Biotech and eCommerce stocks aren’t the only ones benefiting from the stay-at-home economy. Semiconductor industry heavyweight Nvidia (NVDA) delivered another bang-up quarterly performance, with its data center and gaming segments driving the charge forward.

Speeding past the Street’s $1.08 billion call, revenue for its data center business, which accounted for 37% of sales, came in at $1.14 billion for fiscal Q1 2021 thanks to strong demand from hyperscale and vertical customers and across workloads, including training, inference and high-performance computing. Not only did this reflect a quarter-over-quarter gain of 18%, but on a year-over-year basis, the growth landed at 80%. If that wasn’t enough, T4 and V100 chips exhibited a quarter-over-quarter increase.

Weighing in on the chipmaker for Needham, five-star analyst Rajvindra Gill thinks that the story is only going to improve. During the quarter, NVDA released its A100 7nm GPUs, with the product already having a tangible impact on revenues.

“We view the DGX A100 as a game changer for NVDA’s data center business: The A100 increases performance by 20x and can handle both AI training and inference workloads, as well as data analytics, scientific computing, and cloud graphics. Moreover, the DGX A100 is configurable from 1 to 56 GPUs and delivers an elastic software-defined data center infrastructure for AI training, inference, and data analytics workloads,” he explained. As a result, the analyst thinks both the top public cloud and enterprise cloud providers will utilize this chip in their data centers.

When it comes to its gaming segment, NVDA reported quarterly revenue of $1.34 billion, besting the $1.31 billion consensus estimate. Higher sales, for its GeForce laptop GPUs and SoCs for Switch in particular, drove the 27% year-over-year increase.

Expounding on this result, Gill stated, “Due to the stay-at-home economy, NVDA has seen a 50% rise in gaming hours on its GeForce platform. NVDA also benefited from the launch of 100 Ge-Force powered laptops, increasing RTX adoption in games, including Minecraft and Cyberpunk, and the expansion of GeForce cloud gaming platform to 650-plus games and 2 million-plus users. Gaming declined quarter-over-quarter on seasonality, but we expect it to grow in Q2.”

The good news didn’t end there. Mellanox, which was recently acquired by the company, could generate sales that amount to a low-teens percentage in fiscal Q2 2021. Mellanox’s products offer high throughput and low latency, which improve data center efficiency by delivering data at faster speeds and unlocking system performance capability. Therefore, once it is further integrated, NVDA’s standing within the enterprise data center space should improve, in Gill’s opinion.

To this end, Gill left a Buy rating on the stock. In addition, he bumped up the price target from $360 to $400, implying 11% upside potential. (To watch Gill’s track record, click here)

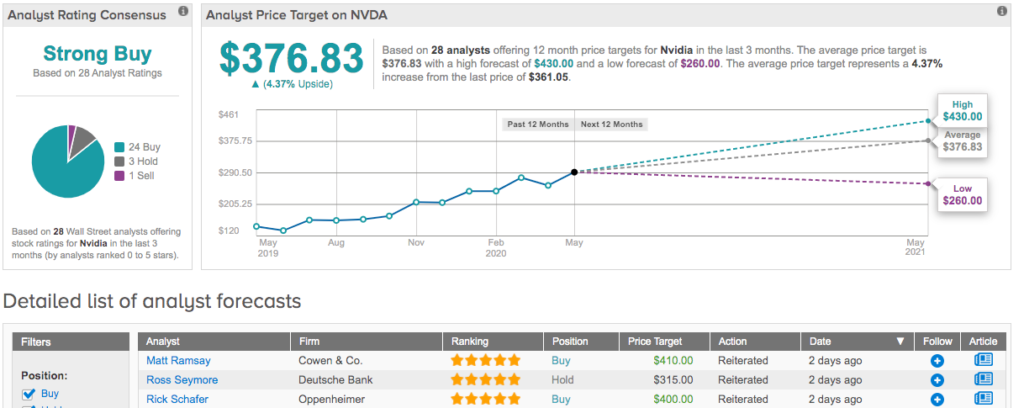

Turning now to the rest of the Street, other analysts also like what they’re seeing. 24 Buys, 3 Holds and 1 Sell add up to a Strong Buy consensus rating. While less aggressive than Gill’s, the $376.83 average price target still indicates 4.4% upside potential. (See Nvidia stock analysis on TipRanks)