The Trade Desk (TTD) is one of the world’s largest demand-side platforms for digital ads. However, that hasn’t stopped the company’s share price from falling more than 50% year-to-date. The Trade Desk’s stock plummeted due to an increase in interest rates and other macro headwinds that pushed investors toward conservative investments.

However, with a solid financial outlook and impressive quarterly performances, we are bullish on TTD stock.

TTD allows advertisers and ad agencies to bid on ad inventories and handle their ads. The Trade Desk has served more than a thousand customers in its last quarter and maintained an attractive impression rate. Let’s discuss what makes this stock worth looking into.

The Trade Desk’s Growth Continues to Impress

The Trade Desk’s top line surged by more than 26% in 2020, soon after the pandemic’s impact boosted ad sales throughout the globe. Then, in 2021, the company’s revenue rose 43%, reaching $1.2 billion due to a relaxation in lockdown measures. The growth is impressive, but it isn’t over yet.

The company continues to produce attractive results that are too good to ignore. In the first quarter of 2022, The Trade Desk reported revenue growth of more than 43% year-over-year. As a result, the company’s quarterly revenue reached $315 million, and its adjusted EBITDA rose 70%, amounting to $121 million. In addition, its earnings per share (EPS) amounted to $0.21, which is up 50% year-over-year.

These numbers speak a lot about The Trade Desk’s efficiency, considering the uncertainty prevailing in the U.S. Moreover, according to the company’s first-quarter report, it expects its top line to rise at least 30% year-over-year. This confidence level implies that the company has a solid plan in hand and is ready to enhance its services.

Unfortunately, the company didn’t present precise guidance beyond the second quarter of 2022. However, we expect a strong showing this year again. Hence, it may be an excellent time to Buy this growth stock and reap benefits for the rest of the year.

Moreover, the company expects the forthcoming elections to bring tailwinds towards the end of the year. The good thing is that The Trade Desk’s revenue isn’t dependent on Europe, so it isn’t affected by the Russia-Ukraine war very much. Additionally, the firm is relieved of supply-chain issues, unlike its competitor Magnite (MGNI).

A Bright Future

The Trade Desk recently released OpenPath, which gives clients direct access to publishers’ ad inventory. Moreover, its launch of Solimar proved to be a success, as it helped the business grow further and attract more advertisers.

Currently, the company has an addressable market of around $750 billion. However, this number is expected to rise to $1 trillion in the coming years, providing TTD with the tailwind of a growing market.

Moreover, its CEO, Jeff Green, said that they recently completed their first quarter with Walmart (WMT) and saw over 200 advertisers in the last quarter. He added that the company expects more expansions going forward and hopes the partnership will prove to be a great growth driver for both companies in the future.

These ventures have allowed The Trade Desk to grow. Furthermore, the fundamental shift in advertising with thousands of dollars moving away from traditional mediums entails that The Trade Desk is here for the long haul.

Lastly, Netflix’s (NFLX) decision to pivot toward ad-tier subscriptions could present a massive opportunity for The Trade Desk to work with a powerful platform. The fact that Netflix’s CFO, David Wells, is one of the board of directors of The Trade Desk could point to future collaboration.

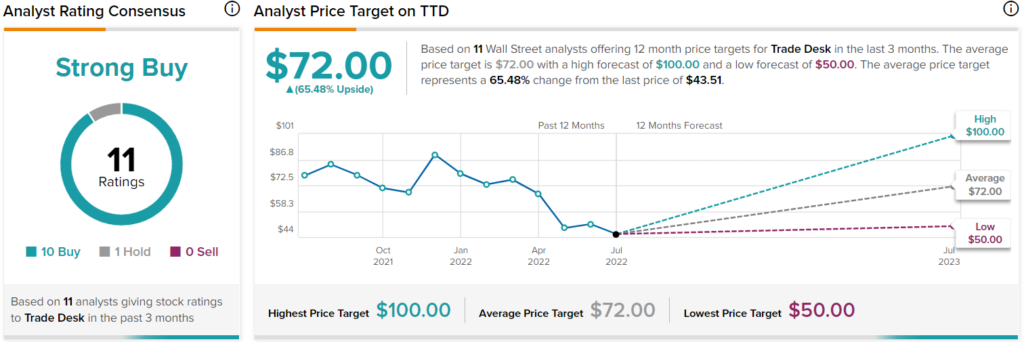

Wall Street’s Take on TTD Stock

Turning to Wall Street, TTD stock maintains a Strong Buy consensus rating. Out of 11 total analyst ratings, 10 Buys, one Holds, and zero Sell ratings were assigned over the past three months.

The average TTD stock price target is $72.00, implying 65.5% upside potential. Analyst price targets range from a low of $50 per share to a high of $100 per share.

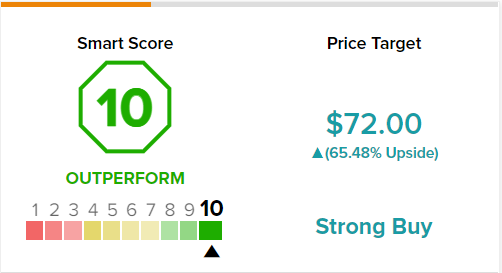

A Perfect Smart Score Rating

Interestingly, here’s another interesting thing to add to the company’s bull case: TTD stock has a ‘Perfect 10’ Smart Score rating, implying that it has a high chance of outperforming the market, going forward.

The Takeaway – TTD Stock is Worth Considering

The Trade Desk’s first-quarter reports are a sight for sore eyes. However, its attractive revenue growth isn’t the only reason you should consider investing in its stock.

The company has big projects and partnerships in the pipeline that will allow it to expand further. Moreover, the transition towards online advertisement and CTV entails that the company has a bright future ahead.

So, right now might be a good time to consider TTD stock for your portfolio. Yes, the macroeconomic headwinds might haunt the company in the short run, but its future seems glorious.