While markets are up this year, by almost 8% on the S&P 500 and more than 15% on the NASDAQ, they remain volatile – and they have yet to recoup all of last year’s losses. The result is an uncertain market environment, one that investors are not quite sure they can trust, even as they want to buy in.

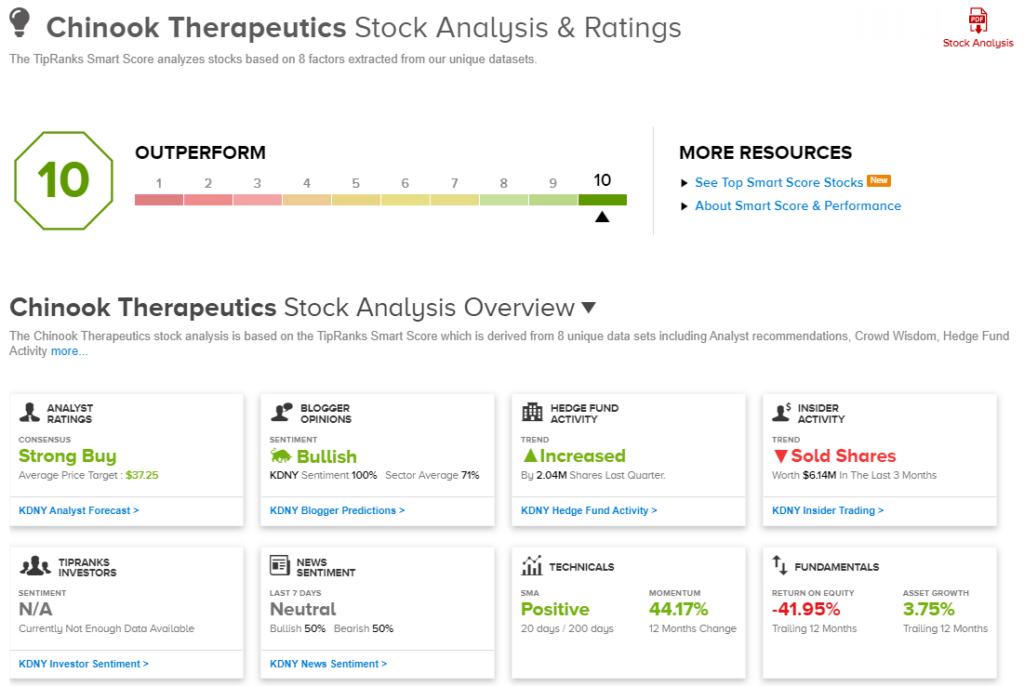

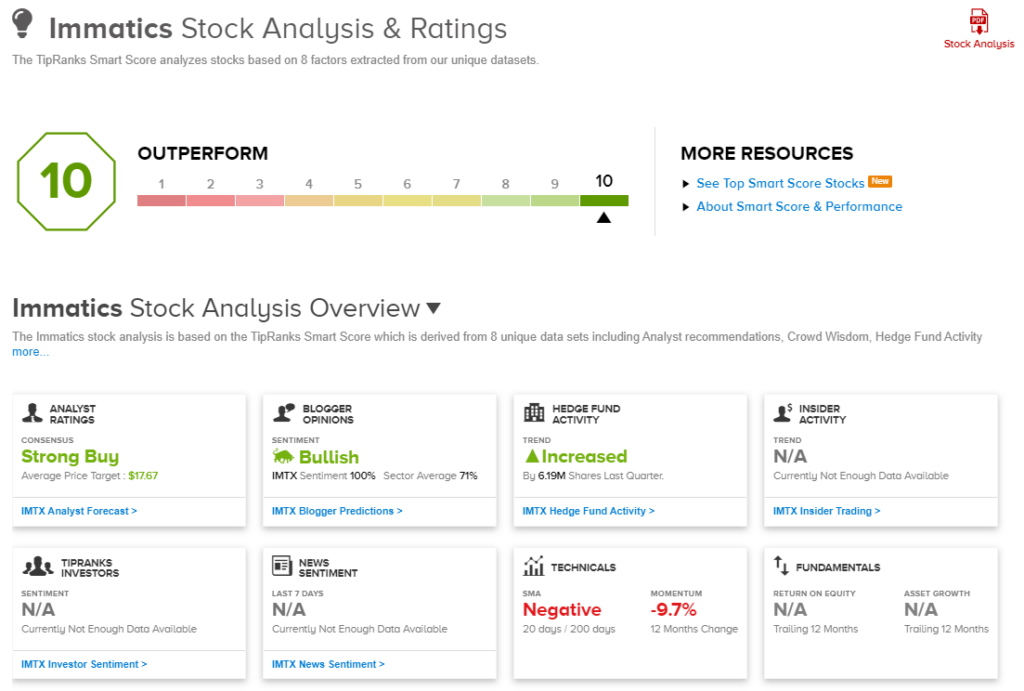

What’s needed here is a reliable tool to find the upwardly mobile stocks, the ones that are primed to win, and to keep winning, in the coming months. That’s where the Smart Score comes in. Based on the TipRanks database, the Smart Score algorithms take the accumulated data points on more than 8,500 publicly traded stocks – and sorts, measures, and combines it. All of the data is evaluated against a set of 8 factors that are known as solid predictors of future share movements.

Eventually, all are combined and recalculated to produce a single score, a number on a scale of 1 to 10, that will indicate where each stock is likely to go from here. Think of the Smart Score as an analytical snapshot of your favorite stocks. One look will tell you the main chance for the near-term.

The Smart Score’s highest rating, the ‘Perfect 10,’ doesn’t necessarily mean that a stock scores high on every metric – but it does mean that the stock in question deserves a closer look. So let’s do just that. We’ve used the TipRanks platform to pull up the details on 2 Perfect 10 stocks, ones with top ratings from the Street and potential to emerge as winners for the long-haul.

Chinook Therapeutics (KDNY)

The first stock we’ll look at is clinical-stage biopharmaceutical company, Chinook Therapeutics. As this firm’s stock ticker suggests, its focus is on diseases of, and treatments for, the kidneys, one of the most vital organ systems of the body, responsible for filtering and cleansing the blood. Chinook is working on several research tracks, with the goal of creating new precision medicines that will address severe kidney diseases with high unmet medical needs.

There is a definite market for new kidney medications. The usual treatment for chronic kidney conditions is dialysis, or mechanical filtration of the blood; this is both invasive and exhausting, prompting both doctors and patients to seek alternatives. The competing company Calliditas saw its drug tarpeyo approved for use in treating proteinuria (excessive proteins in the urine, a common signal of kidney failure) in late 2021. Tarpeyo is steroidal-based, however, leaving many physicians cautious about prescribing it. This is where Chinook’s late stage pipeline of non-steroidal drug candidates for kidney disease comes in.

Chinook’s leading drug candidate is atrasentan, a selective endothelin A receptor agonist with potential to produce direct therapeutic benefit across a range of kidney diseases by reducing proteinuria, and through both anti-inflammatory and anti-fibrotic effects. The overall results is a preservation of kidney function.

Atrasentan is currently the subject of two ongoing clinical trial programs. The Phase 3 ALIGN trial is testing the drug in patients with IgAN, and has so far enrolled more than 270 patients. The company will base its interim data on the proteinuria endpoint on the first 270 enrolled patients; assuming that is done, the topline data for the complete study should be released in 4Q23.

On the second clinical trial of Atrasentan, the Phase 2 AFFINITY basket trial in patients with proteinuric glomerular diseases, the company has completed enrollment of the first patient cohort while continuing enrollment of additional patient cohorts. Data from this trial is expected to start becoming available during 2H23.

Atrasentan forms the core of Piper Sandler’s Yasmeen Rahimi’s take on this company. Rahimi, a 5-star analyst and expert on the medical sector, writes of Chinook, “We continue to believe KDNY has the best and most comprehensive approach in IgAN…. considering KDNY’s potentially best-in-class proteinuria benefits with two differentiated IgAN assets, we remain highly bullish on the name…. given the robust signals we have seen thus far in proteinuria reduction from Atrasentan, we believe this data shows a positive read-through to see sustained benefit in eGFR (2.5 year secondary endpoint) and overall clinical benefit as we head into the Ph3 ALIGN topline data in 2H23.”

Quantifying her stance on KDNY, Rahimi gives the stock an Overweight (Buy) rating, with a $41 price target that indicates her confidence in a robust 88% upside potential for the next 12 months. (To watch Rahimi’s track record, click here)

The Piper Sandler view is hardly the only bullish take here; this stock has 5 recent analyst reviews, and they are all positive – for a unanimous Strong Buy consensus rating. The shares are trading for $21.80 and their $37.25 average price target implies a 71% upside heading out to the one-year time frame. (See KNDY stock analysis)

Immatics (IMTX)

Next up is Immatics, another biopharma firm with some promising clinical trials. Immatics is working on new cancer treatments, based on T cell therapy. Interestingly, the company is following a dual-track approach to drug candidate development, working on both adoptive cell therapies and TCR bispecifics. The difference here can be summed up by the number of T cell donors. On the adoptive track, the patient is the sole donor for T cells, resulting in a highly personalized approach to treatment; on the bispecific track, there are multiple unrelated T cell donors, resulting in an ‘off the shelf’ drug candidate.

The two development tracks will both create T cell therapeutic agents, but each track will show distinct attributes, producing desired therapeutic effects from different starting points. The results show up in drug candidates appropriate for patients at a wide range of disease states, and showing different types of solid tumors. Immatics has ongoing collaborations with several larger companies in the global pharmaceutical industry.

In the pipeline, Immatics has multiple tracks for IMA203, the company’s leading drug candidate, designed on the proprietary ACTengine platform. Cohort A of the IMA203 trial, as a TCR-T monotherapy in PRAME-expressive tumors, is undergoing a Phase 1b trial. Interim data from the first 27 patients was released last October; another 5 patients are enrolled in a dose escalation phase. The data shown so far has been positive. Cohort B of the trial, investigating the IMA203 TCR-T as a combination therapy with nivolumab, initiated dosing in May of last year. And, finally, the IMA203CD8 variation, a 2nd generation TCR-T monotherapy, was started as Cohort C of the Phase 1b trial with patient dosing in August of last year. Immatics has a clinical data update planned for all three cohorts in 2H23.

The company also has a Phase 1 trial underway, since last May, of TCER IMA401, from the TCR bispecific track. The trial is designed to test the safety and tolerability of the drug candidate, as well as initial anti-tumor activity.

Mizuho analyst Graig Suvannavejh has been covering Immatics, and sees an upbeat future for the stock. He says of it, “…IMTX is advancing both TCR-based cell therapies and TCR-based bispecific candidates, with a primary focus on PRAME, a novel target that is expressed across a variety of solid tumors. Given (1) our enthusiasm for TCR-based approaches and the opportunity with PRAME; (2) promising 1st Phase 1b data announced last fall; (3) follow-up Phase 1b data expected in 2H23 (and potential, we believe, for stock appreciation thereafter), (4) the stock -12% YTD (vs. -9.5% XBI), and (5) …we favor the risk/reward.”

Giving some numbers for that risk/reward, Suvannavejh rates the stock as a Buy, with a price target of $12 to imply a 61% one-year upside potential for the shares. (To watch Suvannavejh’s track record, click here)

The three recent share reviews on IMTX are positive, backing up the stock’s unanimous Strong Buy consensus rating. With a trading price of $7.44 and an average price target of $17.67, IMTX boasts an impressive potential gain of 137.5% for the year ahead. (See IMTX stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.