Occasionally, the market delivers unintuitive surprises that catch many investors off guard. Dillard’s (NYSE:DDS), an upscale department store, should be counted among the discretionary retailers struggling for traction. Instead, DDS stock is currently up double digits, seemingly defying gravity and the broader economic context. Still, with ambiguous waters ahead, lucky contrarians should consider at least securing some profits. I am bearish on the circumstances likely to drag down DDS.

On the surface level, prospects for Dillard’s appear compelling. Primarily, the company delivered an earnings and revenue beat for its most recent second-quarter earnings report. Adjusted for non-recurring items, Dillard’s posted earnings of $9.30 a share, comparing favorably to the year-ago result of $8.81 per share. Also, it handily beat Wall Street’s consensus estimate of $3.47.

Significantly, over the last eight quarters, Dillard’s beat consensus estimates for earnings per share all eight times.

On the revenue front, Dillard’s rang up sales of $1.59 billion for the quarter that ended July 31, 2022. Here too, Dillard’s beat the consensus target, in this case by 2.23%. Moreover, the latest tally compared favorably to the year-ago result of $1.57 billion. Dillard’s beat the Street’s consensus revenue target four out of the last four quarters.

Following the report, DDS stock closed up nearly 18% against the prior day’s session. Shares would continue to move higher, hitting a closing high of $330.02. Since then, however, market sentiment has soured, with Dillard’s down 12.4% heading into the Labor Day weekend.

In addition, DDS stock lost more than 3% of market value last week, presenting a possible sign: get out while the going is good.

DDS Stock was Solid until Powell Had a Word

Although DDS stock beating out both its department store peers and the S&P 500 index represents one of the outstanding stories of this year, no guarantees exist that the circumstance will continue to hold. In fact, the recent volatility of DDS stock suggests that contrarian stakeholders should consider pocketing at least some profits. That’s because Federal Reserve chair Jerome Powell changed the rules of the game.

Several days ago, at the annual economic symposium at Jackson Hole, Wyoming, Powell issued a hawkish message indicating that “interest rates might stay at a level that restrains growth,” according to TipRanks contributor Reuben Jackson. The news sent most, if not all, risk-on sectors down, whether that be cryptocurrencies or, in this case, companies tethered to the discretionary retail segment.

It’s no secret why DDS stock dropped more than 3% for the week following Powell’s comments. While it’s encouraging on a broader level that the Fed acknowledged the devastation wrought by rising inflation, the subsequent rise in purchasing power is essentially anathema to consumer spending.

As I pointed out in early August, “In 2021, the purchasing power of the U.S. dollar declined by 6%. However, just in the first half of this year, purchasing power dipped by 5.3%. Put another way, the rate of acceleration in currency erosion almost doubled this year.”

Cynically, should the Fed adopt a dovish monetary policy, consumers have a greater incentive to spend. Under this paradigm, holding onto dollars makes them worth less. Therefore, it’s better to spend now. However, in a hawkish paradigm, it’s better to sit on your dollars because, over time, they will be worth more (assuming the hawkishness marches forward and all other things being equal).

Frankly, sitting on your dollars is the last thing Dillard’s – or any other discretionary retailer – will want you to do.

The Devil is in the Details for DDS Stock

At the present juncture, circumstances don’t appear particularly bearish for DDS stock. However, with the Fed changing the framework of the economy, investors need to watch for shifting tides within the granularity of key data points.

On the Aug. 25 edition of TipRanks’ Stock Market Today, it reported that “Continuing Jobless Claims are currently sitting near their lowest levels since 1970. Relatively speaking, this suggests that individuals aren’t struggling to find other jobs after being laid off.”

“However, this figure has been on an overall uptrend since the beginning of June. It will be interesting to see if this trend continues as interest rates rise while economic growth continues to slow down.”

One week later, Stock Market Today reported, “Continuing Jobless Claims, which measures the number of unemployed people who qualify for unemployment insurance, came in at 1.438 million, in line with the forecast but higher than last week’s 1.412 million.”

To be fair, it would be inappropriate to classify such fine details as a call to hit the panic button. At the same time, investing is all about anticipating future events, not trading on known facts. Interestingly, this uptrend in jobless claims is occurring amid the Fed’s commitment to a hawkish monetary policy. Therefore, investors should be careful about overexposure to a discretionary retail play like DDS stock.

Is DDS Stock a Good Investment?

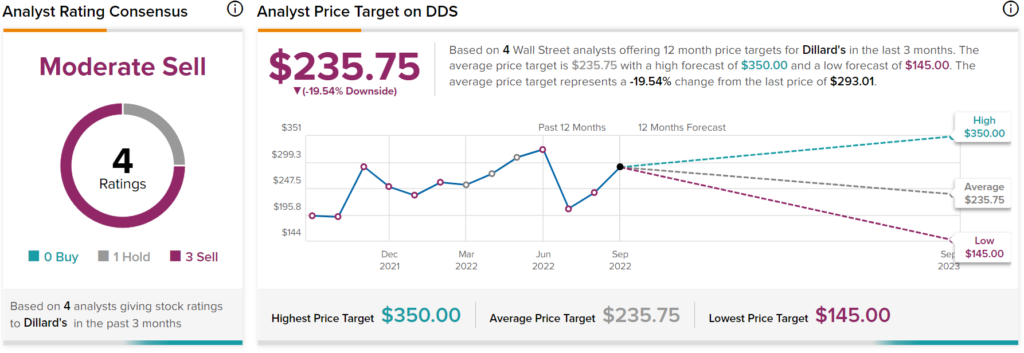

Turning to Wall Street, DDS stock has a Moderate Sell consensus rating based on zero Buys, one Hold, and three Sells assigned in the past three months. The average DDS price target is $235.75, implying 19.5% downside potential.

Takeaway – DDS Stock Investors Need to Read the Signs

Naturally, optimists of DDS stock won’t particularly enjoy reading articles about the bearish implications of discretionary retailers like Dillard’s. However, the math is very simple in this case. The company benefitted (at least somewhat cynically) from an inflationary environment due to the incentivized spending profile. However, with this paradigm set to reverse, it’s vital that investors respond in kind.