Major retailers are lined up to announce their first-quarter results this week, and off-price retailer TJX Companies (NYSE: TJX) is one of them.

TJX sells apparel and home merchandise at deep discounts compared to similar merchandise sold by full-price retailers. It operates over 4,600 stores in the U.S., Canada, UK, Ireland, Germany, Poland, Austria, the Netherlands, and Australia.

Back in February, TJX reported its Q4 FY22 (ended January 29, 2022) results, with sales rising 27% to $13.9 billion and EPS increasing to $0.78 from $0.27 in the prior-year quarter. However the company missed the Street’s expectations due to the impact of Omicron variant, increased freight costs and higher wages.

Q1 Expectations

TJX is scheduled to announce its Q1 FY23 results on May 18. TJX expects U.S. comparable store sales growth of 1% to 3% and EPS in the range of $0.58 to $0.61 compared to $0.44 in the prior-year quarter.

For the full year FY23, the company expects U.S. comparable store sales growth of 3% to 4% However, TJX didn’t provide full year EPS guidance given the uncertainty around elevated expenses.

Analysts expect TJX’s Q1 FY23 sales to rise 14.9% to $11.6 billion and EPS to grow over 36% to $0.60.

What does Website Traffic Hint at?

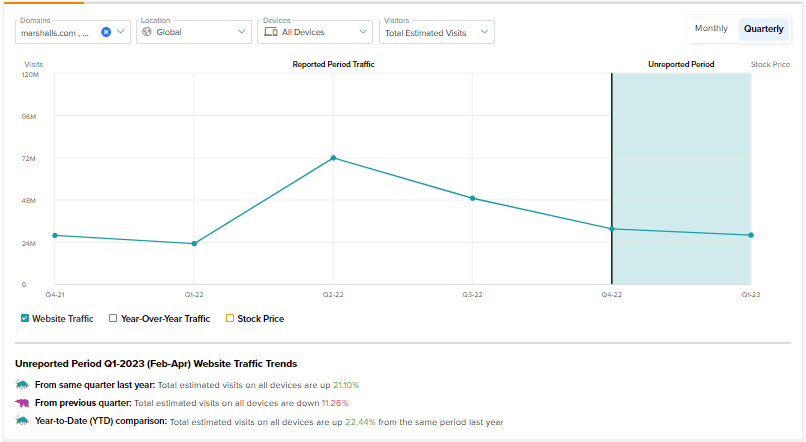

TipRanks’ Website Traffic Tool indicates that the total estimated visits on marshalls.com, sierra.com and tjmaxx.com in the February-April quarter declined 11.26% on a sequential basis but were up 21.1% on a year-over-year basis.

It is important to note that off-price retailer TJX generates a significant portion of its sales from its brick-and mortar stores and only a small proportion from online channels. According to the company’s annual report, sales from its ecommerce sites accounted for less than 3% of overall sales for each of the past three fiscal years.

However, in a volatile environment where every little bit counts, even marginal data must be taken into account when making investment decisions.

Wall Street’s Take

Ahead of the results, J.P. Morgan analyst Matthew Boss lowered his price target on TJX stock to $76 from $81 and maintained a Buy rating.

On TipRanks, TJX scores a Strong Buy consensus rating based on 14 Buys and three Holds. The average TJX price target of $76.47 implies 33.71% upside potential from levels seen before market open on Monday.

Conclusion

As in the case of other retailers, investors will be keen to know the impact of inflation and supply chain issues on TJX.

Moreover, management’s commentary on expected growth rates for the upcoming quarters or full-year outlook will help us understand if the company’s low-cost business model is good enough to survive in a challenging business environment.

Meanwhile, TJX scores a “Perfect 10” on TipRanks’ Smart Score system, indicating that it is more likely to outperform the market.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure