The key to earning in the stock market is to find an equity that shows the right profile based on a mix of attributes that will predict success. Finding them can be tough, especially given the sheer volume of data generated by the market. With thousands of stocks, hundreds of thousands of traders, and a legion of Wall Street analysts all putting their own sometimes contradictory views into the ring, getting down to brass tacks is no easy task.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

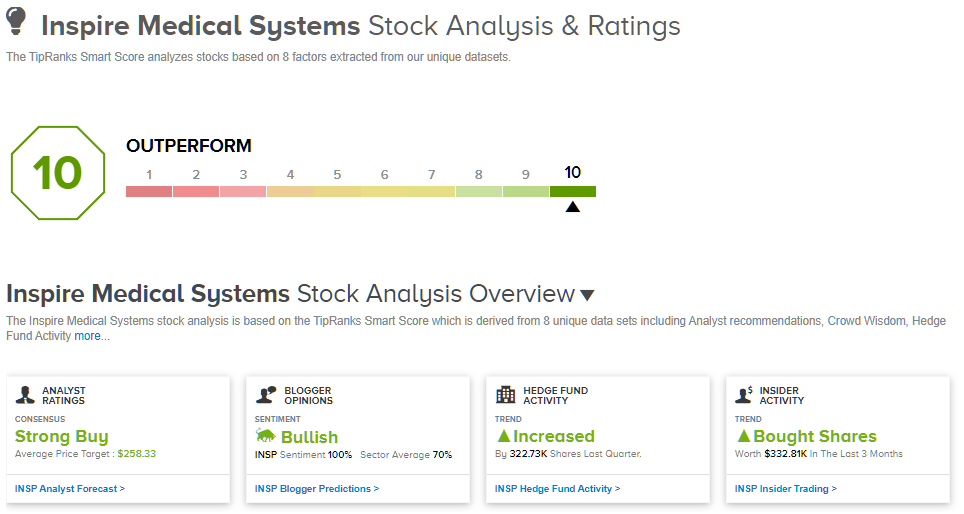

That’s where the TipRanks Smart Score can become a trader’s best friend. The Smart Score is a data sifting and collating tool, based on a proprietary algorithm that measures every stock against a series of factors, 8 in all, that have been correlated with market gains. The factors are taken together and distilled into a single score on a 1 to 10 scale, giving every stock a simple, single-digit score that points toward the stock’s general health and potential performance.

We can take a look under the hood of the Smart Score system to pull up the details on two stocks that have ticked all the boxes – and earned the ‘Perfect 10’ score. Here they are, presented along with comments from the Street’s analysts. Let’s see why they’ve earned their accolades.

Inspire Medical Systems (INSP)

First up on our list is Inspire Medical Systems, a medical technology company working on novel treatments for sleep apnea, a serious condition of the airways that can obstruct breathing during sleep. Sleep apnea can result in symptoms as mild as light snoring – or as severe as cessation of breathing. Inspire Medical has developed, and is now commercializing, the first FDA-approved neurostimulation implant designed to keep the airways open at night, minimizing the symptoms and risks of sleep apnea.

Inspire’s solution is an implanted device that is activated by a hand-held remote. The device is implanted in an outpatient procedure, intended to be minimally invasive. The patient activates it at sleep times, using the remote; it can be turned off during waking hours. In addition to FDA approval, the company has been able to secure insurance coverage of its system through most major health care providers, including Medicare and the VA.

This past August, the company released its last quarterly financial results, for 2Q22, and showed revenue gains of 73% y/y, to reach $91.4 million; of that total, $87.9 million came from US sales. At the same time, the company increased its network of US medical centers using the Inspire device to 785, a gain of 52 centers. The company also updated its FDA approval during the quarter, and patients using the Inspire device are now cleared to receive full-body MRI scans if necessary.

Turning to earnings, Inspire Medical saw its net loss increase y/y in Q2, from $13.1 million to $14.5 million; the diluted EPS loss was 53 cents, up 5 cents from the prior year quarter. Inspire Medical finished 2Q22 with $196.3 million in cash on hand.

Inspire Medical lives in a competitive world, and is hardly along in working on treatments for sleep apnea. At the same time, the company has the advantage of offering the first implant therapy in a crowded market; it can pay to get there first. Piper Sandler’s 5-star analyst Adam Maeder sums up the prospects for Inspire Medical in a recent note: “Despite strong continued execution, INSP shares have not been rewarded YTD we think in part due to the competitive narrative surrounding Apnimed…. Bigger picture, OSA represents an attractive end-market and there are emerging therapies in development. That said, competition on the device and drug front for INSP will need to successfully navigate the U.S. regulatory pathway and are still a few years away from market. Separately, we see numbers as comfortably set for 2H: 2022 / 2023 and a lot of tailwinds at INSP’s back.”

Following from this stance, Maeder rates the shares as Overweight (Buy), and his $285 price target suggests a one-year upside of ~54% for the shares. (To watch Maeder’s track record, click here)

So far, only 3 Wall Street analysts have published reviews of INSP – but those reviews are all positive, for a unanimous Strong Buy consensus rating on the stock. The current trading price of $185.41 and the average price target of $258.33 gives the shares a 39% upside potential for the next 12 months. (See INSP stock forecast on TipRanks)

MKS Instruments (MKSI)

Science and engineering are driving our world; there seems to be no end to the array of new tools and tech that emerge to change our world. But all of that development would come to naught without the supporting services and equipment provided by companies like MKS Instruments. MKS works in the global market, providing process control solutions; analytical, measurement, and monitoring instruments; and control devices and subsystems that make technological innovation possible, through streamlining process performance and productivity.

MKS works with customers across the economy – in industry, life and health sciences, with research and defense firms, but the company has a particular focus on the semiconductor chip industry. Semiconductor chips are an essential keystone in the modern world, and MKS’ products make their manufacture more efficient. MKS offers its customers a range of tools, including photonics, precision optics, motion sensing, PCB lacer processing, plasma generation, ozone solutions, gas delivery, and vacuum products.

In the last reported quarter, 2Q22, the company posted results that were above expectations. At the top line, the revenue of $765 million was only up 3% from the prior quarter – but was 4% above the pre-release forecasts. Earnings came in at $2.59 per share, down from 2Q21 – but beating the $2.31 forecast by over 12%. The positive results were driven by record revenue in the semiconductor market, which, at $515 million, was up 6% from Q1 and 19% y/y.

MKS will report its 3Q22 results on November 2, and, as of the end of Q2, was guiding toward $770 million at the top line with EPS of $2.66.

This company has caught the attention of Krish Sankar, 5-star analyst with Cowen, who writes of the firm, “We view MKSI as the best derivative play on the SPE sector, which could continue to see outsized gains as market demand recovers. We expect demand from its two largest customers (AMAT and LRCX) to continue to be healthy as MKSI navigates through near-term supply constraints impacting the V&A business and view potential share gains in conductor etch positively. MKSI’s Advanced Markets division benefits from many of the same secular themes seen in the semiconductor market around device proliferation, miniaturization, and the data economy.”

Sankar rates these shares as a Buy, and he gives them a $145 price target that implies a robust one-year gain of 83%. (To watch Sankar’s track record, click here)

The consensus view on MKSI, based on 7 recent analyst reviews, is a Strong Buy; the reviews include 6 Buys against a single Hold. The stock is selling for $84.58 and its average target of $125 suggests it has ~48% upside coming to it in the year ahead. (See MKSI stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.