What can investors make of the sheer volume of stock data out there? Wall Street presents us with tens of thousands of actively traded stocks, more thousands of professional stock analysts, and dozens of high-powered banking and investment firms, all generating reams of market decisions. From choices to buy or sell, move aggressively or defensively, the raw data of the stock market itself presents a barrier to the retail investor.

But there are ways to cross that barrier, short of dedicating your life to the study of market psychology and economics. The data tools at TipRanks, especially on the Top Wall Street Analysts, present a gateway to the data, including filters and sorting strategies that can fine-tune an investor’s search. We’ve used these data tools to find several stock recommendations by one of the Street’s top-ranked analysts.

Jason Seidl, of Cowen Equity Research, stands out among his peers in the stock analysis profession. He has over 400 published stock ratings to his credit, and his 77% success has combined with the 29.3% average return of his recommendations to earn him the #4 ranking among the 7,795 analysts reviewed by TipRanks. In short, Seidl is one of the top analysts that investors should listen to.

So, here are two stocks which Seidl has given bullish ratings. Both are also Buy-rated names, with double-digit upside potential. Let’s find out what has piqued this top analyst’s interest.

ArcBest Corporation (ARCB)

The first stock we’ll look at, ArcBest, is an Arkansas-based holding company in the transportation sector. The company’s subsidiaries operate in the less-than-truckload (LTL) shipping industry, moving freight cargoes that are too large for parcel shipping, but not large enough to fill a full semi-trailer. LTL is a vital link in the supply chain, and encompasses services from long-haul interstate shipping to final mile delivery.

In recent months, ArcBest has been moving to streamline and expand its operations, and to improve its technology. On that last, the company in January announced a $25 million investment in Phantom Auto, a company specializing in remote vehicle operation. Phantom’s tech is applicable to vehicles, but also to industrials machinery such as forklifts, and has obvious applications in the warehousing segments of ArcBest’s business.

And this past November, ArcBest closed its most recent expansionary move, when it completed the purchase of Chicago-based MoLo Solutions. The purchase, priced at $235 million up front and with another $215 million dependent on future revenue benchmarks, will add MoLo’s truckload freight brokerage services to ArcBest’s offerings.

In more good news for ArcBest, the company released 4Q21 financial results earlier this month – and easily beat the market expectations. The top line came in at $1.2 billion for the quarter, and $4 billion for the full-year 2021; the numbers were the highest quarterly and full-year revenue in the company’s history. EPS, at $2.79 per diluted share, beat the estimates by 23%. And, in a move that investors are sure to appreciate, ArcBest returned over $116 million in profits to shareholders, through both buybacks and dividends.

All of this adds up to a company with a commanding position in its niche, and one that analyst Seidl sees able to continue delivering the goods. Seidl writes, “We are encouraged by ArcBest’s solid earnings performance in the last year-plus and by its labor deal. The long-term outlook for the company remains favorable with LTL pricing remaining strong despite lower tonnage. With strong underlying fundamentals and an attractive valuation, we rate ARCB Outperform.”

Seidl’s Outperform (i.e. Buy) rating is backed by a $145 price target, which implies the stock has room to run 64% higher this year. (To watch Seidl’s track record, click here)

Seidl may be bullish here, but he is no outlier. The Street’s outlook on this stock is a Strong Buy, based on a 4 to 1 split in favor of Buy reviews over Holds. The shares are priced at $88.34 and their $132 average target suggests a 49% one-year upside. (See ARCB stock analysis on TipRanks)

Knight-Swift Transportation (KNX)

For the second stock on our list, we’ll stick with the transport sector. Knight-Swift Transportation is one of the largest trucking companies in North America. Like ArcBest above, it’s a holding company, operating through its subsidiaries. These include both Knight and Swift Transportation in the mid- to long-haul segment, and, since last year, AAA Cooper, a carrier in the LTL business. Knight-Swift Holdings boasts one of the industry’s major fleets, with over 4,000 trucks, 11,000 trailers, and 25 shipping terminals.

This past December, Knight-Swift announced an important expansion of its LTL business, through its acquisition of Midwest Motor Express. The move adds an important LTL shipping network to Knight-Swift’s capabilities, and expands the company’s services in 15 states. The purchase transaction was conducted in cash, $150 million at the time of closing.

Not long after the acquisition closing, in January, the company announced its 4Q21 results – and blew away the forecasts. On the bottom-line, EPS jumped more than 71%, to reach $1.61, against a consensus estimate of $1.43, while the top-line revenues climbed to $1.82 billion, well above the forecast $1.73 billion. The company saw high growth in all of its segments, from 74% in Truckload to 90% in LTL. The Intermodal and Logistics segments grew by 81% and 84%.

Seidl points out Knight-Swift’s recent successes in LTL, in both moving orders and acquiring carriers, and believes that the company will shift more in that direction. He writes, “…we believe there to be more synergistic opportunities (for 2022 and the out years) through the year, and management reiterated its confidence in achieving its 85% adj. OR in the coming years. We would be unsurprised to see KNX add another strategic LTL acquisition in the not too distant given its recent success and emphasis on revenue diversification.”

In line with his upbeat outlook on the stock, Seidl rates KNX as Outperform (i.e. Buy), with an $84 price target implying a one-year upside of 56%. (To watch Seidl’s track record, click here)

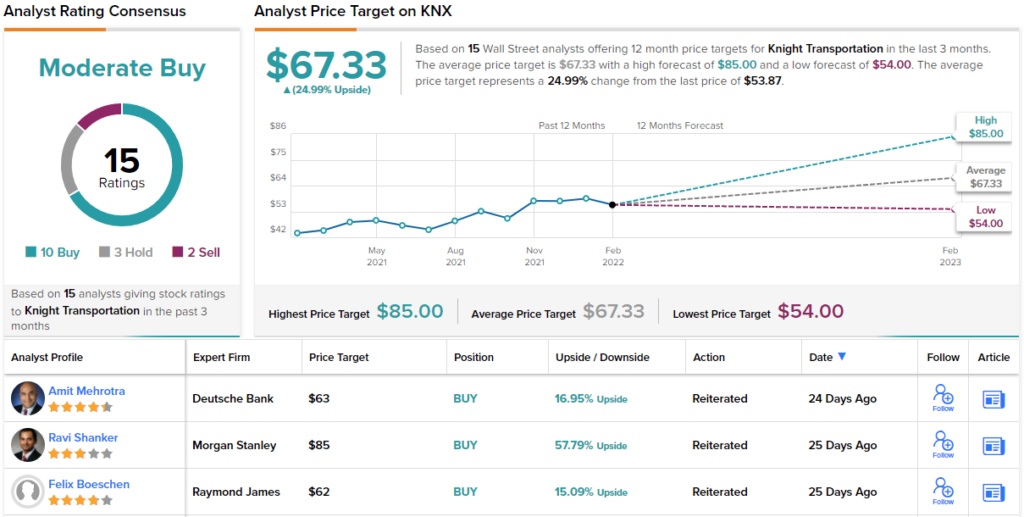

The Cowen analyst is on the bullish end of the spectrum here – but Wall Street generally is less certain. Yes, the stock has a Moderate Buy consensus rating, and yes, it has received 10 Buy ratings recently. But it has also gotten 3 Holds and 2 Sells in that same time. The average price target is $67.33, and the trading price $53.87, for an upside potential of 25% in the next 12 months. (See KNX stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.