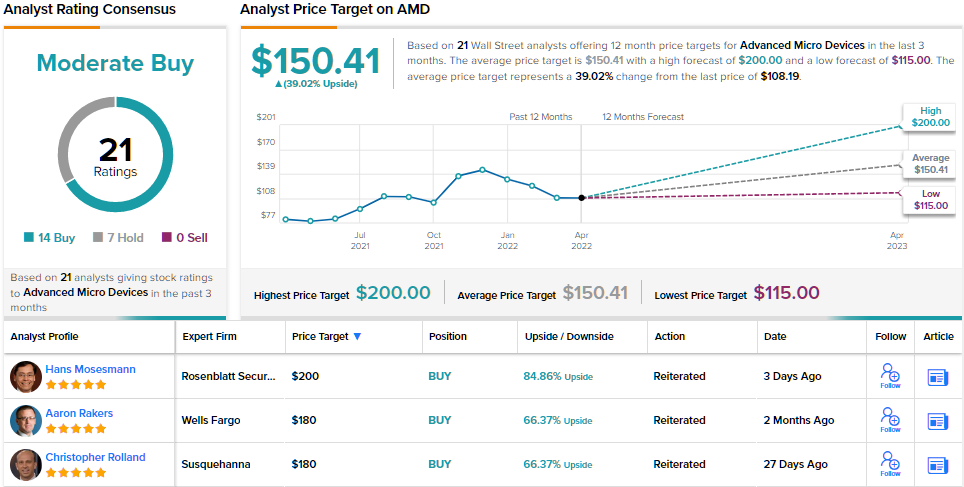

Unsurprisingly, the analyst gives AMD a Buy rating and a Street-high price target of $200. Should his thesis play out, a potential upside of ~85% could be in the cards. (To watch Mosesmann’s track record, click here)

AMD tends to attract a lot of attention – the stock has 21 analyst reviews on record, and they include 14 Buys against 7 Holds to give the stock its Moderate Buy consensus recommendation. The shares have an average price target of $150.41, indicating room for 39% growth from the current price of $108.19. (See AMD stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.