Whatever your opinion of the ongoing and unfolding Twitter (TWTR) – Elon Musk saga, it’s undeniably popcorn worthy entertainment. At least for neutral onlookers.

For those invested in the social microblogging platform – or in Musk’s Tesla for that matter – it’s a more nail-biting affair. TWTR stock has been at the mercy of the real-life drama as the pendulum has swung from one side to the other. The latest development was seen as wholly positive for Twitter.

On Tuesday, the company announced that it is suing Musk for breaking his agreement to buy the company for $44 billion – signed in late April. Musk’s reasoning is that Twitter has been withholding information from him, thereby breaking its side of the deal. This specifically pertains to Musk’s claim that there are far more spam bots on the platform than Twitter cares to admit.

But in Twitter’s filing, the company claimed that when going after the company, Musk acted in “bad faith” and said that once the market began to turn following the April bid, he soured on the deal.

The company also said it had made an effort to explain their bot calculations to Musk’s team while also proposing the CFO talk through any other issues with Musk personally. Musk turned down the chance to participate and refused to go over notes from the due diligence sessions.

The new revelations are a game changer, says Rosenblatt analyst Barton Crockett, who has now completely “flipped” in his view of the case.

“We had formerly seen meaningful risk (based largely on Musk’s assertions and also a history of mDAU restatements), that Twitter was being evasive in disclosure of its spam bot calculations,” said the analyst. “That lead us to assume that Musk had leverage to extract a meaningful concession to avoid discovery damaging to Twitter in a court process. But Twitter’s disclosure of very detailed efforts to explain its spam bot calculations to Musk, and Musk’s reluctance to engage, largely ends our skepticism about Twitter, and instead makes us skeptical about Musk. As a result, we now see leverage on Twitter’s side in this fight.”

Musk might have to pay a settlement of well over $1 billion and could even be forced to conclude the deal and buy Twitter for the agreed $54.20 per share price.

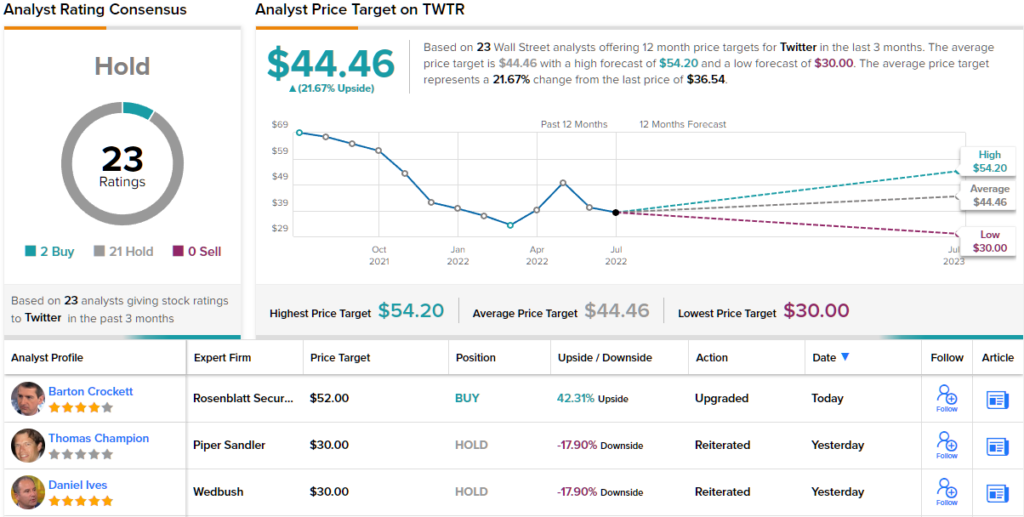

As such, Crockett has now upgraded TWTR’s rating from Neutral to Buy, while the price target is bumped from $33 to $52, suggesting shares will climb 42% higher over the coming months. (To watch Crockett’s track record, click here)

In contrast to Crockett’s updated take, almost all other analysts remain on the sidelines. Barring one additional Buy, the stock garners 21 Holds, naturally culminating in a Hold consensus rating. However, the shares now appear undervalued to many; going by the $44.46 average price target, they are expected to change hands for ~22% premium a year from now. (See Twitter stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.