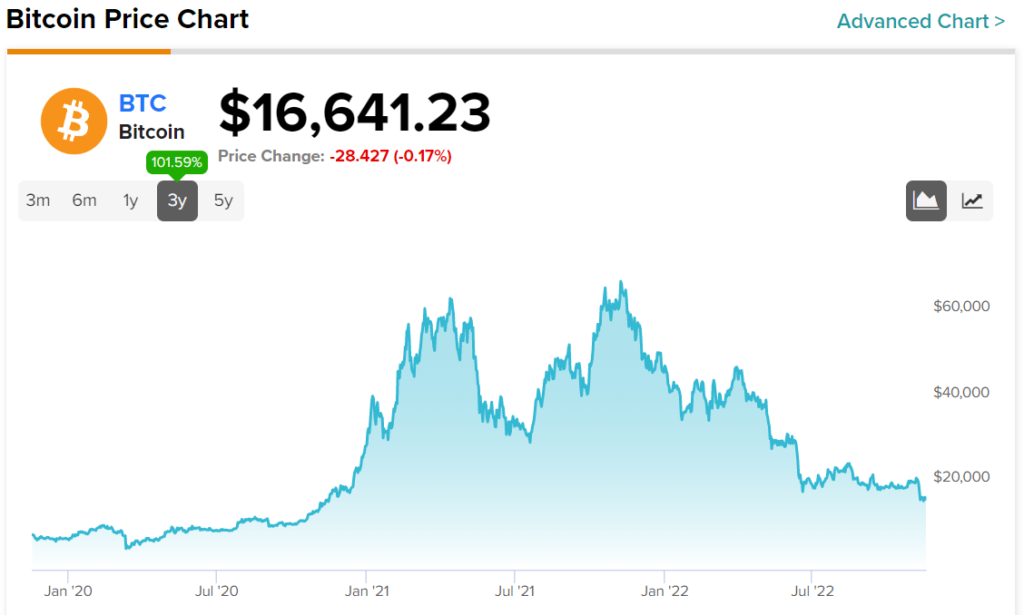

With FTX filing bankruptcy and several other prominent crypto platforms following suit, Bitcoin (BTC-USD) has found itself clinging to major levels. The flagship currency hit 2-year lows over the last seven sessions and is currently trading just above the $16,500 support level.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Although BTC’s value registered a quick jump to $17,000 on November 15 as U.S. economic data indicated cooling inflation, the value of BTC has remained extremely rangebound, with performance flat week-over-week, keeping a lid on other cryptocurrencies as well.

Meanwhile, the latest report from the Bank of International Settlements (BIS) highlights that almost one-third of BTC retail investors across various exchanges are currently dealing with losses. Experts believe that BTC may fall further after miners offloaded another 7,700 BTC over the past seven days. Meanwhile, investors have withdrawn as much as $3 billion worth of BTC since November 6.

Another report from Glassnode indicates that BTC sellers have faced massive losses since March 2020, with the Bitcoin spent output profit ratio (SOPR) now sitting at two-year lows. At the same time, BTC exchange outflows have hit new record highs of 106,000 BTC per month as more investors opt for self-custody of their cryptos.

Mayhem Spreads across the Altcoin Realm

Reacting to the FTX collapse, major altcoins stumbled over the last seven sessions. Among the top-ten altcoins by market capitalization, Solana (SOL) led the losses, dropping by roughly 13% over the last seven sessions. Since the FTX meltdown arose, SOL has plunged by more than 41% in two weeks, making it the worst performer among the top ten cryptocurrencies by market capitalization.

The platform’s total value locked (TVL) in decentralized finance protocols (DeFi) has also nosedived as trading volume suffered a major setback.

Tron ($TRX), though not a top-ten crypto by market cap, plunged around 11.8% as rumors of Tron’s involvement with FTX and Justin Sun preparing to rescue the ailing crypto exchange began circulating across the internet. Another reason behind TRON’s slip was the declining peg of its USDD stablecoin with USD.

That said, the biggest loser this week was Cronos ($CRO). Crypto exchange Crypto.com’s CRO token lost nearly 22.3% this week. The platform’s native token came under scrutiny after reports of the exchange clumsily transferring $405 million triggered alarm bells. The funds, which were originally destined for an offline cold storage wallet, were instead delivered to Gate.io – another crypto exchange.

Chiliz Capitalizes on FIFA Frenzy

After weeks of consolidation, fan token Chiliz (CHZ) jumped by roughly 26.1% over the last seven sessions. The value of CHZ surged after crypto exchange Binance announced a new FIFA-themed event to appeal to football fans worldwide. In addition, Chiliz allocated around $38 million of CHZ to compensate FTX users who were affected by the recent hack, helping the CHZ token sustain its advance.

Another low-cap altcoin, TonCoin (TON), was also able to distance itself from the ongoing market meltdown. The value of TON gained 19.29% following the successful completion of its Telegram username auctions and ongoing security audit certification of its network by CertiK.

This week’s standout performer was Trust Wallet Token ($TWT). Amid questions about fund security in exchanges and an increasing number of custodial wallet service providers halting withdrawals, users are pulling out their funds en masse and depositing them in non-custodial wallets like Trust Wallet. This reality has pushed the value of $TWT – Trust Wallet’s utility token – up by 100%, echoed by a massive spike in its trading volume.

Post FTX Collapse Tremors, New Expansions, and More

As FTX attempts to restructure, the ripple effect across the industry has become increasingly evident. Over the last few days, several prominent platforms like Genesis Global, BlockFi, and Liquid Global have suspended withdrawals, citing “tumultuous market conditions” or “directly attributing” the liquidity crunch to FTX.

In response to the collapse, U.S. lawmakers are considering extraditing FTX’s CEO, Sam Bankman-Fried, for questioning. Bahama’s securities regulators, financial investigators, and Turkey’s financial authorities have also launched a probe to investigate FTX and its leadership for criminal misconduct.

Global payment provider Visa, eSports team TSM, and other former strategic partners have cut ties with FTX, adding to the mounting problems for the crypto ecosystem, especially in pursuing more mainstream use.

Despite the regulatory chaos ensuing from FTX’s collapse, Binance is moving forward with its expansionary plans after getting the all-clear to operate in Abu Dhabi. After meeting Financial Services Permission requirements, Binance will start offering clients crypto custodial services. Lastly, in crypto adoption news, stablecoin platform Circle has partnered with Apple Pay, enabling crypto-native businesses to accept payment from Apple users without requiring lengthy sign-ups.