Finding the right stock is a challenge for any investor, from the greatest of the Wall Street legends down to John Q Public, the retail stock buyer. The problem comes from volume – the sheer quantity of raw data generated by tens of thousands of traders dealing in thousands of stocks, with millions of shares changing hands hour by hour, of every trading day. It’s a daunting challenge.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

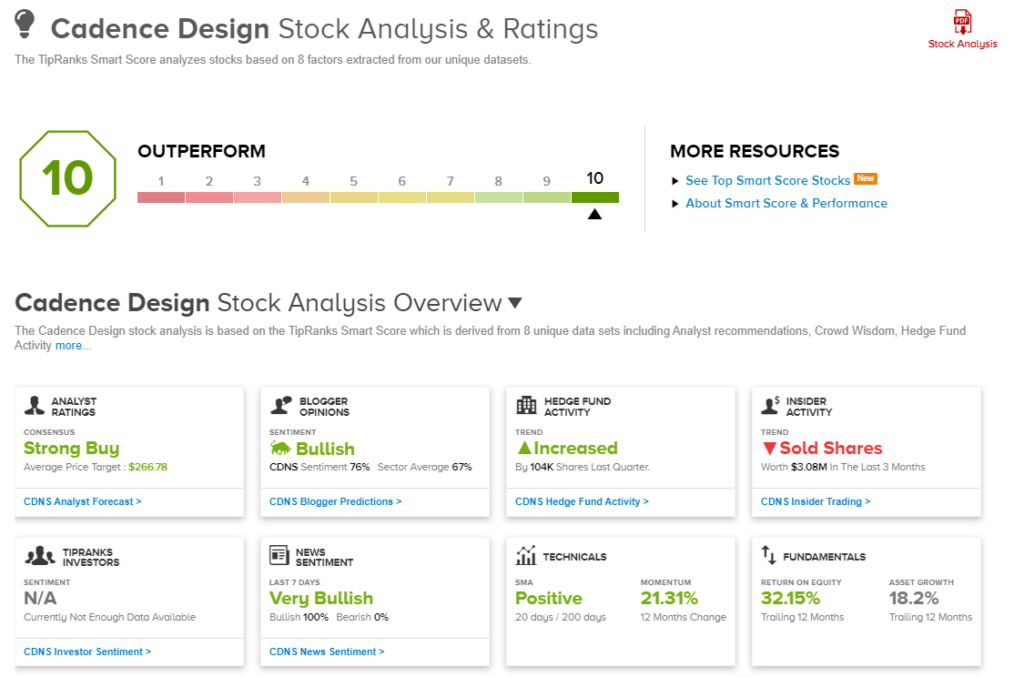

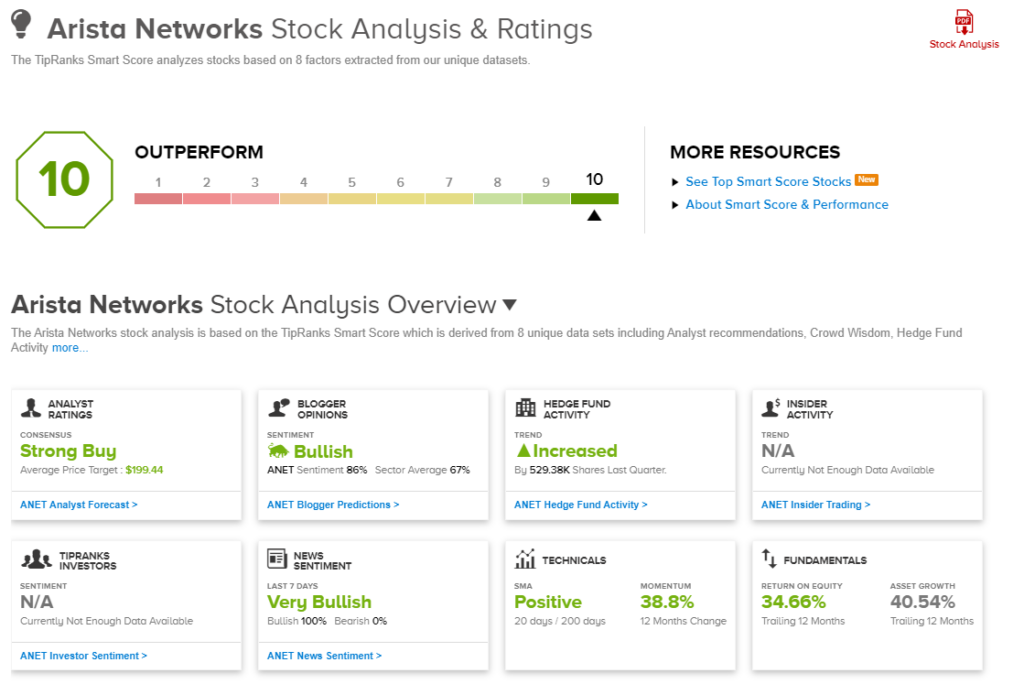

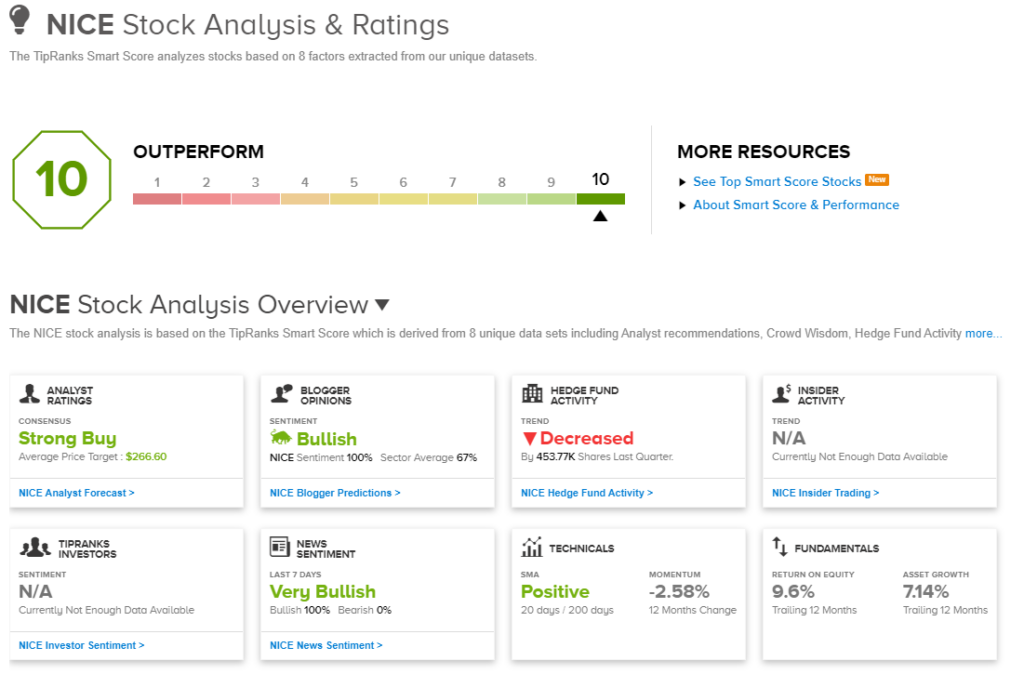

Fortunately, the tools are available to sort through the data and find the true nuggets. The Smart Score, a set of AI-driven algorithms, exists to collect and collate the constant march of facts from the stock market, and to measure every stock against a set of factors known to correlate with future outperformance. The result is a single score, given on a scale of 1 to 10, that points toward a stock’s likely forward path. A ‘Perfect 10’ share has shown, based on the data, that it deserves an investor’s close scrutiny.

And, when the Smart Score matches up with the analysts’ recommendations, it’s an alignment of the stars. The Wall Street pros are experts in their fields – in both stocks, generally, and in the particular fields of their specialties – and they build their reputations on the quality of their recommendations.

We’ve done the legwork here and have found three ‘Perfect 10’ stocks that also boast a Strong Buy rating from the Street’s analysts and a sound upside potential. Each comes from the tech sector, which has been leading this year’s bull market, yet the analysts think there is enough to suggest these stocks are going to show gains going forward. Here are their details.

Cadence Design Systems (CDNS)

The first stock on our list, Cadence Design, is an electronic systems design firm, with over 30 years’ experience. The company uses its expertise in computational software to deliver the hardware and IP necessary for moving new designs from concept to reality. Cadence counts some of the world’s top tech innovators among its customers, and its products include chips, circuit boards, and complete systems, found in applications from hyperscale computing to 5G communications networks, to mobile telecom, and consumer and industrial products.

Cadence is also taking a lead in the next generation of tech evolution, with the Allegro X AI system, a generative AI product that has potential to bring immense time saving to PCB design. With Allegro X AI, customers can reduce their placement and routing timing from days to minutes, while maintaining product quality.

The company generated over $3.56 billion in revenue last year, and has continued to show year-over-year top line gains in 2023. In last month’s Q2 report, we find that that the company showed a top line of $976.6 million. This was up almost 14% y/y, and met analyst expectations. At the bottom line, the non-GAAP EPS, based on a net income of $334 million, came in at $1.22 per share. This beat the forecast by 3 cents, and compared favorably to the 2Q22’s $1.08 EPS.

The company’s outlook for Q3, however, was slightly weaker than analysts had expected. The consensus had predicted a Q3 revenue guide of $1.01 billion, and EPS of 1.27; the company projected an outlook of $990 million to $1.01 billion in revenue – the midpoint slightly below the consensus – and earnings in the range of $1.18 to $1.22 per share.

Nevertheless, despite the mixed showing, Ruben Roy, 5-star analyst from Stifel, thinks highly of this name, and is impressed by Cadence’s moves to capitalize on AI technology.

He writes, “We believe that AI presents a virtuous cycle for the EDA companies wherein AI chip development will not only drive increased chip design starts but will also facilitate productivity enhancements to increasingly complex chip designs by moving EDA tools to emerging accelerated compute platforms coupled with AI-based toolkits. We expect this virtuous cycle to drive continued double-digit top-line growth, which is likely to normalize at 12% +, longer-term, at improving margin as the productivity enhancements enabled by AI-based tools are ultimately monetized.”

“From a valuation perspective, while CDNS shares are trading above average historical multiples, we expect shares to trade towards the higher end of the range as our revenue growth and margin expansion thesis plays out,” Roy further added.

Going forward, Roy puts a Buy rating on the shares, and his $300 price target implies a one-year upside potential of 33%. (To watch Roy’s track record, click here)

The Street’s Strong Buy consensus rating on Cadence is built on 9 recent reviews, including 8 to Buy and 1 to Hold. The stock’s $226.07 trading price and $266.78 average price target together suggest an 18% gain in store for the shares. (See CDNS stock analysis)

Arista Networks (ANET)

Next up on our Perfect 10 list, Arista Networks, one of Silicon Valley’s networking firms. Arista was a pioneering company in software-driven, cognitive cloud networking to power large scale datacenters and enterprise campus environments. The company’s platforms deliver an industry-leading combination of availability, agility, analytics, automation, and system security, and its ground-breaking network operating system, Extensible Operating System (EOS), offers a modern open core architecture giving single-image consistency across hardware platforms.

Arista was launched in 2008, and has grown to boast more than 8,000 cloud customers around the world. The company’s customer base includes Fortune 500 giants. Arista has powered its own growth through smart acquisition moves, with three such moves (the acquisitions of Awake Security, Pluribus Networks, and Untangle) occurring last year and bringing expansions of the company’s security, 5G network, and commercial customer services.

When we look at Arista’s performance, we find that the company has been beating expectations lately. Arista posted revenues of $1.459 billion in 2Q23, for an 8% quarter-over-quarter gain and an even stronger 38% year-over-year gain. The revenue also came in more than $81 million higher than expected. At the bottom line, the company’s non-GAAP EPS was reported at $1.58 per share, or 14 cents higher than the estimates. The EPS figure was based on $501.2 million in net income. Looking ahead, Arista guided toward $1.45 billion and $1.50 billion in Q3 revenue, at the midpoint, just slightly below consensus at $1.48 billion.

That didn’t bother investors, who sent shares up by almost 20% after the earnings release, while the stock is up more than 44% so far this year.

There are more gains in store, according to BNP Paribas analyst Karl Ackerman, who likes Arista for its industry-leading position. The 5-star analyst writes, “Arista is the market leader in high-speed networking switches for hyperscalers and large enterprises investing in next generation networks, and AI is the killer app. While growth should moderate in ’24, we think share gains in enterprise campus and investments in AI networks should drive growth above consensus. We think ANET is the only networking hardware company that can grow revenue by double digit CAGR through 2025.”

These comments back up Ackerman’s Outperform (Buy) rating on the shares, and his $210 price target points toward a 20% increase in share value on the one-year horizon. (To watch Ackerman’s track record, click here)

Of the 17 recent analyst reviews on ANET shares, 14 are to Buy and 3 to Hold, for a Strong Buy consensus rating. The stock’s $199.44 average target and $174.94 current trading price together indicate potential for a 14% upside in the next 12 months. (See ANET stock analysis)

NICE, Ltd. (NICE)

Wrapping up our Perfect 10 list is NICE, a software company in the customer experience field. The company’s product line is designed to ‘remove the friction’ between companies and customers, by allowing enterprise clients to create the seamless experiences that build brand loyalty and create unbreakable customer bonds. NICE’s platform, the CXone cloud-based customer experience platform, allows organizations to track and address the expectations of both customers and employees, with an innovative, end-to-end approach, including purpose-build analytics and AI.

NICE has more than 7,500 experts on the payroll, managing operations in more than 30 countries and its customer list contains such major names as Visa, Valvoline, Radisson Hotels, and MoneyGram.

All helped the company deliver a strong display in the most recently reported quarter – for 1Q23. NICE showed a top line of $571.9 million, for an 8% y/y increase – and beating the forecast by $4.9 million. The revenue increase was driven by a 25% y/y bump in cloud revenue, which hit $367.6 million.

Looking at the bottom line, Q1 had a non-GAAP operating income of $163.4 million, for a 10% y/y increase. This translated to a non-GAAP diluted EPS of $2.03, up 13% y/y and 5 cents ahead of the estimates.

The company will report its 2Q23 results this Thursday (Aug 17) and has guided for revenue in the range between $573 million to $583 million and adj. EPS between $2.00 to $2.10. The Street has $579.24 million and $2.06, respectively.

Patrick Walravens, of JMP, covers this stock and he has a long-term upbeat view of NICE. The analyst points out several reasons to back this name. Laying them out, he says, “1) we believe ‘cloudification’ should provide a tailwind to the business as the company has ~ $500M of non-cloud recurring revenue that it can potentially convert into cloud recurring revenue, and it typically sees a 3x-10x ARR expansion in these types of on-prem to cloud migrations; 2) we think digital AI may drive incremental cloud gross margins for NICE; 3) the company is pursuing a large market opportunity, which it estimates will grow from $8B in 2022 to $22B in 2027; and 4) we like the veteran leadership of CEO Barak Eilam and CFO Beth Gaspich, with the support of long-time Chairman David Kostman.”

For the JMP analyst, this adds up to an Outperform (Buy) rating, while his $343 price target suggests a robust one-year upside potential of 57%. (To watch Walravens’ track record, click here)

Overall, the Street has confidence in NICE. The stock claims a Strong Buy consensus rating based on 6 recent analyst reviews, including 5 Buys and 1 Hold. The shares are trading for $218.20 and the $266.60 average price target implies an upside of 22% for the coming year. (See NICE stock analysis)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.