Fears Twitters’ (TWTR) ban of Donald Trump could result in a loss of engagement on the platform appear to be misplaced. While the company’s strong 4Q20 results were from before the ban came into play, the latest data suggests a Trump-less Twitter is doing just fine.

The company said that through the end of January, the rise in average absolute mDAU (monetizable daily active users) was higher than the last four years’ average and anticipates mDAU growth of roughly 20% year-over-year in 1Q21.

Interestingly, in a strong report which beat the estimates on several major metrics, mDAU was not one of them.

While mDAU increased by 27% year-over-year to 192 million, the number was just under the consensus estimate of 193.5 million.

Elsewhere, the micro-blogging platform delivered revenue of $1.29 billion, a 27.7% year-over-year uptick and coming in ahead of the Street’s forecast by $100 million. There was a beat on the bottom-line, too, with Non-GAAP EPS of $0.38 beating the forecasts by $0.07.

For 1Q20, Twitter is guiding for revenue between $940 million and $1.04 billion, higher at the mid-point than the Street’s guidance of $965 million.

Investors liked Twitter’s latest financial report, sending shares higher by 13% in the subsequent session. Deutsche Bank analyst Lloyd Walmsley is among those singing the company’s praises.

“We come away from 4Q20 results with increased confidence in the Twitter inflection year thesis, with strong early signs on direct response ramping, better-than-feared mDAU growth and continued optimism that more new revenue products around subscription could be a further catalyst for shares,” the 5-star analyst said. “We have not heard Twitter’s tone on an earnings call sound this good in as long as we can remember.”

There are several other catalysts on the horizon, says Walmsley; An Analyst Day is slated for Feb 25, while there are some big sporting events on the way, including March Madness, the Masters, the Major League Baseball season’s kick off, the NBA Finals and the Olympics.

Based on all of the above, Walmsley rates TWTR a Buy along with a $76 price target. This figure implies an 11% upside from current levels. (To watch Walmsley’s track record, click here)

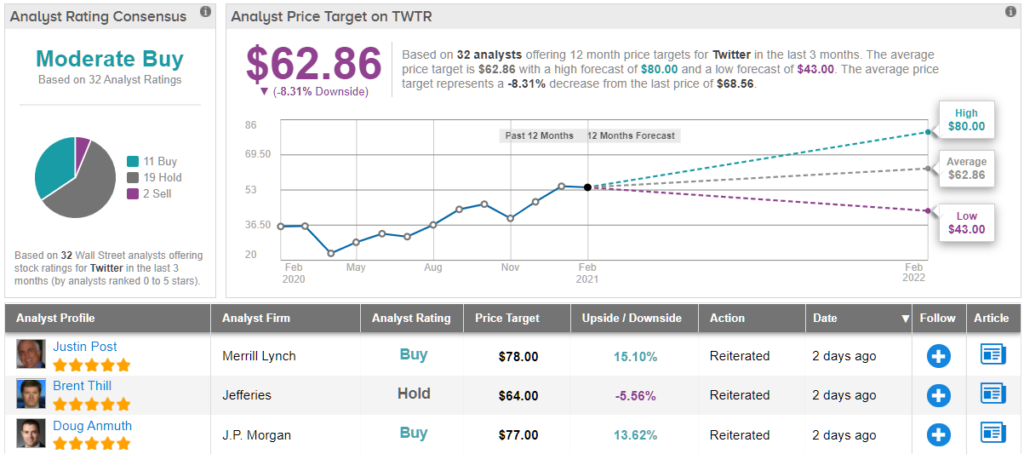

What does the rest of the Street think? Looking at the consensus breakdown, opinions from other analysts are more spread out. 11 Buys, 19 Holds and 2 Sells add up to a Moderate Buy consensus. In addition, the $62.86 average price target indicates 8% downside potential. (See TWTR stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.