Stock picking can boil down to a numbers crunching game, sifting through the ever-shifting data that pours in from the markets as thousands of investors make decisions on thousands of stocks. The permutations are endless.

Not every investors has the time or ability to handle this sorting, but the data tools at TipRanks, especially the Smart Score, have already done the necessary collection and collation. The Smart Score algorithm, after gathering the latest information on every stock, sorts it according to 8 factors, each known as a strong predictor of future outperformance. The result, for more than 8,800 stocks in the database, is a single-digit score, on a scale of 1 to 10, giving investors an at-a-glance indicator of where the stock is headed.

The Perfect 10 is the Smart Score’s seal of approval and especially in uncertain times such as these, the stocks that earn it deserve a second look. We’ll give some of them just that, combining the most recent data from the TipRanks platform, the Smart Score results, and the latest comments from Wall Street’s analysts.

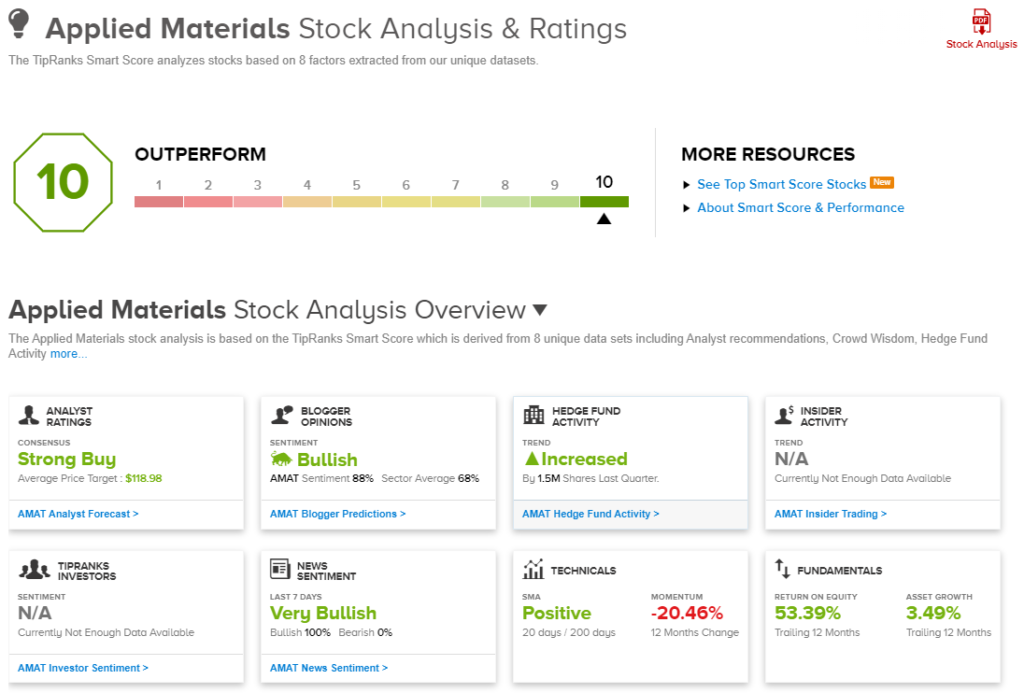

The Trade Desk (TTD)

First up is The Trade Desk, an ad-tech software company based in Ventura, California. Trade Desk offers a powerful data-driven marketing platform for brands and ad agencies, offering tools for marketing and programmatic advertising, all to find maximum advantage in the global digital ad world – a total addressable market that is rapidly approaching $1 trillion. With Trade Desk, users can expand their reach, put their data to work, and even customize the platform.

This is big business, and Trade Desk boasts a market cap exceeding $22 billion. The company brought in almost $1.2 billion in total revenues in 2021 and is on track to beating that total for the following year; despite a difficult economic environment, Trade Desk’s 2022 quarterly reports have consistently shown year-over-year revenue gains. In the last report, for 3Q22, the company had a top line of $395 million, up 31% from 3Q21. Earnings numbers were a bit mixed; the GAAP results, of $16 million in net income and EPS of 3 cents, were down significantly from the prior year. But – the non-GAAP results showed y/y gains, with net income growing from $89 million to $129 million, and adjusted EPS from 18 cents to 26 cents.

In one strongly positive metric, the company reported its eight consecutive year of 95% or better customer retention.

Looking at the Smart Score here, we find that a stock can still earn a ‘Perfect 10’ even if some of the 8 factors are negative. The crowd wisdom on TTD registers very negative, with a 5.1% reduction in share holdings over the past 30 days, but several other factors rate highly positive. The financial bloggers’ sentiment, always hard to please, is 91% positive on this stock, while corporate insiders have bought more than $64,000 worth of shares in the last three months. Of the hedge funds tracked by TipRanks, holdings in TTD increased by more than 210,000 shares last quarter. Add in the good press from 100% bullish news sentiment, and it’s enough for the highest Smart Score.

Analyst Matt Farrell covers this stock for Piper Sandler, and in his last note on it he came to a highly upbeat conclusion: “The company is strategically positioned to benefit from the demand for data-driven solutions and the rise of connected TV (CTV), leading to market share gains. Despite the ‘advertising VIX’ being at all-time highs, the company has continued to execute and outperform the broader digital advertising landscape. While the macro could prove to be choppy in the near term, we expect Trade Desk to continue to outperform regardless of macro-cycle. We recommend investors own Trade Desk for exposure to the multi-year connected TV ramp but also as a unique asset in the broader digital advertising market.”

Farrell uses these comments to back up his Overweight (Buy) rating on the shares, and he gives the stock a price target of $60, suggesting a one-year upside potential of 32%. (To watch Farrell’s track record, click here)

Wall Street, generally, agrees with the Piper Sandler take here; the stock has 14 recent analyst reviews, including 11 Buys and 3 Holds, for a Strong Buy consensus rating. The shares are priced at $45.57 and their $63.57 average price target is more bullish than Farrell’s, indicating potential for a 39% one-year gain. (See TTD stock analysis on TipRanks)

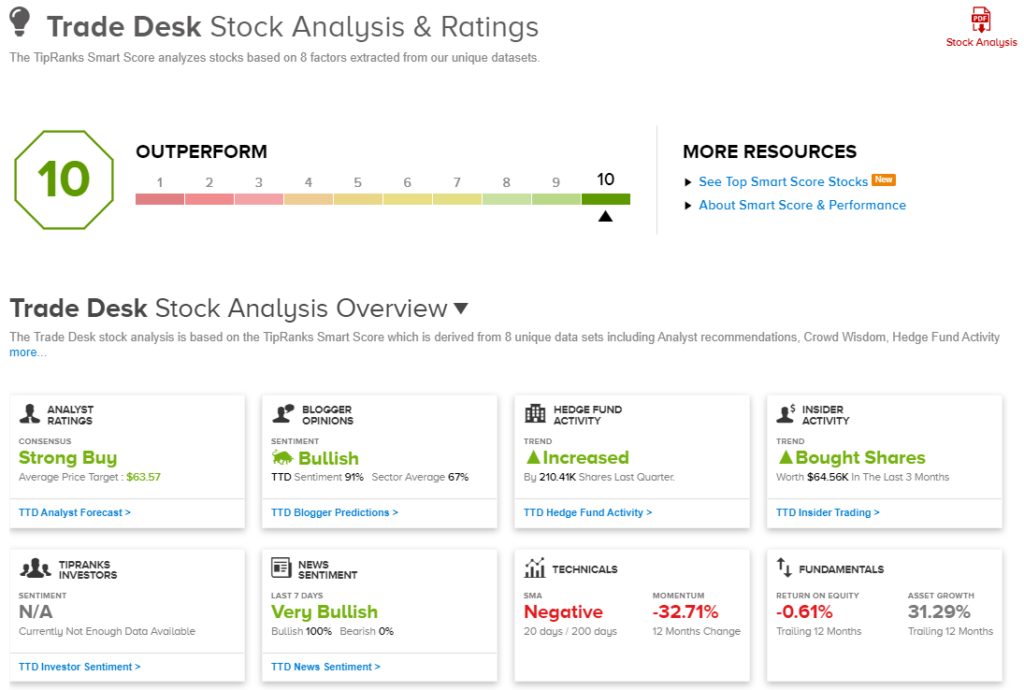

Applied Materials (AMAT)

For the second stock on our Perfect 10 list, we’ll look at Applied Materials. This company operates in the semiconductor chip industry, where it is known as an important player – although it does not produce any chips. Rather, Applied Materials is a designer and manufacturer of the equipment and software needed in the production of integrated circuits for a wide range of electronics; flat panel displays for desktop monitors, tablets, and smartphones; and coatings for flexible electronic devices. The company boasts a market cap of over $92 billion and annual revenues exceeding $25 billion.

This past November, Applied Materials reported earnings for both the fourth quarter and full year of fiscal 2022, and the release showed continued, steady increases at both the top and bottom lines. For Q4, which closed the fiscal year on October 30, the company reported revenue of $6.75 billion, up 10% y/y and a company quarterly record. At the bottom line, AMAT had a non-GAAP EPS of $2.03, up by 5%. Both figures beat Street expectations.

For the full fiscal year, the top line revenue of $25.79 billion was up 12% from fiscal 2021 – and like the Q4 result, was a company record. Full year adj. EPS came in at $7.70 for a 13% y/y increase.

At the end of the fiscal year, the company had $1.99 billion in cash on hand, after returning $6.98 billion to shareholders. The capital return included $6.1 billion in share repurchases and $873 million in common share dividend payments.

On the Smart Score, Applied Materials’ Perfect 10 is based on several solidly positive metrics. These include 88% bullish blogger sentiment, 100% positive news sentiment, and an increase in hedge fund holdings last quarter of 1.5 million shares. The company’s return on equity for the trailing 12-month period was 53%.

In his coverage of this stock for Stifel, analyst Brian Chin notes sector-related weakness that could haunt AMAT – but lays out a strong case for the positives to outweigh the negatives on this stock. Chin writes, “Applied has too many tentacles to be immune as aggregate semi investment eventually weakens. Yet by that token, we believe Applied possesses a better/broader arsenal of products (portfolio) through which to attack/address semi customers’ future technology roadmap scaling/integration challenges. Especially in the current/foreseeable climate limiting additive/external M&A in the sector – Applied has more pathways to served addressable market (SAM) expansion/solutions engineering than many of its peers.”

Looking ahead, Chin sees the company as a strong performer, and rates the shares as a Buy. His price target of $132 implies a gain of 20% on the 12-month horizon. (To watch Chin’s track record, click here)

Hi-tech always attracts attention from Wall Street, and Applied Materials has no fewer than 24 recent analyst reviews on file.. These break down 19 to 5 favoring the Buys over Holds, supporting the Strong Buy consensus rating. The shares are selling for $109.65 and their $118.98 average price target suggests a modest 8.5% upside potential for the coming year. (See AMAT stock analysis on TipRanks)

Stay abreast of the best that TipRanks’ Smart Score has to offer.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.