Bitcoin Slips Below Critical Support

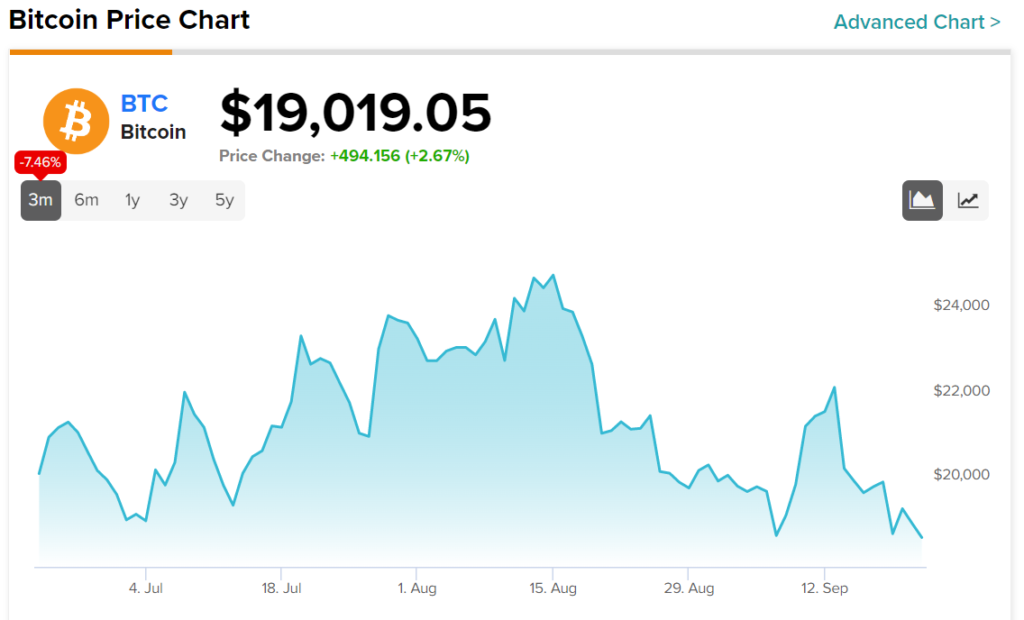

The value of Bitcoin (BTC-USD) tumbled by 6.1% over the last seven sessions following another 75-basis point interest rate hike undertaken by the United States Federal Reserve. Experts predict further downward momentum for the flagship cryptocurrency and the broader market as Fed Chair Jerome Powell hints toward another significant hike before the end of 2022.

The selling pressure is echoed by the latest on-chain data from CryptoQuant, indicating a consistent increase in exchange reserves over the last seven days, which traditionally exhibit an inverse correlation with prices. Additionally, a fresh report from Arcane Research showed a significant drop in BTC mining profitability, with daily miner revenue slumping by almost 10% in the last week alone.

The bearish price action has led to a massive spree of position liquidations across the broader market, adding to the downward momentum. Weekly data from Coinglass highlights that nearly $324.4 million worth of liquidations occurred over the last 24 hours, with BTC traders selling roughly 5,008 BTC worth $94.79 million.

Ethereum Spirals Lower, Echoed by Other Top Coins

A series of liquidations beginning after the Merge on September 15, paired with Ethereum (ETH-USD) miners dumping their ETH rewards, has taken a sharp toll on the network’s valuation. ETH has lost around 20.10% of its value in the past seven sessions. The Fed rate hike and cascading liquidations have added to ETH’s woes. On-chain data from Coinglass indicates that nearly 115,700 ETH worth $147 million has been liquidated over the past 24 hours.

Most other altcoins are mimicking Bitcoin and Ethereum’s losses with varying degrees of underperformance and outperformance. The week’s “risk-off” theme left few coins unscathed as prevailing market conditions and macroeconomic pressures weighed heavily on investor sentiment.

Polkadot (DOT) and Polygon (MATIC) registered significant losses this week among the other large-capitalization altcoins, falling 10.1% and 13.1%, respectively. Most mid-to-low cap altcoins are also sitting on losses as the aggregate crypto market capitalization drops to $920 billion. In the meantime, even though miners have been migrating to Ethereum Classic (ETC) to allocate their unused mining resources, the network saw its native token plunge by nearly 23.4%, outpacing losses in ETH.

Ripple and Algorand Rebound

Amidst the crypto market’s broader losses, Ripple (XRP-USD) registered an impressive 25% gain over the last seven sessions. The value of XRP soared after reports revealed that the U.S. Securities and Exchange Commission (SEC) and Ripple are urging a Federal judge to issue an immediate ruling and resolution for their long-running legal battle.

Besides pushing for a legal decision, Ripple announced an extension of its existing partnership with i-Remit to expand its cross-border payments solution, helping XRP break past critical resistance levels. Another reason behind XRP’s upward momentum is the company’s decision to join the Climate Pledge, with the network aiming to achieve net zero emissions by 2040.

Another outperformer amid a sea of red results, Algorand (ALGO) bounced back from its previous week’s losses, moving up by nearly 18% over the last seven sessions. The blockchain ecosystem has been rolling out a series of upgrades, helping its native token gain investors’ confidence.

The Pure Proof-of-Stake (PPoS) chain now features cross-chain communication and transaction speed improvements via a new upgrade on its core protocol. This new upgrade unlocks trustless communication between standalone blockchain networks and increases Algorand’s transaction throughput from 1,200 TPS to 6,000 TPS.

Cardano’s Vasil Upgrade, Crypto Hacks, Development, and More

After months of anticipation, Cardano’s long-awaited Vasil upgrade is finally happening. A tweet by IOHK – the company behind Cardano – clarified that all parties had confirmed their readiness for the hard fork. The Vasil hard fork is a significant milestone for Cardano since its Alonzo hard fork in September last year.

Meanwhile, hackers continue to pick apart vulnerabilities in the crypto space, with decentralized exchange GMX becoming the latest victim after a hacker walked off with nearly $565,000 from the platform’s AVAX-USD market. In another hacking attempt, cybercriminals took over the official CoinDCX crypto exchange Twitter account and targeted users by posting fake XRP promos embedded with phishing links.

In development news, Coinbase’s blockchain infrastructure platform, Coinbase Cloud, has launched its latest Web3 developer platform. This new platform will allow users to build decentralized applications (dApps) and NFT applications using its free and tiered subscription plans.

Last but not least, Dubai’s Virtual Asset Regulatory Authority (VARA) has granted a Minimal Viable Product (MVP) license to Binance. With this licensing granted, the crypto exchange can begin offering virtual asset services to all qualified regional investors.