Top Evercore analyst Shweta Khajuria remains bullish about The Trade Desk (NASDAQ: TTD) with a Buy rating even as shares have nearly halved in value this year, falling by 47.7%. The Trade Desk is a large demand-side platform for digital advertising.

The Trade Desk’s stock has plummeted as investors have been concerned about whether the rising interest rates, soaring inflation, and other macro headwinds could see a pullback in advertising. However, Khajuria believes that these concerns could be overdone and outlined her bullish thesis in a research report.

The Trade Desk’s Q2 Outlook

The Trade Desk is expected to announce its Q2 results on August 9. Trade Desk expects Q2 revenues of $364 million and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of around $121 million. However, analyst Khajuria believes that the Street’s estimate of growth in revenues of 5.5% quarter-over-quarter in Q2 and an EBITDA estimate of $136 million could be a bit “aggressive” given the current macro environment.

TTD reaffirmed the above Q2 outlook recently, which Khajuria thinks is a “material positive.”

Trade Desk Could Benefit from an Uptick in CTV Advertising

By Khajuria’s estimate, Trade Desk’s video segment made up more than 40% of TTD’s business, including connected television (CTV), and was the fastest growing business segment in the first quarter.

The analyst anticipates that CTV could comprise approximately 30% of TTD’s revenues in Q2. Khajuria is of the view that this segment could be the “key growth driver for the company and the ad market overall.”

Even in the current difficult macro environment, Khajuria believes that CTV “could be more insulated than other forms of Brand spend” as there is only an 18% ad penetration when it comes to CTV.

Trade Desk Could Benefit from Netflix’s Move to Ad-Supported Tier

As Netflix (NFLX) gets ready to launch an ad-supported tier, Khajuria believes that this move could speed up the shift of linear television ad spend to CTV “as Brand advertisers chase premium content with large audiences, potentially even shifting some ad dollars away from user-generated content.”

The top-rated analyst also opined that this could provide consumers with a better television experience as they will get better-targeted ads with lower advertising loads.

Khajuria added, “Additionally, as more of the Connected TV Ad dollars are sold and executed programmatically (a shift that we believe is inevitable), TTD will emerge as a significant beneficiary given the company’s leadership position on the demand side.”

Analysts’ Take on TTD

However, Khajuria lowered the price target on the stock to $50 from $55, implying an upside potential of 6.1% at current levels. The analyst’s price target is the lowest price target on the Street.

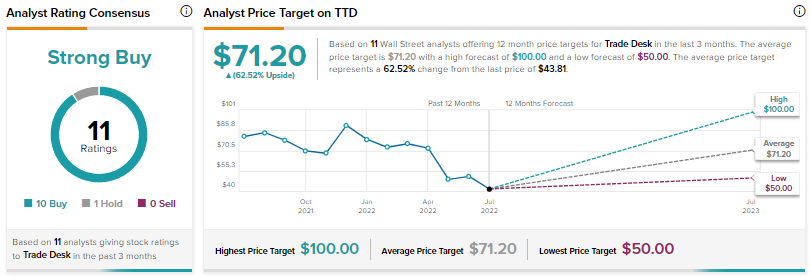

Wall Street analysts remained bullish about Trade Desk with a Strong Buy consensus rating based on 10 Buys and one Hold. The average Trade Desk price target of $71.20 implies an upside potential of 62.5% at current levels.

Conclusion

Even as the macro environment remains volatile, it appears that Trade Desk could very well ride out this challenging environment.

The Trade Desk scores a ‘perfect 10’ on the TipRanks Smart Score system, indicating that the stock is highly likely to outperform the market.

The TipRanks Smart Score system is a data-driven, quantitative scoring system that analyses stocks on eight major parameters and comes up with a Smart Score ranging from 1 to 10. The higher the score, the more likely the stock will outperform the market.